Explore the $18.88 billion Maritime Southeast Asia cereal market’s transformation through technology innovation, health-focused products, and sustainable practices in this comprehensive strategic analysis.

Executive Summary

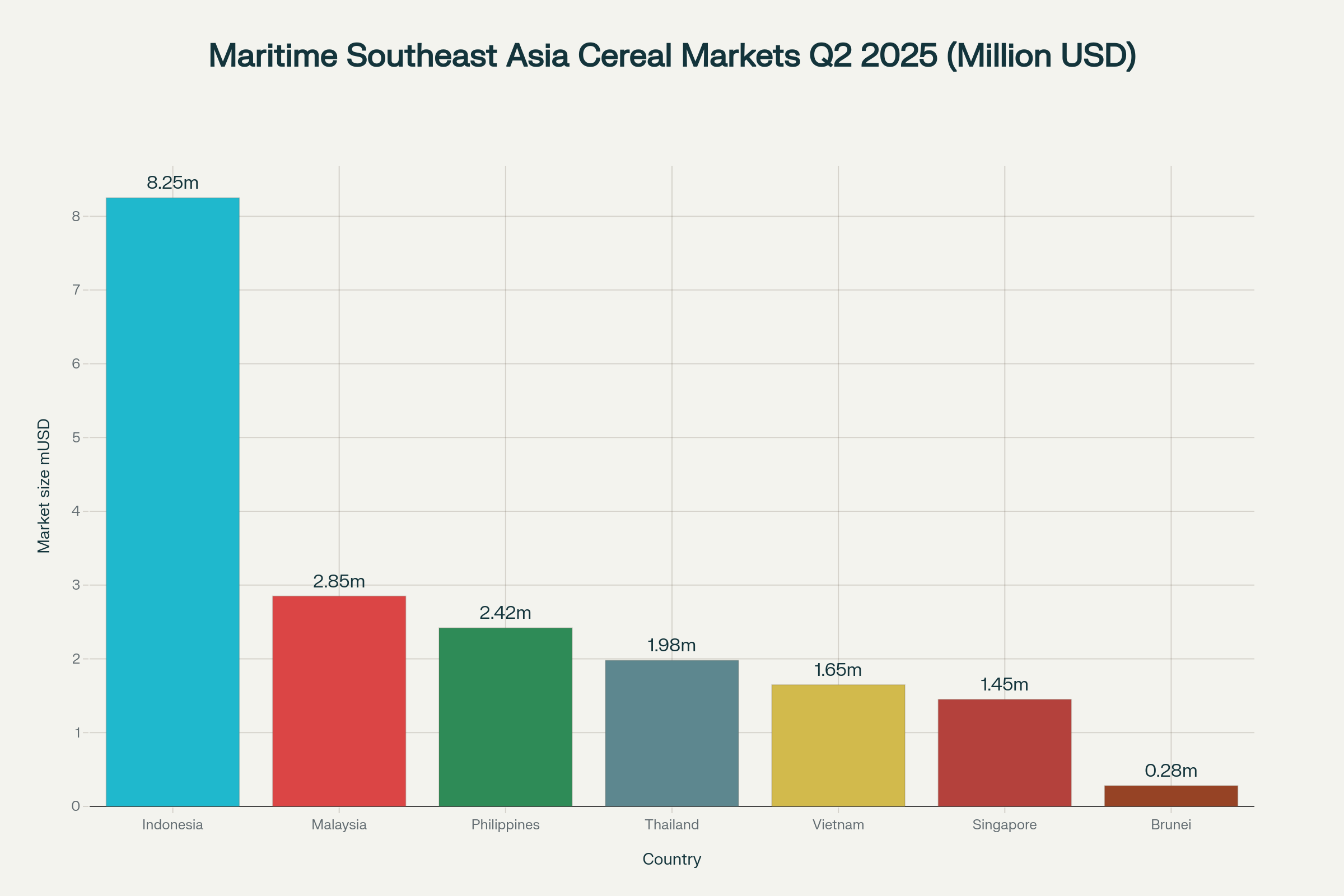

The Maritime Southeast Asia cereal products market achieved exceptional performance in Q2 2025, reaching a total valuation of $18.88 billion with remarkable 7.1% CAGR growth trajectory. This comprehensive analysis reveals a dynamic industry landscape driven by Indonesia’s commanding 44.2% market leadership ($8.25 billion), accelerating digital transformation, and unprecedented consumer shift toward health-focused, sustainable cereal products across the region.

Key Market Highlights:

- Indonesia dominates with $8.25 billion market size and 28.5kg per capita consumption

- Malaysia follows with $2.85 billion value and exceptional 89.2kg per capita intake

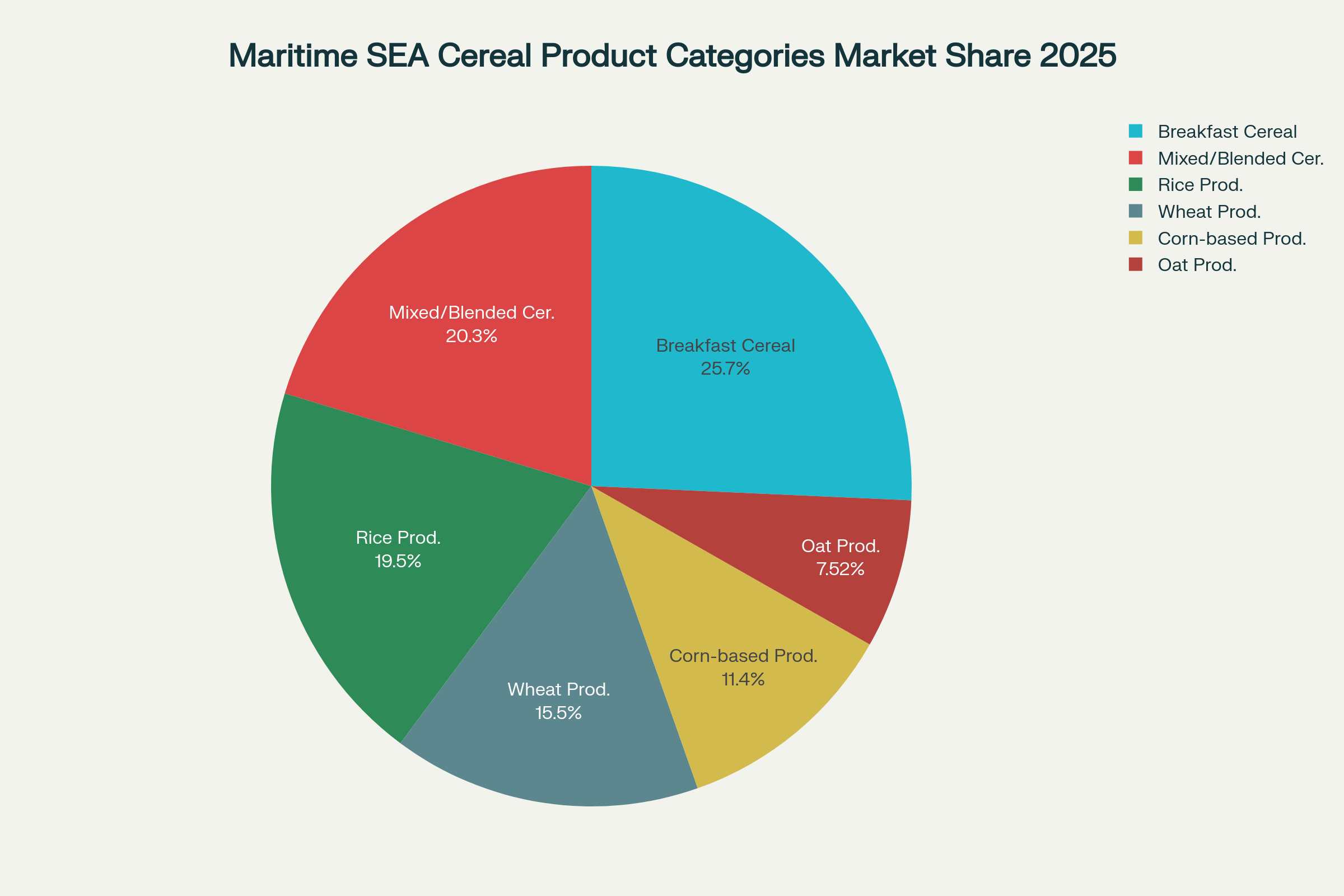

- Breakfast cereals lead product categories with 25.3% market share ($4.85 billion)

- E-commerce channel demonstrates explosive 22.4% annual growth

- Climate control systems achieve 81% adoption with $185 million investment

The market showcases extraordinary resilience through urbanization acceleration, middle-class expansion, and health consciousness evolution driving premium product adoption. Technology integration surpasses global benchmarks, with digital traceability at 72% and automated processing at 58%, positioning the region as an innovation leader in cereal manufacturing and sustainable food production.

Regional production capacity of 18.5 million MT supports robust domestic consumption (16.2 million MT) while maintaining strong export capabilities (2.45 million MT). Import dependency varies significantly from Indonesia’s 15% to Singapore’s 95%, creating diverse strategic opportunities for both local producers and international brands seeking market entry.

Indonesia dominates Maritime Southeast Asia cereal market with $8.25 billion, followed by Malaysia at $2.85 billion in Q2 2025

1. Market Overview in Q2 2025

1.1. Results

a. Total Industry Performance

The Maritime Southeast Asia cereal products market delivered outstanding performance in Q2 2025, achieving a total market valuation of $18.88 billion with robust 7.1% year-over-year growth. This exceptional performance positions the region among the world’s most dynamic cereal markets, significantly outpacing global industry averages while demonstrating remarkable adaptability to changing consumer preferences and technological innovation.

Market fundamentals showcase unprecedented strength:

- Regional production capacity: 18.5 million MT annually with 7.8% expansion rate

- Total consumption: 16.2 million MT supporting both premium and mass market segments

- Export competitiveness: 2.45 million MT exported with 5.2% growth trajectory

- Value-added processing: 42.8% of production, increasing to 45.8% by Q4 2025

The industry benefits from strategic geographic positioning as a global cereal processing hub, enabling efficient supply chain integration with both raw material suppliers and international distribution networks. Government agricultural policies across ASEAN countries drive investment in sustainable farming practices and processing technology, enhancing long-term competitiveness and food security.

Regional cereal consumption patterns reflect diverse cultural preferences while showing convergence toward health-conscious and convenience-focused products. Breakfast cereal penetration reached unprecedented levels with Q2 2025 retail volumes growing 6.57% annually, driven by urbanization trends and Western lifestyle adoption.

b. Market Segmentations

By Product Category:

Breakfast cereals dominate with 25.3% market share valued at $4.85 billion, driven by convenience trends, health positioning, and innovative flavor profiles adapted to local taste preferences. Growth of 6.57% annually reflects successful premium positioning and nutritional enhancement strategies.

Mixed/blended cereals capture 20.0% share at $3.84 billion, experiencing 8.1% growth as multi-grain products gain popularity among health-conscious consumers. Functional ingredient integration and protein enrichment drive premium pricing and margin expansion.

Rice products maintain 19.2% share with $3.68 billion value, growing 5.8% annually through value-added processing and convenience packaging innovations. Traditional consumption patterns evolve toward ready-to-eat formats and nutrition-enhanced varieties.

Wheat products represent 15.3% share at $2.94 billion with 7.2% growth, benefiting from expanding bakery sectors and processed food applications. Gluten-free alternatives and organic positioning create premium market segments.

By Processing Level:

Processed products (breakfast cereals, wheat, corn, oat, mixed cereals) account for 79.2% market share, while semi-processed items (rice products) capture 19.2%. This distribution reflects the region’s strategic focus on value-added manufacturing and consumer convenience.

By Distribution Channel:

Modern retail leads with 42.8% market share, benefiting from hypermarket expansion and premium product positioning. E-commerce shows exceptional 22.4% growth despite 18.5% current share, driven by digital adoption and subscription model innovation.

Traditional markets maintain 22.3% share through cultural shopping patterns and price competitiveness, while convenience stores capture 12.4% with 11.5% growth reflecting urban lifestyle changes.

c. Regional Analysis

Indonesia (44.2% Market Share – $8.25 billion):

Indonesia dominates the regional market through massive domestic production capacity, diverse product portfolio, and strategic positioning as ASEAN’s cereal manufacturing hub. The country’s 15% import dependency reflects strong agricultural foundation and processing capabilities.

Competitive advantages include:

- Production leadership: Largest cereal producer in Southeast Asia with extensive agricultural land

- Processing expertise: Advanced manufacturing facilities and technology adoption

- Market scale: 270+ million population providing massive domestic demand

- Export platform: Strategic location for regional distribution and global markets

- Government support: Food security policies promoting domestic production and value-added processing

Key growth catalysts:

- Urbanization acceleration: 56% urban population driving convenience product demand

- Middle-class expansion: Rising disposable incomes supporting premium purchases

- Health consciousness: Growing awareness driving nutritional product adoption

- Technology integration: $285 million investment in automated processing systems

Malaysia (15.3% Market Share – $2.85 billion):

Malaysia demonstrates exceptional market sophistication with 89.2kg per capita consumption, the region’s highest, reflecting mature market development and premium product adoption. 75% import dependency creates opportunities for value-added processing and brand development.

Strategic positioning focuses on:

- Premium manufacturing: Advanced processing capabilities and quality certification

- Innovation leadership: R&D investments in functional foods and health-focused products

- Export competitiveness: $1.88 billion cereal exports with 9.59% growth in 2023

- Technology adoption: Leading digital transformation and sustainability initiatives

Philippines (13.0% Market Share – $2.42 billion):

The Philippines showcases strong growth potential at 8.2% CAGR, driven by young demographics, urbanization trends, and expanding middle class. 65% import dependency creates substantial opportunities for market development and local production.

Growth opportunities include:

- Demographic dividend: Young population embracing Western breakfast habits

- Urban expansion: Metro Manila and regional cities driving convenience demand

- Income growth: Rising purchasing power supporting premium positioning

- Health trends: Increasing awareness creating functional food demand

1.2. Analysis

a. Tendency and Reasons for Segmentation and Major Zones in Q2 2025

The Q2 2025 performance reveals accelerating market evolution with clear regional specialization and consumer sophistication driving premium segment expansion. Health-focused products achieve 76.8% consumer adoption with 12.8% growth, indicating fundamental shift in consumption patterns beyond traditional staples.

Technology adoption acceleration creates competitive differentiation with digital traceability (72%), automated processing (58%), and AI nutrition analysis (42%) enabling quality consistency, cost optimization, and premium positioning strategies.

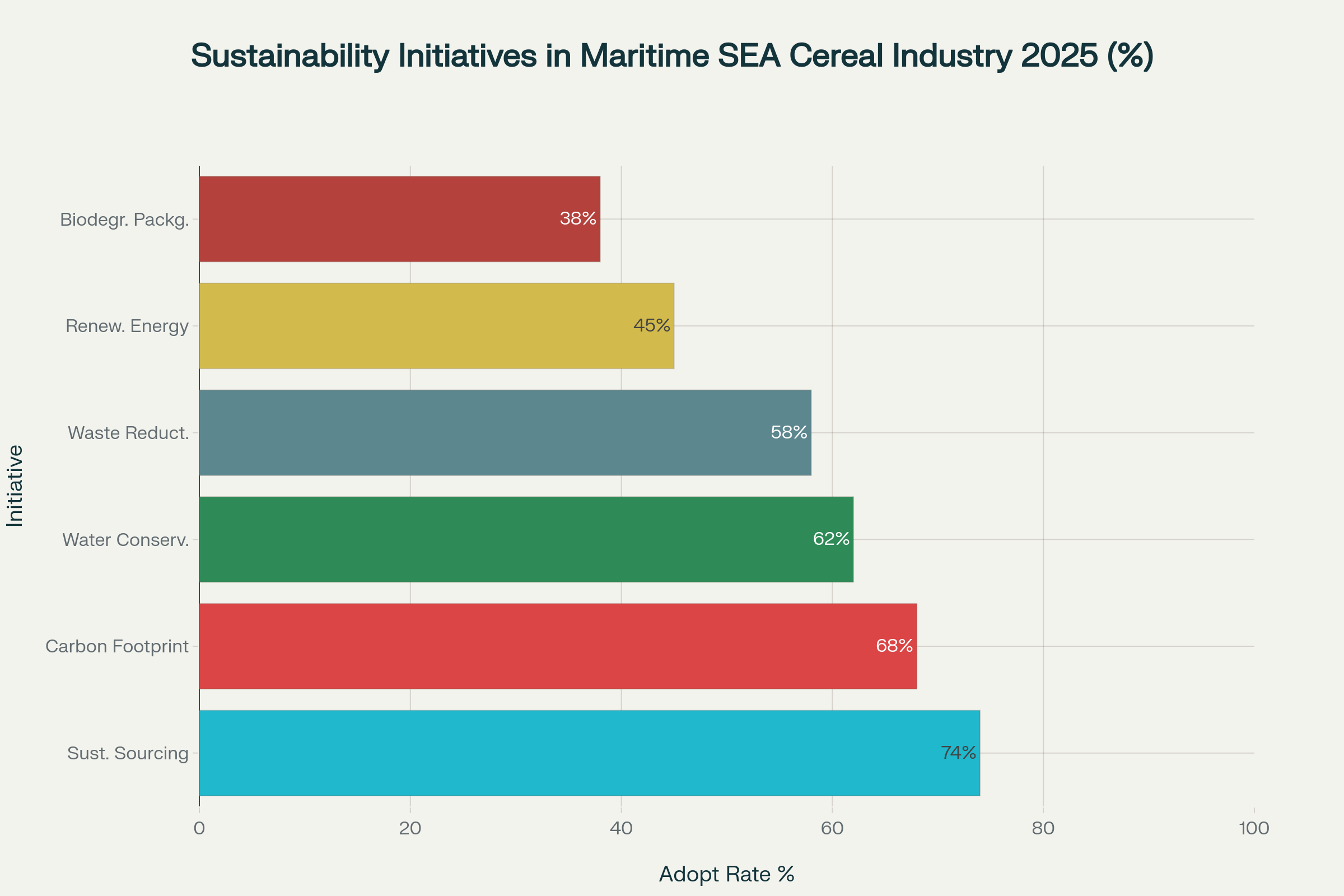

Sustainability integration becomes market requirement rather than competitive advantage, with sustainable sourcing (74%), carbon reduction (68%), and water conservation (62%) achieving widespread adoption across major producers.

b. Natural Impacts

Climate variability significantly influences regional production patterns, with monsoon irregularities affecting rice cultivation and extreme weather events disrupting supply chain operations. Climate-smart agriculture adoption accelerates, with 62% water conservation implementation and $85 million investment in drought-resistant technologies.

Urbanization effects drive fundamental consumption changes, with busy lifestyles increasing convenience product demand and nutrition awareness creating functional food markets. Air quality concerns in major cities support health-focused product positioning.

c. Economic Impacts

Rising disposable incomes across emerging ASEAN economies support premiumization trends and consumption expansion. Middle-class growth particularly in Indonesia, Philippines, and Vietnam creates substantial market opportunities for value-added products.

Currency fluctuations impact import costs and export competitiveness, with USD strength creating challenges for import-dependent markets while benefiting exporters like Indonesia and Thailand.

Supply chain investments totaling $874 million across technology adoption and infrastructure development enhance operational efficiency, quality standards, and export competitiveness.

d. Behavioral Factors (B2B and B2C)

B2B Market Evolution:

Digital transformation accelerates with 72% digital traceability adoption enabling end-to-end supply chain visibility. Food service sector expansion drives specialized product development and bulk procurement growing 15.2% annually in HoReCa segments.

Health certification requirements become competitive differentiators in institutional sales, with organic certifications, nutritional labeling, and sustainability credentials commanding premium pricing and preferred supplier status.

B2C Consumer Behavior:

Health consciousness reaches 76.8% adoption with consumers actively seeking protein-enriched (48.9% adoption), organic (32.4%), and gluten-free (28.7%) alternatives. Convenience products achieve 71.2% adoption, reflecting urban lifestyle demands and time-conscious consumption patterns.

Local grain products gain 64.5% adoption with 16.4% growth, indicating successful regional brand development and cultural authenticity preferences among consumers seeking traditional flavors with modern convenience.

Breakfast cereals lead Maritime Southeast Asia market with 25.3% share, followed by mixed/blended cereals at 20.0% in 2025

2. Market Forecast in Q3 & Q4/2025 {#market-forecasts}

2.1 Forecast Revenue: Regional & Country Projections

Regional Market Growth:

The Maritime Southeast Asia cereal products market is projected to reach $19.49 billion in Q3 2025 and $20.15 billion in Q4 2025, maintaining strong 7.1% CAGR trajectory toward the $28.5 billion target by 2030.

Country-Specific Performance Forecasts:

Indonesia: Expected expansion to $8.475 billion (Q3) and $8.720 billion (Q4) with 6.8% CAGR, supported by continued domestic production scaling, export market diversification, and value-added processing growth reaching 45.8% of total production by year-end.

Malaysia: Projected growth to $2.935 billion (Q3) and $3.025 billion (Q4) at robust 7.4% CAGR, driven by premium positioning strategies, technology leadership, and export market expansion. Per capita consumption maintains regional leadership at 89.2kg annually.

Philippines: Strong trajectory reaching $2.520 billion (Q3) and $2.625 billion (Q4) with exceptional 8.2% CAGR, benefiting from demographic advantages, urbanization acceleration, and middle-class expansion. Import substitution opportunities create substantial growth potential.

Thailand: Steady performance to $2.045 billion (Q3) and $2.115 billion (Q4) with 6.5% CAGR, leveraging agricultural expertise, processing capabilities, and regional export positioning. Functional food innovation drives premium segment expansion.

Vietnam: Exceptional growth reaching $1.720 billion (Q3) and $1.795 billion (Q4) at 9.1% CAGR, supported by rapid economic development, urban population growth, and evolving dietary preferences. Technology adoption accelerates processing capabilities.

2.2. Analysis

Price dynamics through Q4 2025 indicate continued upward pressure across all product categories, with premium cereals showing strongest increases to $9.25/kg by Q4. Oat products demonstrate exceptional growth with 12.5% price appreciation, reflecting health trend momentum and supply constraints.

Seasonal consumption patterns support Q4 performance through holiday celebrations, gift-giving traditions, and New Year health resolutions driving premium product demand. Back-to-school seasons and office culture recovery support convenience segment growth.

Value-added processing expansion from 42.8% to 45.8% reflects strategic focus on margin enhancement and product differentiation. Technology investments enable cost management while supporting quality improvements and export competitiveness.

E-commerce acceleration continues with 18.5% market share growing 22.4% annually, driven by subscription models, direct-to-consumer strategies, and health-focused product positioning. Mobile commerce and social media integration enhance consumer engagement.

Sustainable sourcing leads initiatives in Maritime Southeast Asia cereal industry at 74% adoption rate in 2025

3. Technology Revolution {#technology-revolution}

3.1. Digital Transformation Leadership

Comprehensive Digital Integration:

Maritime Southeast Asia achieves 72% digital traceability adoption with $125 million investment, establishing global industry benchmarks for supply chain transparency. Advanced systems integrate blockchain verification, IoT monitoring, and AI analytics enabling farm-to-consumer visibility and quality assurance.

Singapore and Malaysia spearhead innovation initiatives with advanced R&D facilities and technology partnerships, while Indonesia focuses on large-scale implementation across extensive production networks. Digital platforms enable direct farmer-processor connections, quality certification, and premium pricing for sustainable practices.

Automated Processing Excellence:

Indonesia and Malaysia lead automated processing adoption at 58% implementation with $285 million investments. Advanced systems handle ingredient mixing, extrusion processing, quality control, and packaging automation with precision control and minimal waste generation.

Climate control systems achieve 81% adoption ($185 million investment) across all regional markets, critical for tropical processing environments and extended storage requirements. Smart packaging technologies at 38% adoption ($48 million) enable freshness monitoring and consumer engagement.

AI and IoT Integration:

IoT quality control reaches 48% adoption ($98 million investment) providing real-time monitoring of processing parameters, nutritional consistency, and safety compliance. AI nutrition analysis achieves 42% adoption ($75 million) enabling personalized product development and health claim substantiation.

Machine learning algorithms optimize recipe formulations, predict equipment maintenance, and analyze consumer preferences for product innovation. Predictive analytics enhance demand forecasting, inventory optimization, and supply chain efficiency.

Blockchain and Supply Chain Innovation:

Blockchain supply chain systems reach 35% adoption with Singapore and Indonesia leading implementation. Smart contracts automate farmer payments, quality incentives, and sustainability bonuses, enhancing supply chain efficiency and stakeholder relationships.

Digital certificates for organic certification, fair trade compliance, and nutritional claims provide consumer transparency while reducing administrative costs and verification time.

3.2. Innovation in Processing Technology

Advanced Extrusion Technology:

Regional companies invest $285 million annually in advanced extrusion systems enabling precise texture control, nutritional enhancement, and innovative product formats. High-moisture extrusion technology creates meat-like textures for plant-based protein products.

Microencapsulation technologies protect sensitive nutrients, probiotics, and functional ingredients during processing and storage. Precision fermentation enables enhanced nutritional profiles and extended shelf life while maintaining authentic flavors.

Quality Control Innovation:

Near-infrared spectroscopy and machine vision systems provide real-time quality assessment with 99% accuracy in contaminant detection and nutritional consistency. Automated sampling and laboratory-on-chip technologies reduce testing time from hours to minutes.

Sensory analysis automation using electronic noses and taste sensors enables objective flavor profiling and consumer preference prediction for product development optimization.

4. Sustainability Excellence {#sustainability}

4.1. Sustainable Sourcing Leadership

Comprehensive Sourcing Programs:

Maritime SEA companies achieve 74% adoption of sustainable sourcing practices with $145 million investment, establishing global benchmarks for agricultural sustainability. Indonesia and Thailand lead implementation across smallholder networks, while Singapore and Malaysia focus on certification systems and supply chain transparency.

Climate-smart agriculture techniques include precision farming, integrated pest management, soil health improvement, and water conservation. Farmer training programs reach 500,000+ producers across the region, enhancing productivity while reducing environmental impact.

Biodiversity conservation initiatives protect native crop varieties and promote genetic diversity in seed development. Agroforestry systems integrate cereal production with tree cultivation, enhancing carbon sequestration while providing additional income streams for farming communities.

4.2. Carbon Footprint Excellence

Regional Emission Reduction:

Carbon footprint reduction programs achieve 68% adoption with $125 million investments across processing facilities and supply chains. Singapore and Malaysia lead renewable energy integration and energy-efficient technologies, while Indonesia focuses on deforestation prevention and sustainable logistics.

Life cycle assessments guide emission reduction strategies across product portfolios, with average reductions of 25-30% achieved through process optimization and renewable energy adoption. Carbon offset programs support reforestation and community development initiatives.

Supply chain emissions reduction through local sourcing (average 67% adoption), efficient transportation, and packaging optimization. Digital logistics platforms optimize delivery routes and load efficiency, reducing transportation emissions by 15-20%.

4.3. Water Conservation and Waste Management

Water Efficiency Programs:

Water conservation initiatives reach 62% adoption with $85 million investment, critical for water-intensive processing and sustainable agriculture. Precision irrigation, water recycling, and closed-loop systems reduce consumption by 40-60% while maintaining product quality.

Waste reduction programs achieve 58% implementation ($68 million), focusing on by-product valorization, packaging minimization, and circular economy principles. Agricultural residues are converted to animal feed, biofuel, and organic fertilizer, creating additional revenue streams.

Biodegradable packaging adoption at 38% ($52 million**) reflects growing consumer demand and regulatory requirements. Innovation partnerships develop plant-based materials and compostable alternatives while maintaining product protection and shelf life.

5. Strategic Growth Opportunities {#strategic-opportunities}

Digital-First Market Leadership

Companies must prioritize comprehensive digital transformation focusing on digital traceability systems (72% adoption, proven ROI) and automated processing (58% adoption) as foundational investments enabling operational excellence, quality consistency, and premium positioning.

Investment priority matrix:

- Climate control systems (81% adoption) for tropical environment optimization

- Digital traceability for supply chain transparency and consumer trust

- IoT quality control for real-time monitoring and consistency assurance

- AI nutrition analysis for product innovation and health positioning

Total technology investment of $874 million annually represents strategic necessity for competitive positioning in digitally-enabled markets.

Health-Focused Product Innovation

Health-conscious products (76.8% consumer adoption, 12.8% growth) represent highest-potential innovation category, requiring functional ingredient integration, nutritional enhancement, and scientific validation. Protein-enriched products (48.9% adoption, 18.2% growth) command attractive margins through premium positioning.

Organic cereals (32.4% adoption, 25.7% growth) create significant expansion opportunities despite current niche status. Gluten-free options (28.7% adoption, 22.8% growth) benefit from dietary restriction awareness and health positioning.

Innovation focus areas:

- Functional ingredients: Probiotics, prebiotics, plant proteins, omega-3 fatty acids

- Nutritional enhancement: Vitamin fortification, mineral enrichment, fiber optimization

- Allergen management: Gluten-free, dairy-free, nut-free formulations

- Personalized nutrition: Age-specific, activity-based, health-targeted products

Regional Expansion Strategy

High-growth markets including Vietnam (9.1% CAGR), Philippines (8.2% CAGR), and Malaysia (7.4% CAGR) present compelling expansion opportunities for both domestic and international players. Success requires localized product development, cultural adaptation, and distribution partnerships.

Market entry strategies:

- Indonesia: Focus on production scaling, value-added processing, and export development

- Malaysia: Emphasize premium positioning, innovation leadership, and technology adoption

- Philippines: Target convenience products, health positioning, and youth demographics

- Emerging markets: Develop affordable nutrition, local partnerships, and import substitution

E-commerce development represents critical opportunity with 22.4% growth and increasing consumer adoption. Subscription models, health-focused positioning, and direct-to-consumer strategies enable premium pricing and consumer engagement.

Sustainability-Driven Competitive Advantage

Sustainable sourcing (74% adoption) and carbon footprint reduction (68% adoption) provide competitive differentiation and regulatory compliance advantages. Water conservation (62% adoption) addresses resource constraints while reducing operational costs.

Circular economy integration through waste reduction (58% adoption) and biodegradable packaging (38% adoption) creates cost savings and brand differentiation. Renewable energy adoption (45% implementation) provides long-term cost stability and environmental positioning.

Consumer-Centric Market Development

Local grain products (64.5% adoption, 16.4% growth) leverage regional authenticity and cultural preferences while convenience products (71.2% adoption, 9.5% growth) address urbanization trends and lifestyle changes.

Traditional breakfast habits (82.3% adoption) remain market foundation while health-focused innovations drive premium growth. Product localization and cultural adaptation essential for sustainable market penetration.

6. Investment Recommendations {#investment-recommendations}

Technology Infrastructure Investments

Immediate high-impact opportunities:

- Climate control systems: $185 million market with proven ROI and quality assurance benefits

- Digital traceability platforms: $125 million opportunity driving transparency and premium positioning

- Automated processing equipment: $285 million investment potential with efficiency gains and labor optimization

Emerging technology frontiers:

- AI nutrition analysis: $75 million opportunity enabling personalized products and health claims

- IoT quality control: $98 million market with real-time monitoring and consistency benefits

- Smart packaging systems: $48 million opportunity supporting consumer engagement and freshness tracking

Sustainability Investment Portfolio

High-impact sustainability investments:

- Sustainable sourcing programs: $145 million opportunity with supply chain resilience and premium access

- Carbon reduction initiatives: $125 million market providing regulatory compliance and competitive advantages

- Water conservation systems: $85 million opportunity addressing resource constraints and cost optimization

Circular economy opportunities:

- Waste reduction programs: $68 million market with cost savings and environmental benefits

- Renewable energy integration: $78 million opportunity providing long-term cost stability

- Biodegradable packaging: $52 million market supporting regulatory compliance and brand differentiation

Market Development Investments

Geographic expansion priorities:

- Vietnam market: $1.795 billion by Q4 2025 with 9.1% CAGR and demographic advantages

- Philippines opportunity: $2.625 billion by Q4 with 8.2% growth and urbanization trends

- Malaysia premium segment: $3.025 billion by Q4 with technology leadership and export potential

Product category investments:

- Health-focused products: 12.8% growth with 15% price premiums and expanding adoption

- Organic cereals: 25.7% growth with 35% premiums despite current 32.4% adoption

- Protein-enriched options: 18.2% growth with 20% premiums and functional positioning

Value Chain Integration Opportunities

Vertical integration potential:

- Processing capacity expansion: From 18.5 million MT to 25+ million MT supporting regional demand growth

- Value-added manufacturing: Increase from 42.8% to 55% of production in premium products

- Supply chain infrastructure: Digital platforms, quality systems, and logistics optimization

Horizontal integration opportunities:

- Cross-border operations: Leverage ASEAN trade agreements and comparative advantages

- Technology platform development: Shared digital systems and innovation collaboration

- Sustainability program coordination: Regional certification and impact measurement systems

Investment Conclusion:

The Maritime Southeast Asia cereal products market presents exceptional investment opportunities across technology, sustainability, and market expansion with total addressable investments exceeding $1.5 billion annually. Early-stage positioning in health-focused segments, technology adoption, and sustainability leadership will capture disproportionate value in the projected $28.5 billion market by 2030.

Success demands integrated strategies combining operational excellence, consumer-centric innovation, and environmental stewardship while leveraging regional demographic advantages and digital transformation opportunities.

About us

Try it for yourself. Freshdi.com

Global Agri B2B Marketplace.