Bacon has evolved from a simple preservation method for pork into a global culinary phenomenon worth billions of dollars. This crispy, smoky, and savory meat product has captured the hearts and palates of consumers worldwide, driving a global bacon market valued at $73.2 billion in 2024 and projected to reach $95.9 billion by 2033 with a steady growth rate of 3% annually.

Nutritional Profile: Understanding Bacon’s Composition

Bacon’s nutritional profile reflects its status as a high-calorie, protein-rich food with significant fat content. One ounce (28g) of raw cured bacon contains approximately 118 calories, with 87% of calories from fat, 12% from protein, and only 1% from carbohydrates. This macronutrient distribution makes bacon particularly popular among followers of ketogenic and low-carb diets, where high-fat foods are valued for their satiating properties and metabolic benefits.

Per 100 grams, bacon provides 417 calories, 12.6 grams of protein, and 40 grams of fat. The fat composition includes 13 grams of saturated fat (66% of daily value), along with significant amounts of monounsaturated and polyunsaturated fats. While often criticized for its high saturated fat content, recent nutritional research has nuanced views on saturated fats, particularly when consumed as part of balanced diets.

Bacon contains several essential nutrients beyond macronutrients. Notable micronutrients include selenium (110% of daily value per 100g), phosphorus (62% DV), potassium (17% DV), and zinc (32% DV). B-vitamins are well-represented, including niacin, thiamine, riboflavin, and vitamin B12, which support energy metabolism and nervous system function. However, bacon’s sodium content is significant at 1,986mg per 100g (86% of daily value), requiring consideration in sodium-restricted diets.

Cooked bacon’s nutritional profile differs slightly from raw bacon due to fat rendering during cooking. One slice of cooked bacon (8g) contains 37 calories, 3g fat, and 3g protein. The cooking process reduces total fat content while concentrating protein and other nutrients, making cooked bacon more nutrient-dense per gram than raw bacon.

Global Production Landscape: The Powerhouses of Pork

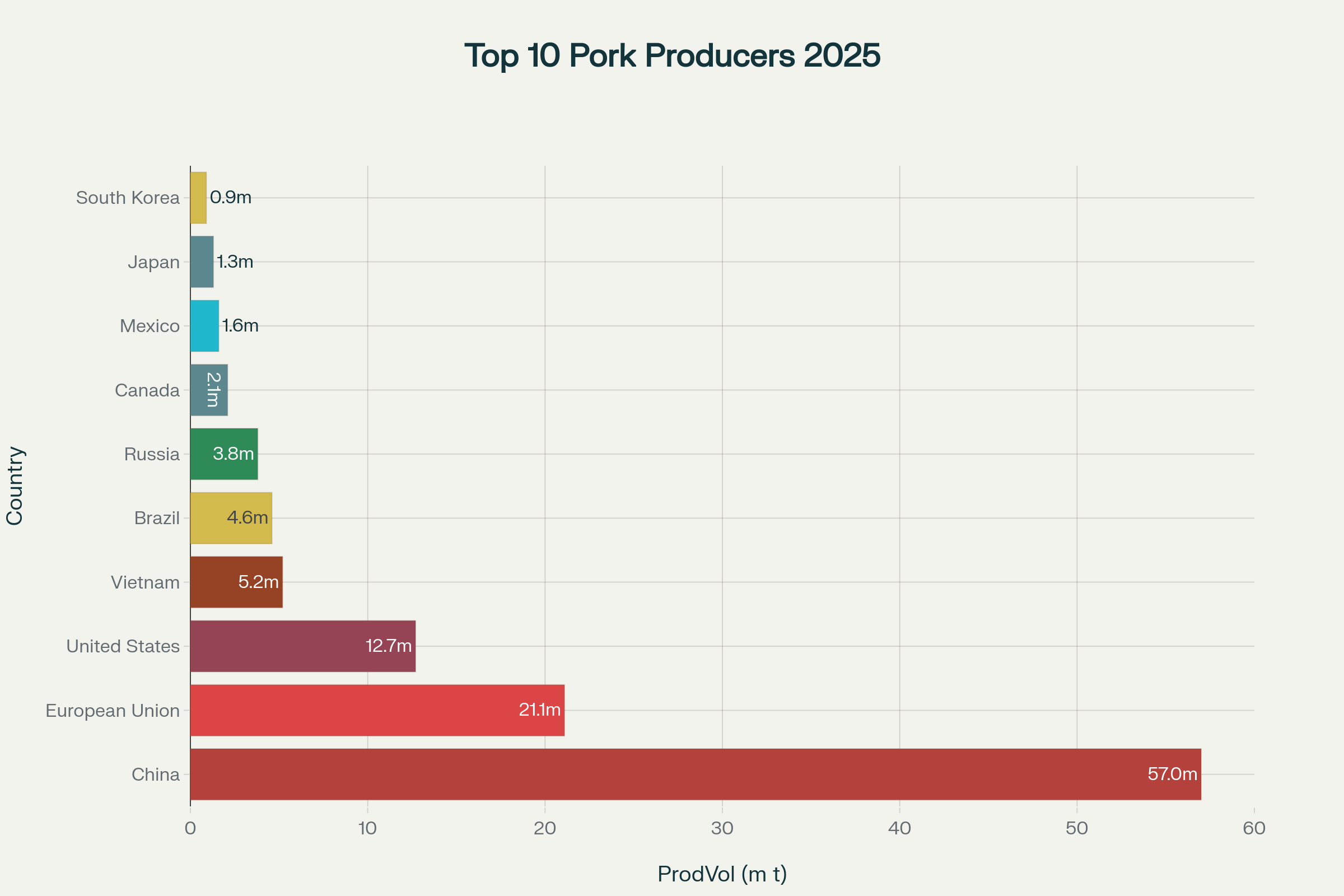

The global bacon industry relies fundamentally on pork production, with worldwide pork production expected to reach 116.7 million tons in 2025, representing a slight 0.2% increase from 2024. Understanding the major pork-producing nations provides insight into bacon supply chains and market dynamics that influence global pricing and availability.pig333

China dominates global pork production with an estimated 57.0 million tons in 2025, accounting for nearly half of worldwide production. Despite China’s massive production capacity, the country is also a significant importer, consuming most of its domestic production while importing additional supplies to meet growing demand. Chinese per capita pork consumption reached 40.2 kg annually, reflecting pork’s cultural significance in Chinese cuisine.

The European Union ranks second with 21.1 million tons projected for 2025, though production is expected to decline by 1% due to changing consumer preferences, animal disease concerns, and evolving regulations. European pork production faces unique challenges including environmental regulations, animal welfare standards, and competition from alternative proteins. However, the EU remains a major exporter, particularly of processed pork products including bacon.

The United States is projected to increase pork production by 1.0% to 12.7 million tons in 2025. American pork production benefits from advanced farming technologies, efficient feed conversion, and strong domestic demand. The US exported 2.2 million metric tons of pork products in 2014, representing over 26% of domestic production, generating nearly $7 billion in export revenue.

Brazil emerges as a significant growth market with production expected to increase 2% to 4.6 million tons in 2025. Brazilian pork benefits from competitive feed costs, favorable climate conditions, and expanding international market access. Brazil’s export volume is expected to increase by 5%, positioning the country as an increasingly important global supplier.

Top 10 Pork Producing Countries/Regions by Production Volume (2025)

Major Consumer Markets: Where Bacon Dominates

Global bacon consumption patterns reveal significant regional variations driven by cultural preferences, economic factors, and dietary traditions. North America leads global bacon consumption, accounting for approximately 41% of the worldwide market , reflecting bacon’s integral role in American and Canadian breakfast culture and its widespread incorporation into diverse culinary applications.

The United States represents the largest single national market for bacon consumption. Americans consume approximately 29.6 kg of pork per capita annually , with bacon representing a significant portion of this consumption. The popularity of bacon in American cuisine extends beyond breakfast into burgers, pizza, salads, and even desserts, driving sustained demand growth across foodservice and retail channels.

European markets demonstrate strong bacon consumption, with several countries ranking among global leaders in per capita pork consumption. Croatia leads worldwide with 59.1 kg per capita annually, followed by Spain at 56.2 kg, Montenegro at 55.3 kg, and Poland at 53.6 kg. These high consumption rates reflect pork’s traditional importance in European cuisines and the availability of diverse processed pork products including various bacon styles.

Asia-Pacific represents the fastest-growing regional market for bacon, projected to expand at a 3.2% CAGR through 2030. This growth reflects changing dietary preferences toward Western-style foods, urbanization trends, and rising disposable incomes in countries like China, Japan, and South Korea. Vietnam has emerged as a significant pork consumer, ranking among the world’s top 10 countries with 27.7 kg per capita consumption in 2023.

Japan maintains its position as the world’s second-largest pork importer at 1.46 million tons, creating substantial opportunities for bacon and processed pork products. South Korean consumers show growing interest in Western breakfast concepts, driving bacon adoption in foodservice and retail channels.

Export Champions: Global Bacon Trade Leaders

The international bacon trade is dominated by countries with advanced pork processing capabilities and strong agricultural infrastructure. The Netherlands holds the largest share of global bacon exports at 21.08%, with export values reaching $145.02 million in 2023. Dutch bacon exports benefit from advanced processing technologies, strategic geographic location, and strong trade relationships throughout Europe and beyond.

The United States ranks second in bacon exports with a 17.4% market share. American bacon exports leverage the country’s massive pork production capacity, advanced processing facilities, and strong quality standards. US pork and pork product exports totaled 2.2 million metric tons in 2014, adding more than $62 to the value of each hog marketed. These exports support approximately 110,000 jobs in the US pork and allied industries.

Canada maintains a 15.77% share of global bacon exports , benefiting from high-quality pork production, strong food safety systems, and preferential trade relationships. However, Canadian bacon exports are expected to decline by 4% in 2025 due to uncertainty in demand from key markets.

Italy holds an 11.78% share of global bacon exports , reflecting the country’s strong tradition in cured meat production and premium positioning in international markets. Italian bacon products often command premium prices due to traditional processing methods and perceived quality advantages.tridge

Denmark has historically been a major bacon exporter, though volumes have declined in recent years. Danish bacon exports to EU markets reached approximately 3,100 metric tons in 2023 , with export values totaling roughly 1.3 billion Danish kroner in 2021. Denmark’s bacon industry benefits from high animal welfare standards and quality reputation, though production costs remain challenging.statista

Market Trends and Consumer Preferences

The global bacon market is experiencing significant evolution driven by changing consumer preferences, health consciousness, and innovative product development. Plant-based bacon alternatives represent one of the fastest-growing segments, as manufacturers develop products that replicate bacon’s distinctive flavor and texture using vegetable proteins and natural flavoring compounds.

Health-conscious offerings are gaining market share as consumers seek bacon products with reduced sodium, nitrate-free processing, and organic certification. These premium products often command 20-40% price premiums while addressing consumer concerns about processed meat health impacts. Turkey bacon has emerged as a popular alternative, offering 30 calories per slice compared to pork bacon’s 43 calories.

Global flavor innovations incorporate international culinary traditions into bacon products. Korean BBQ bacon, Japanese miso-seasoned varieties, and other fusion products appeal to diverse consumer bases while introducing bacon to new cultural contexts. This trend reflects globalization’s impact on food preferences and the bacon industry’s adaptability to local tastes.

Convenience and ready-to-eat products drive significant market growth. Pre-cooked bacon products that require minimal preparation appeal to time-conscious consumers seeking high-quality protein sources for quick meals. Advanced packaging technologies extend shelf life while maintaining flavor and texture quality.

Sustainability considerations increasingly influence purchasing decisions, with consumers preferring bacon from farms practicing humane animal husbandry and sustainable farming methods. Transparency in production practices, environmental impact disclosure, and ethical sourcing have become important differentiators in premium market segments.

Economic Impact and Industry Structure

The bacon industry generates substantial economic impact through integrated supply chains spanning feed production, livestock farming, processing, distribution, and retail. The US pork industry alone supports approximately 547,000 jobs, generates $22.3 billion in personal income, and adds $39 billion to the nation’s GDP. These figures demonstrate bacon’s role as part of broader agricultural value chains supporting rural economies and urban food systems.

Major corporations dominate bacon production and distribution, including Smithfield Foods, Tyson Foods, Hormel Foods, Maple Leaf Foods, and various European processors. These companies leverage economies of scale, advanced processing technologies, and extensive distribution networks to serve global markets efficiently.

Regional specialization creates competitive advantages for different producers. Iowa leads US pork production with $4.2 billion in annual value, followed by Illinois ($1.54 billion), Minnesota ($1.47 billion), and North Carolina ($1.46 billion). These regional concentrations benefit from feed availability, processing infrastructure, and transportation networks optimized for efficient pork production.

International trade relationships significantly influence bacon markets, with free trade agreements, tariff structures, and food safety regulations affecting competitiveness and market access. EU tariff reductions have stimulated demand for European pork products, while trade tensions can disrupt established supply chains and pricing patterns.

Future Outlook and Challenges

The global bacon market faces both opportunities and challenges as it evolves to meet changing consumer expectations and regulatory requirements. Projected market growth to $95.9 billion by 2033 reflects continued global demand, though growth rates may moderate as markets mature and alternative proteins gain acceptance.imarcgroup

Health and wellness trends present both challenges and opportunities for the bacon industry. While some consumers reduce processed meat consumption due to health concerns, others embrace bacon as part of ketogenic and high-protein diets. Product innovation focusing on cleaner ingredients, reduced processing, and improved nutritional profiles will likely determine competitive success in health-conscious market segments.

Environmental sustainability concerns require industry adaptation, including reduced water usage, improved waste management, and lower greenhouse gas emissions from livestock production. Companies implementing comprehensive sustainability programs may achieve competitive advantages while meeting evolving consumer and regulatory expectations.

Technology adoption in production, processing, and distribution offers opportunities for efficiency improvements and quality enhancements. Precision agriculture, automated processing, and blockchain traceability systems could reduce costs while improving food safety and supply chain transparency.

Conclusion

Bacon’s evolution from traditional preservation method to global culinary phenomenon reflects broader trends in food production, international trade, and consumer preferences. The $73.2 billion global market demonstrates bacon’s economic significance, while projected growth to $95.9 billion by 2033 indicates continued expansion opportunities despite evolving dietary trends.imarcgroup

The bacon industry’s future success depends on balancing traditional appeal with evolving consumer expectations, environmental sustainability, and health considerations. Companies that successfully navigate these challenges while maintaining bacon’s distinctive qualities and cultural significance will likely capture the greatest share of continued market growth in this dynamic global industry.

About us

Try it for yourself. Freshdi.com

Global B2B Marketplace.