From its humble beginnings in the rugged mountains of Central Asia over 5,000 years ago to its current status as a $5.7 billion global industry, he almond has evolved from a precious trade commodity into one of the world’s most scientifically studied and nutritionally celebrated foods.

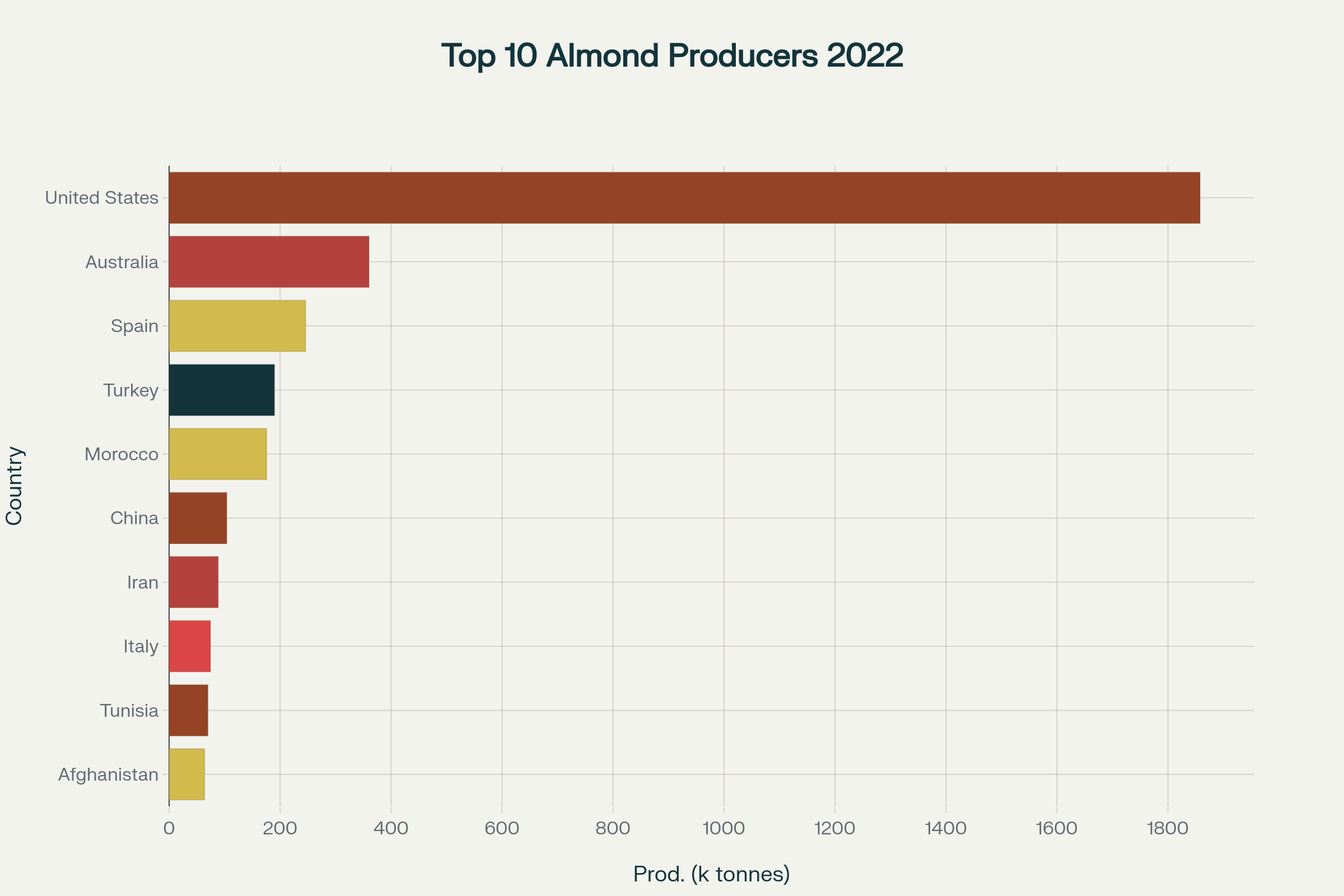

The United States leads global production with an astounding 1.86 million tonnes annually – representing approximately 80% of worldwide supply. While emerging producers like Australia, Spain are reshaping the global almond landscape through innovative cultivation techniques and strategic market positioning.

The Undisputed Champion: United States Almond Supremacy

California’s dominance in global almond production represents one of agriculture’s most remarkable success stories. The Golden State produces virtually 100% of America’s commercial almond supply and 80% of the world’s total production, generating $4.9 billion in export value annually. This extraordinary concentration reflects a perfect convergence of Mediterranean climate, advanced irrigation infrastructure, and decades of agricultural innovation.fao+1

California’s almond industry encompasses 1.25 million acres across the Central Valley, with production concentrated in Kern, Fresno, Madera, Stanislaus, and San Joaquin counties. These regions benefit from hot, dry summers and mild, wet winters—the precise Mediterranean conditions that almond trees require for optimal fruit development. The industry’s growth has been remarkable: almond acreage nearly tripled since 1969, expanding from 61,794 hectares to over 500,000 hectares today.currentaffairs.adda247+1

The economic impact extends far beyond agricultural production. California’s almond industry supports 110,000 direct and indirect jobs while generating $4.9 billion annually, ranking third among all California agricultural commodities. Export markets consume 66% of California’s production, with key destinations including the European Union, India, China, and the Middle East. This export orientation makes California almonds vulnerable to international trade dynamics, currency fluctuations, and geopolitical tensions.fao

California’s success stems from several competitive advantages: advanced mechanization that reduces labor dependence, sophisticated irrigation systems that maximize water efficiency, and comprehensive research programs that continuously improve varieties and cultivation practices. Tree shakers used during harvest reduce labor requirements compared to hand-picked crops, addressing concerns about migrant worker shortages while maintaining cost competitiveness.farmonaut

Top 10 Almond Producing Countries by Production Volume (2022)

Rising Powers: Australia’s Ambitious Expansion

Australia has emerged as the world’s second-largest almond producer with 360,328 tonnes in 2022, though production faced challenges with unprecedented 30% yield declines due to climatic factors and pollination issues. Despite these setbacks, Australia’s almond industry represents a remarkable growth story, with 62,412 hectares under cultivation and ambitious expansion plans targeting 175,000 metric tons by 2024.worldpopulationreview+1

Australian almond cultivation concentrates in South Australia, Victoria, and New South Wales, with the Riverina region emerging as the second-largest growing area. The industry benefits from hot, dry summers and winter rainfall patterns similar to California, though southern hemisphere growing seasons provide counter-seasonal supply opportunities for global markets. Australian almonds command premium prices due to perceived quality advantages and smaller production volumes.inc.nutfruit

Market performance demonstrates strong international demand, with exports increasing 50% in early 2024 despite production challenges. India represents a particularly strong growth market, with sales increasing 111% following new trade agreements. European markets including Spain and Turkey also show significant growth, reflecting Australia’s success in premium market positioning.inc.nutfruit

The industry faces unique challenges including biosecurity controls that limit bee hive availability for pollination, contributing to poor crop set and lower yields. However, optimistic projections for 2024 anticipate strong production recovery based on exceptional bloom conditions and improved pollination outcomes.inc.nutfruit

Traditional Producers: Spain’s Mediterranean Heritage

Spain holds third position globally with 245,990 tonnes of almond production, representing the largest European producer and maintaining centuries-old cultivation traditions. Spanish almonds primarily grow in Andalusia and Catalonia, regions that benefit from Mediterranean climates and traditional farming knowledge passed down through generations.worldpopulationreview+1

Spanish almond exports focus heavily on European markets while expanding into Middle Eastern destinations. The country’s production benefits from established processing infrastructure, quality reputation, and proximity to major consumer markets. However, Spanish producers face increasing competition from lower-cost countries including Morocco and Turkey, forcing industry adaptation toward premium market segments.wikipedia

Traditional varieties and artisanal processing methods differentiate Spanish almonds in global markets. Many Spanish operations emphasize organic production, heritage varieties, and sustainable farming practices that appeal to quality-conscious consumers willing to pay premium prices. Climate change presents challenges through increased drought frequency and temperature extremes that stress traditional production systems.

Emerging Giants: Turkey and Morocco’s Growth Trajectory

Turkey ranks fourth globally with 190,000 tonnes of production, representing significant growth potential in both domestic and export markets. Turkish almond cultivation benefits from diverse microclimates across Anatolia and strong domestic demand that supports price stability. Export opportunities focus on neighboring European and Middle Eastern markets where Turkish products enjoy competitive advantages.worldpopulationreview+1

Morocco’s production of 175,763 tonnes positions the country as a major North African supplier. Moroccan almonds benefit from favorable growing conditions, competitive labor costs, and strategic geographic location for accessing European markets. Government support for agricultural modernization is driving productivity improvements and quality upgrades throughout the sector.worldpopulationreview

Both countries represent emerging competition for established producers, offering lower production costs and expanding cultivation areas. Their success demonstrates how strategic investments in agricultural infrastructure and market development can rapidly transform regional production capabilities.

Ancient Origins: The 5,000-Year Journey

The almond’s journey from wild mountain slopes to global commodity represents one of agriculture’s most remarkable domestication stories. Archaeological evidence traces almond cultivation to Southwest Asia, particularly Iran, with testimony extending back at least 5,000 years. Early Bronze Age sites in Jordan (3000-2000 BCE) contain the earliest confirmed domesticated almonds, though cultivation likely began even earlier.jagranjosh+2

Biblical references provide rich historical context, with almonds mentioned numerous times including Jacob taking almonds to Egypt as “the best fruits of the land” (Genesis 43:11) and Aaron’s rod blossoming with almonds as a divine sign (Numbers 17:23). These references, dating to approximately 1400 BCE, demonstrate almonds’ cultural and economic importance in ancient Middle Eastern societies.jagranjosh

The domestication process involved selecting sweet varieties from naturally bitter wild almonds. Wild almonds contain high levels of cyanide-producing compounds that make them toxic, requiring extensive processing to neutralize toxicity. A genetic mutation eliminated amygdalin production in certain trees, creating naturally sweet almonds that early farmers cultivated and propagated.statista+1

Trade routes facilitated almond distribution across the ancient world. By 600-900 AD, almond orchards flourished across Spain, Morocco, Greece, and Israel, with almonds traveling eastward along the Silk Road to China. Spanish explorers and Franciscan missionaries brought almonds to California in the 1700s, establishing the foundation for America’s eventual dominance in global production.statista

Nutritional Science: Discovering the Almond Advantage

Modern nutritional research has transformed scientific understanding of almonds from simple nuts to complex functional foods. Over 25 years of research encompassing nearly 200 scientific publications has established almonds as one of the most thoroughly studied foods in nutrition science. This extensive research base provides compelling evidence for almonds’ role in health promotion and disease prevention.momex

Macronutrient composition makes almonds unique among plant foods. Each one-ounce (28g) serving provides 6 grams of plant-based protein, 4 grams of dietary fiber, and 13 grams of predominantly unsaturated fats. The fat profile consists of 60% monounsaturated fatty acids and 30% polyunsaturated fatty acids, similar to olive oil’s heart-healthy lipid composition.israelalmond+1

Micronutrient density adds significant nutritional value. Almonds provide substantial amounts of vitamin E (37% of daily value per ounce), magnesium (19% DV), and potassium, along with important minerals including phosphorus, zinc, and copper. Polyphenol content reaches approximately 312 mg per 100g, concentrated primarily in almond skins and including proanthocyanidins, hydrolyzable tannins, and flavonoids.israelalmond

Energy density research has revolutionized understanding of almond metabolism. Clinical studies demonstrate that almonds provide only 4.6 calories per gram rather than the 6.0 calories predicted by standard food composition tables—a 23% overestimation. This discrepancy occurs because almond cell walls resist digestive breakdown, reducing fat bioavailability and actual caloric absorption.nuthealth

Processing methods significantly affect nutritional bioavailability. Whole raw almonds provide the lowest energy density due to incomplete fat release during digestion, while almond butter approaches predicted caloric values due to complete fat availability. Roasting and chopping increase energy density by breaking down cellular structures that normally limit fat absorption.nuthealth

Cardiovascular and Metabolic Health Research

Cardiovascular health research represents the most established area of almond nutrition science. Meta-analyses of randomized controlled trials consistently demonstrate that almond consumption significantly reduces LDL cholesterol levels while improving overall lipid profiles. Daily consumption of 42.5 grams significantly lowers 10-year Framingham coronary heart disease risk estimates.momex+1

Blood pressure research shows dose-dependent effects, with significant diastolic blood pressure reductions occurring when almonds are consumed at doses exceeding 42.5g daily or for periods longer than 6 weeks. These findings suggest that consistent, adequate consumption is necessary for cardiovascular benefits rather than occasional or minimal intake.nuthealth

Weight management studies challenge traditional assumptions about high-calorie foods. Despite their energy density, almonds are the only nut that significantly decreases both body mass and fat mass in controlled trials. Biological mechanisms include enhanced satiety, increased resting energy expenditure, and displacement of other foods from the diet.nuthealth

Emerging research areas show promising results for cognitive performance, stress response, and skin health. Recent studies suggest that regular almond consumption may enhance cognitive performance, improve heart rate variability under mental stress, and reduce facial skin aging from UV radiation exposure. These findings expand almonds’ potential health applications beyond traditional cardiovascular and metabolic benefits.nuthealth

Agricultural Innovation and Future Prospects

Modern almond cultivation continues evolving through technological innovation and environmental adaptation. Climate change challenges traditional production regions through increased drought frequency, temperature extremes, and pollination disruptions. Water usage concerns have prompted development of more efficient irrigation systems and drought-tolerant rootstocks that maintain productivity under stress conditions.

Precision agriculture technologies are transforming orchard management. Satellite monitoring, drone surveys, and IoT sensors enable farmers to optimize irrigation, fertilization, and pest management with unprecedented precision. Automated harvesting equipment continues advancing, reducing labor dependence while improving efficiency and cost competitiveness.

Sustainability initiatives address environmental concerns about almond production’s resource intensity. Water conservation programs, pollinator protection protocols, and carbon footprint reduction strategies are becoming standard industry practices. Regenerative agriculture approaches that improve soil health while maintaining productivity offer promising pathways for sustainable intensification.

Genetic research is developing improved varieties with enhanced disease resistance, improved nutritional profiles, and climate adaptation characteristics. Marker-assisted breeding programs accelerate variety development while maintaining desirable traits including flavor, texture, and processing characteristics.

Conclusion: The Almond’s Continuing Evolution

From its ancient origins in the mountains of Central Asia to its current status as a global agricultural powerhouse, the almond represents a remarkable success story of human agricultural innovation. The United States’ dominance in production, processing, and export—particularly California’s 80% share of global supply.

Emerging producers including Australia, Turkey, and Morocco are reshaping global supply dynamics through strategic expansion and quality improvements, creating more diverse and resilient supply chains. Traditional producers like Spain maintain their position through premium positioning and heritage variety cultivation that appeals to quality-conscious consumers.

As global population growth, urbanization, and health consciousness drive demand for nutritious, sustainable foods, almonds are well-positioned for continued growth. The challenge for producers will be balancing expansion with environmental sustainability, particularly regarding water usage and climate adaptation. Innovation in cultivation techniques will likely determine competitive success in this dynamic and growing global market.

The almond’s journey from ancient trade commodity to modern superfood reflects humanity’s capacity.

About us

Try it for yourself. Freshdi.com

Global B2B Marketplace.