America canned and processed food industry represents one of the nation’s most robust manufacturing sectors, generating $1.9 trillion in combined annual sales across more than 21,000 food production facilities that employ 1.56 million workers nationwide. This massive industry, which ranks as the third-largest contributor to U.S. manufacturing GDP, encompasses everything from iconic soup brands to innovative snack foods, processed meats, and convenience meals that define American eating habits.gourmetpro

The sector’s remarkable scale and diversity are exemplified by industry leaders who have built global empires around household brand names. The global canned food market alone reached $111.04 billion in 2024 and is projected to grow at 4% annually to $164.37 billion by 2034 , driven by consumer demand for convenience, shelf-stable nutrition, and consistent quality. Understanding the key players, their production capabilities, and market dynamics reveals the extraordinary scope of America’s food processing dominance.industryselect

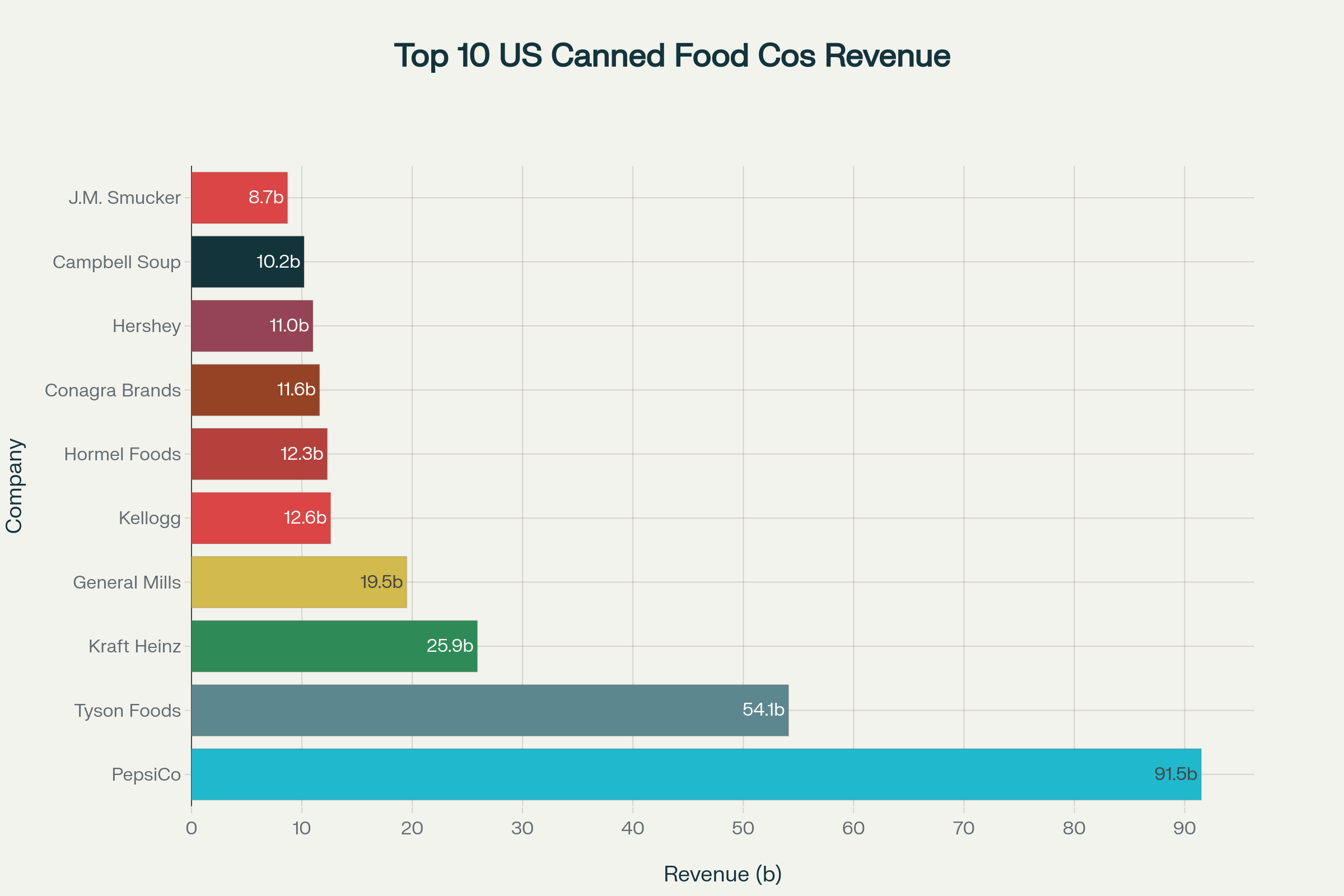

The Revenue Champions: America’s Food Processing Giants

The American canned and processed food landscape is dominated by several massive corporations whose revenue streams dwarf many entire national economies. PepsiCo leads the sector with $91.5 billion in annual revenue, though the company’s portfolio extends far beyond traditional canned goods into beverages, snacks, and fresh foods. The company’s Frito-Lay division alone processes millions of pounds of potatoes, corn, and other raw materials daily across dozens of manufacturing facilities.csimarket

Tyson Foods ranks second with $54.1 billion in revenue, representing the largest meat processor in America and a major producer of canned and processed meat products. The company operates 123 food processing plants across the United States, processing billions of pounds of chicken, beef, and pork annually for both retail and foodservice markets.expertmarketresearch+1

The Kraft Heinz Company holds third position with $25.9 billion in annual sales, generated through 75 manufacturing and processing facilities worldwide with approximately 36,000 employees. Formed in 2015 through the merger of Kraft Foods Group and H.J. Heinz Holding Corporation, the company produces iconic brands including Heinz Ketchup, Kraft Macaroni & Cheese, Oscar Mayer, and Philadelphia Cream Cheese across multiple product categories.truevaluemetrics+1

General Mills follows with $19.5 billion in revenue, though the company experienced a 2% decline in fiscal 2025 as it adapts to changing consumer preferences. The Minneapolis-based company operates major production facilities manufacturing everything from Cheerios cereal to Betty Crocker baking mixes, representing substantial processed food volume despite recent market challenges.ers.usda+1

Top 10 American Canned and Processed Food Companies by Revenue (2024-2025)

Production Scale and Manufacturing Capabilities

The sheer scale of production across America’s leading food processors staggers the imagination. Campbell Soup Company, with $10.2 billion in annual revenue, operates as the undisputed leader in canned soup production. The company’s iconic red-and-white soup cans represent 64.5% market share in the ready-to-serve soup category, with four of the top ten soup brands belonging to Campbell’s portfolio. The company produces millions of cans daily across multiple manufacturing facilities, with sophisticated supply chains managing everything from tomato sourcing to can manufacturing.statista+1

Kraft Heinz demonstrates remarkable production diversity through its 75 global facilities, processing ingredients ranging from tomatoes for ketchup production to milk for cheese manufacturing. The company’s Heinz ketchup alone requires processing millions of pounds of tomatoes annually, while its Oscar Mayer division processes substantial volumes of meat products. The company engages approximately 5,550 ingredient and packaging suppliers and partners with 210 external manufacturers to meet global demand.metatechinsights+1

ConAgra Brands, with $11.6 billion in revenue, operates extensive production networks focusing on frozen foods, snacks, and shelf-stable meals. The company’s brands include Marie Callender’s, Healthy Choice, and Orville Redenbacher’s, requiring specialized processing equipment for everything from popcorn production to frozen meal assembly. ConAgra’s facilities process millions of pounds of raw ingredients monthly, transforming basic commodities into finished consumer products.expertmarketresearch

Hormel Foods generates $12.3 billion annually through diversified protein processing operations. Beyond its famous SPAM canned meat products, Hormel operates major facilities processing turkey, pork, and beef for both canned and fresh applications. The company’s Jennie-O Turkey Store division alone processes millions of turkeys annually, while its canned meat operations require sophisticated preservation and packaging technologies.expertmarketresearch

Market Share Dynamics and Competitive Positioning

The American canned and processed food industry demonstrates significant market concentration, with leading companies commanding substantial market shares across product categories. In the canned soup segment, Campbell’s maintains overwhelming dominance with 64.5% market share, followed by private label products at 25.5%. This concentration reflects both brand loyalty built over decades and the substantial barriers to entry in large-scale food processing.rowyal

Kraft Heinz holds commanding positions across multiple categories, including 48.3% market share in cheese products and significant positions in condiments and sauces. The company’s Heinz ketchup brand alone controls substantial market share in the condiment category, leveraging both taste preferences and distribution advantages built over more than a century.rowyal

Market share data reveals the industry’s diversity and specialization. General Mills commands 40.5% of the granola bar market through its Nature Valley brand, while Kellogg maintains 27.8% of the crackers market through Cheez-It, Keebler, and other brands. These specialized positions demonstrate how large food processors build competitive moats through brand development, production efficiency, and distribution scale.rowyal

Private label products represent significant competition, accounting for substantial market shares across categories including 63.4% of skim milk, 53.8% of eggs, and 29.4% of sour cream. This private label growth reflects both retailer strategies to capture higher margins and consumer acceptance of store-brand quality, creating competitive pressures on branded manufacturers.rowyal

Technological Innovation and Production Efficiency

America’s leading food processors invest heavily in technological innovation to maintain competitive advantages and improve production efficiency. Campbell Soup has implemented advanced supply chain technologies to optimize ingredient sourcing, production scheduling, and distribution logistics. The company’s facilities utilize automated systems for everything from ingredient measurement to packaging, enabling consistent quality while managing labor costs.statista

Kraft Heinz operates sophisticated manufacturing systems across its 75 facilities, incorporating automated processing lines, quality control systems, and packaging technologies. The company’s tomato processing operations, for example, utilize advanced systems to sort, process, and package tomatoes at massive scale while maintaining consistent product quality. Investment in automation has enabled the company to maintain profitability despite challenging market conditions.metatechinsights

General Mills has implemented comprehensive manufacturing optimization programs, achieving significant cost savings through improved efficiency. The company’s facilities utilize advanced mixing, baking, and packaging systems that enable high-volume production while maintaining product consistency. Automation investments have helped offset labor shortages while improving safety and quality control.ers.usda

Food safety represents a critical technological focus area, with companies investing in sophisticated monitoring systems, testing equipment, and traceability technologies. Blockchain-based traceability systems are increasingly common, enabling companies to track ingredients from farm to finished product while facilitating rapid response to food safety issues.

Industry Diversity and Market Segments

The American canned and processed food industry encompasses remarkable diversity across product categories, processing methods, and consumer segments. The broader processed food market, valued at $2.32 trillion in 2025, includes everything from simple canned vegetables to complex frozen meals requiring sophisticated processing technologies.grandviewresearch

Canned foods represent a significant segment, with metal cans dominating packaging at over 70% market share, followed by glass jars, plastic containers, and composite cans. Processing methods vary dramatically, including heat processing, pressure canning, vacuum sealing, aseptic canning, and retort pouch canning, each requiring specialized equipment and expertise.finance.yahoo

Distribution channels reflect industry complexity, with supermarkets and hypermarkets accounting for the largest share, followed by convenience stores, specialty stores, online retail, and wholesale distributors. The rise of e-commerce has created new opportunities and challenges, with companies adapting packaging, logistics, and marketing strategies to serve online consumers effectively.finance.yahoo

End-user segments include household consumers, commercial foodservice, and industrial food processors, each with distinct requirements for packaging, pricing, and product specifications. Commercial and industrial segments often require bulk packaging and specialized formulations, while consumer products emphasize convenience, branding, and shelf appeal.finance.yahoo

Economic Impact and Employment

The canned and processed food industry generates substantial economic impact throughout the American economy. Food and beverage processing establishments employ 1.7 million workers, representing 15.4% of all U.S. manufacturing employment. The meat processing industry alone employs 30.6% of food and beverage manufacturing workers, followed by bakeries and tortilla producers at 14.7%.news.kraftheinzcompany

Geographic distribution shows industry concentration in agricultural regions, with California leading in food manufacturing establishments at 6,569 facilities, followed by Texas at 2,898 and New York at 2,748. This distribution reflects both proximity to agricultural inputs and access to consumer markets, with processing facilities often located at transportation hubs.news.kraftheinzcompany

The industry’s economic multiplier effects extend throughout related sectors, including agriculture, packaging, transportation, and retail. International distribution accounts for 18% of the industry’s $1.8 trillion in sales, generating substantial export revenue while supporting American agricultural producers.gourmetpro

Supply chain complexity creates employment opportunities across multiple skill levels, from entry-level production workers to highly skilled engineers, food scientists, and logistics specialists. The industry’s technology adoption continues creating demand for specialized skills while potentially displacing some traditional manufacturing roles.

Challenges and Market Dynamics

Despite impressive revenue and scale, America’s canned and processed food industry faces significant challenges that impact operations and profitability. Rising input costs for ingredients, packaging, labor, and energy have compressed margins across the sector, forcing companies to implement price increases while managing consumer resistance.generalmills

Changing consumer preferences toward fresh, organic, and minimally processed foods challenge traditional business models built around shelf-stable, highly processed products. General Mills’ revenue decline reflects these broader market shifts, as consumers increasingly seek perceived healthier alternatives to traditional processed foods.ers.usda

Supply chain disruptions have highlighted industry vulnerabilities, from ingredient shortages to packaging material constraints and transportation bottlenecks. Companies have responded by diversifying supplier relationships, increasing inventory levels, and investing in supply chain visibility technologies, though these strategies increase working capital requirements.

Regulatory pressures continue mounting, with increasing scrutiny of food additives, labeling requirements, and nutritional content. Compliance costs are rising, particularly for companies operating across multiple jurisdictions with varying regulatory requirements.industryselect

Future Outlook and Innovation Trends

The American canned and processed food industry continues evolving to meet changing consumer demands while maintaining operational efficiency. Market projections show continued growth, with the global canned food market expected to reach $164.37 billion by 2034 , driven by urbanization, convenience demands, and emerging market expansion.industryselect

Innovation focuses on health and wellness, with companies reformulating products to reduce sodium, eliminate artificial ingredients, and incorporate functional nutrition. Plant-based alternatives represent significant growth opportunities, as companies adapt traditional processing technologies to create meat and dairy alternatives.

Sustainability initiatives are becoming competitive requirements, with companies investing in renewable energy, waste reduction, and sustainable packaging. Consumer awareness of environmental issues is influencing purchasing decisions, forcing companies to balance sustainability with cost considerations.

Digital transformation continues accelerating, with companies implementing advanced analytics, artificial intelligence, and automation technologies to optimize operations and enhance consumer engagement. E-commerce growth requires new packaging, logistics, and marketing capabilities that traditional manufacturers are still developing.

Conclusion

America’s canned and processed food industry represents a remarkable combination of scale, efficiency, and market reach that has fundamentally shaped both domestic eating habits and global food systems. Industry leaders like PepsiCo ($91.5B), Tyson Foods ($54.1B), and Kraft Heinz ($25.9B) demonstrate the extraordinary revenue potential of food processing when executed at massive scale with strong brand portfolios.expertmarketresearch+2

The sector’s 21,000+ facilities employing 1.56 million workers generate $1.9 trillion in annual sales, positioning American food processing as a critical economic driver with global reach. Despite facing challenges from changing consumer preferences, rising costs, and regulatory pressures, the industry’s innovation capabilities and operational scale provide substantial competitive advantages.gourmetpro

Future success will depend on balancing traditional strengths in efficiency and scale with evolving consumer demands for health, sustainability, and transparency. Companies that successfully navigate these transitions while maintaining operational excellence will likely capture disproportionate value in an increasingly competitive and dynamic marketplace. The industry’s continued evolution reflects broader changes in American society, technology, and global trade patterns that will shape food systems for generations to come.

About us

Try it for yourself. Freshdi.com

Global B2B Marketplace.