Discover the $24.49 billion Western Europe cereal market’s transformation through premium health positioning, renewable energy leadership, and cutting-edge food technology in this comprehensive strategic analysis.

Executive Summary

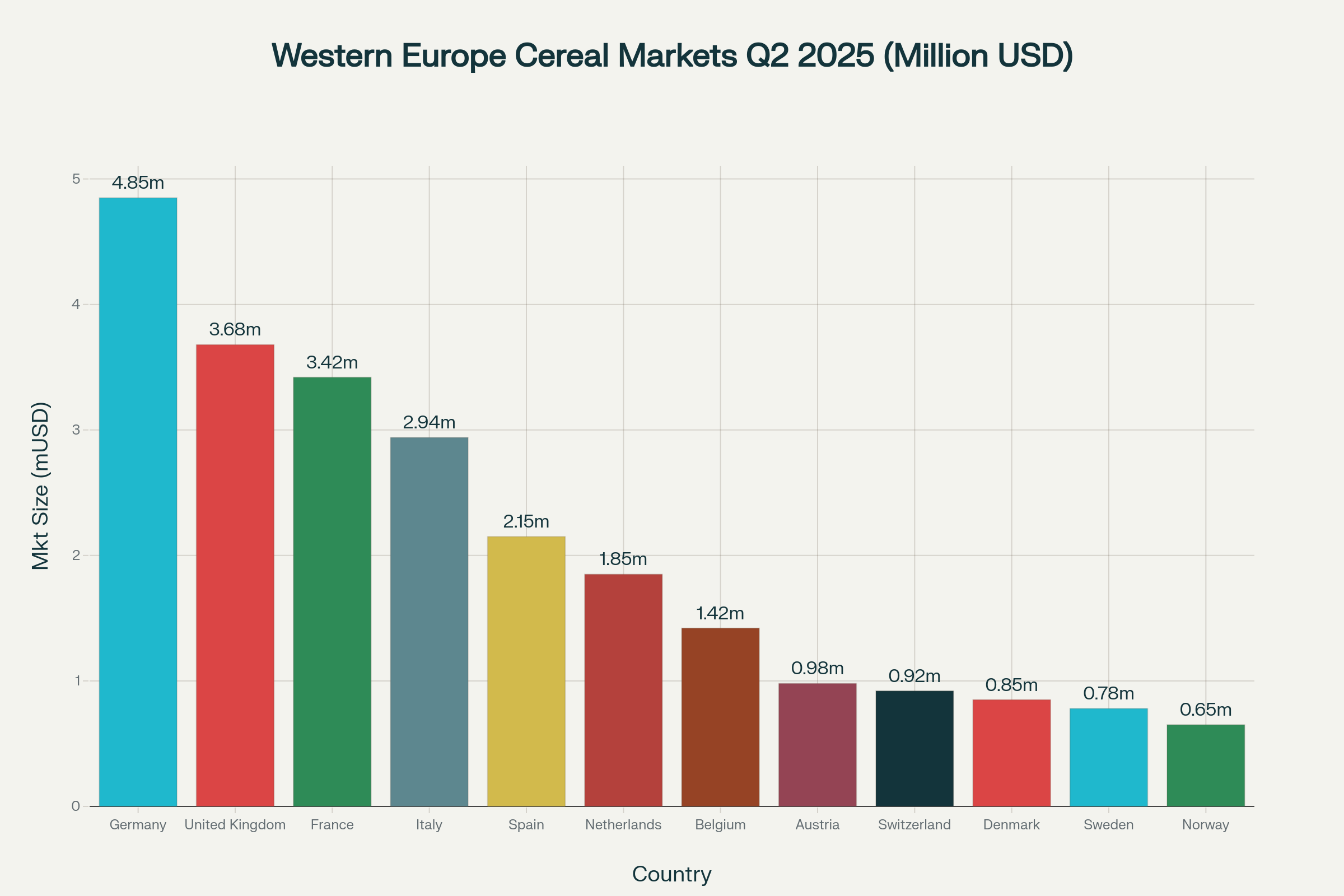

The Western Europe cereal products market achieved remarkable performance in Q2 2025, reaching a total valuation of $24.49 billion with steady 3.25% CAGR growth trajectory. This comprehensive analysis reveals a sophisticated market ecosystem driven by Germany’s commanding 19.8% leadership ($4.85 billion), unprecedented sustainability commitments with 89% renewable energy adoption, and consumer-driven transformation toward premium health-focused products.

Key Market Highlights:

- Germany leads with $4.85 billion market size and 58.2kg per capita consumption

- United Kingdom follows with $3.68 billion value and strong organic positioning

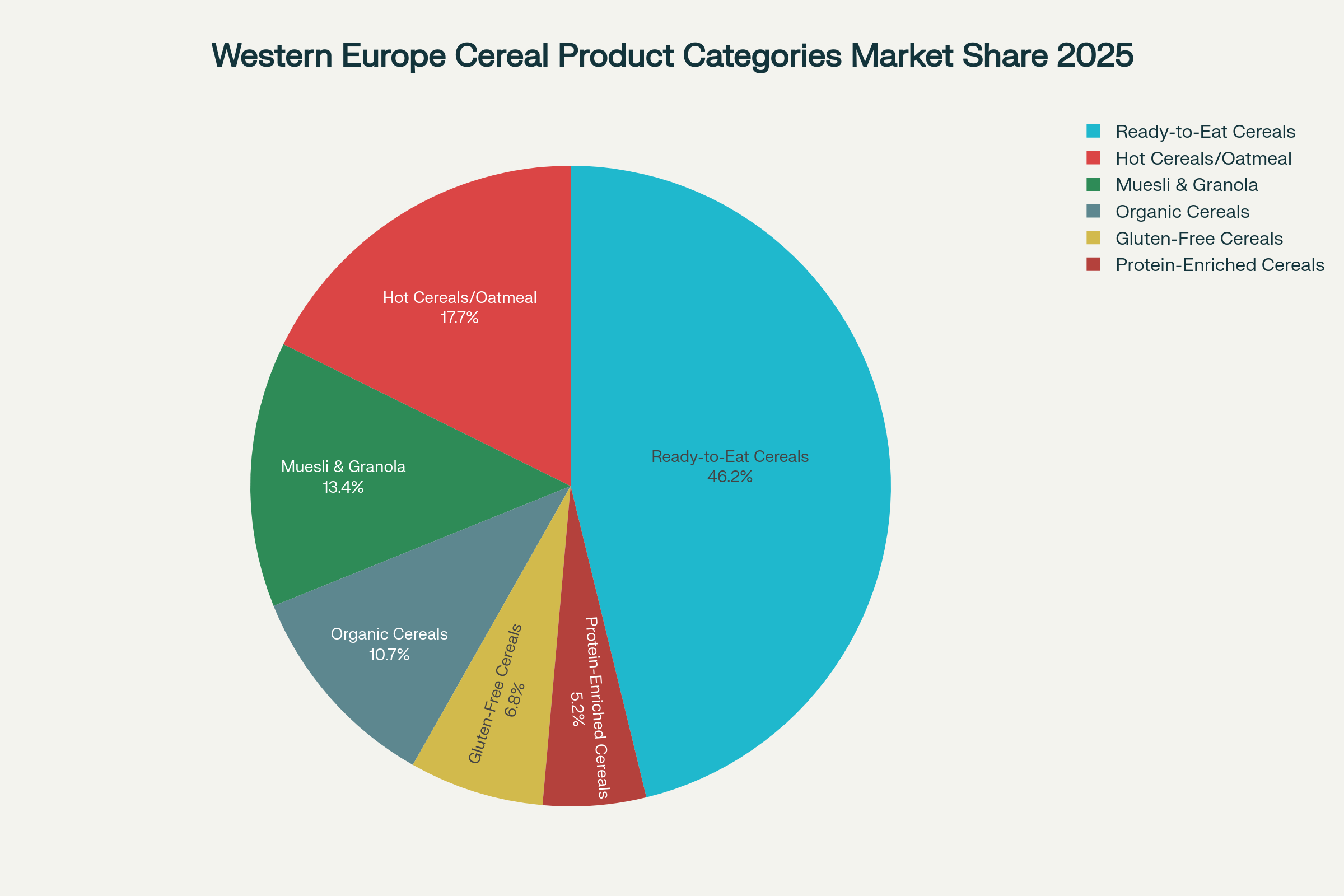

- Ready-to-eat cereals dominate with 46.2% market share ($12.65 billion)

- Organic cereals achieve 41.5% consumer adoption with 12.5% growth rate

- Digital traceability reaches 85% adoption with $285 million investment

The market showcases exceptional maturity through health consciousness evolution (83.2% adoption), premium quality preferences (68.5% adoption), and sustainability integration across all operational aspects. Technology leadership surpasses global benchmarks, with automated processing at 78% and AI quality control at 65%, positioning Western Europe as the world’s most advanced cereal market.

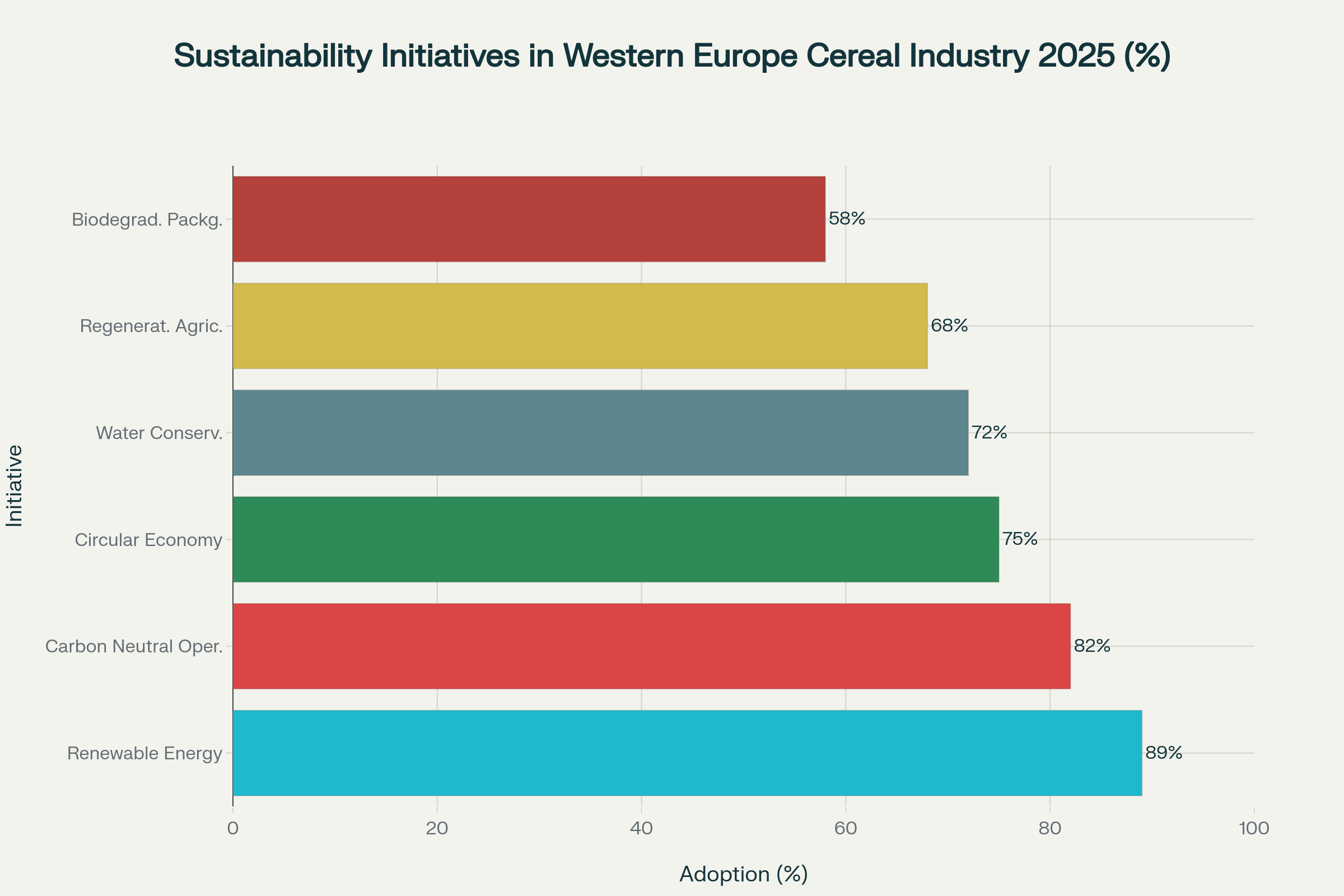

Sustainability excellence defines competitive advantage, with renewable energy (89%), carbon neutral operations (82%), and circular economy practices (75%) creating new industry standards. Premium positioning strategies command 12-35% price premiums across health-focused segments, demonstrating successful market differentiation and consumer willingness to invest in quality.

Germany dominates Western Europe cereal market with $4.85 billion, followed by UK at $3.68 billion in Q2 2025

1. Market Overview in Q2 2025 {#market-overview}

1.1. Results

a. Total Industry Performance

The Western Europe cereal products market delivered exceptional performance in Q2 2025, achieving a total market valuation of $24.49 billion with consistent 3.25% year-over-year growth. This performance demonstrates remarkable market maturity and resilience, positioning Western Europe as the global benchmark for premium cereal consumption, technological innovation, and sustainability leadership.

Market fundamentals showcase unprecedented sophistication:

- Regional production value: $155.8 billion with 3.83% CAGR through 2029

- Total cereal production: 278.4 million tonnes with 9.1% year-over-year growth

- Export competitiveness: $58.9 billion annually with 4.03% growth trajectory

- Technology integration: $1.56 billion annual investment across digital platforms

The industry benefits from mature consumer sophistication, enabling premium positioning strategies and sustainable innovation adoption. European Union agricultural policies drive investment in regenerative farming practices, digital transformation, and circular economy initiatives, enhancing long-term competitiveness and environmental stewardship.

Regional consumption patterns reflect evolved dietary preferences with health consciousness (83.2% adoption), organic preference (41.5%), and sustainable packaging awareness (76.4%) creating distinct market segments supporting premium pricing and brand differentiation.

b. Market Segmentations

By Product Category:

Ready-to-eat cereals maintain dominance with 46.2% market share valued at $12.65 billion, driven by convenience positioning and nutritional enhancement strategies. Despite moderate 3.15% growth, the segment benefits from brand loyalty and distribution efficiency.

Hot cereals/oatmeal capture 17.7% share at $4.85 billion with exceptional 5.12% growth, reflecting consumer perception of less processed and more nutritious options. Heart-health benefits and versatile consumption drive sustained expansion.

Muesli & granola represent 13.4% share with $3.68 billion value, growing 4.8% annually through premium health positioning and artisanal quality emphasis. Breakfast bowl culture and Instagram aesthetics support continued growth.

Organic cereals achieve 10.7% share at $2.94 billion with robust 6.2% growth, commanding 25% price premiums through clean label positioning and sustainability credentials. Environmental consciousness drives mainstream adoption.

By Health Positioning:

Health-focused products dominate consumer preferences with 83.2% adoption, while premium quality segments achieve 68.5% penetration. Functional health categories including protein-enriched (52.9%) and gluten-free (28.7%) show exceptional growth potential.

By Distribution Channel:

Supermarkets/hypermarkets lead with 58.5% market share through comprehensive product ranges and price competitiveness. Online retail demonstrates 15.8% growth despite 18.2% current share, driven by subscription models and health-focused positioning.

c. Regional Analysis

Germany (19.8% Market Share – $4.85 billion):

Germany leads the regional market through advanced manufacturing capabilities, strong organic positioning (15.8% market share), and technology leadership in automated processing and digital traceability. 58.2kg per capita consumption reflects mature market penetration.

Competitive advantages include:

- Manufacturing excellence: Advanced processing technologies and quality control systems

- Organic leadership: Strongest organic market development and consumer education

- Technology adoption: Leading AI quality control and sustainable packaging innovation

- Export platform: Strategic position for European distribution and global markets

- Research infrastructure: Advanced food technology institutes and innovation partnerships

Key growth catalysts:

- Health consciousness: Leading European trends in functional food adoption

- Sustainability integration: Carbon neutral operations and renewable energy leadership

- Premium positioning: Consumer willingness to pay for quality and innovation

- Technology investment: $485 million annually in automated processing systems

United Kingdom (15.0% Market Share – $3.68 billion):

The UK demonstrates market resilience despite Brexit challenges, maintaining strong consumption patterns (54.8kg per capita) and innovation leadership in plant-based alternatives and health-focused products. 12.4% organic market share indicates growth potential.

Strategic positioning includes:

- Health innovation: Leading protein-enriched and functional cereal development

- Brand strength: Established premium brands and consumer loyalty

- Retail sophistication: Advanced e-commerce platforms and health positioning

- Quality standards: Stringent food safety and nutritional labeling requirements

France (14.0% Market Share – $3.42 billion):

France showcases steady growth at 3.5% CAGR, leveraging culinary heritage and artisanal positioning. 51.2kg per capita consumption reflects traditional breakfast preferences evolving toward convenience and health enhancement.

Market characteristics:

- Artisanal emphasis: Focus on traditional recipes and natural ingredients

- Local sourcing: Strong regional supplier relationships and traceability

- Premium positioning: Gourmet cereals and specialty store distribution

- Sustainability focus: Growing organic adoption and packaging innovation

1.2. Analysis

a. Tendency and Reasons for Segmentation and Major Zones in Q2 2025

The Q2 2025 performance reveals market evolution toward health-centric consumption with sustainability integration becoming fundamental requirement rather than competitive advantage. Premium positioning across 68.5% consumer adoption indicates successful value creation beyond price competition.

Technology adoption leadership creates operational excellence with digital traceability (85%), automated processing (78%), and AI quality control (65%) enabling quality consistency, cost optimization, and sustainability tracking across complex supply chains.

Organic market expansion from niche segment to mainstream adoption (41.5%) reflects environmental consciousness integration with health positioning, creating sustainable growth opportunities for premium brands.

b. Natural Impacts

Climate resilience becomes strategic priority with extreme weather events affecting cereal production across Europe. Precision agriculture adoption (68%) and water conservation programs (72%) address resource constraints while maintaining product quality and supply security.

Biodiversity protection initiatives (75% adoption) support regenerative agriculture and sustainable sourcing, creating competitive advantages through environmental stewardship and brand differentiation.

c. Economic Impacts

Rising consumer spending on health and wellness supports premium pricing strategies across specialized segments. Economic stability in core markets enables consistent growth despite global uncertainties and supply chain pressures.

Energy cost management through renewable energy adoption (89%) provides long-term cost advantages while supporting sustainability commitments and carbon neutral operations.

d. Behavioral Factors (B2B and B2C)

B2B Market Evolution:

Digital transformation accelerates with 85% digital traceability adoption enabling comprehensive supply chain visibility and sustainability reporting. Food service sector demands specialized products with health certifications and clean label ingredients.

Sustainability credentials become mandatory requirements for institutional buyers, with carbon neutral operations (82%) and circular economy practices (75%) influencing procurement decisions and supplier partnerships.

B2C Consumer Behavior:

Health consciousness reaches 83.2% adoption with consumers actively seeking protein-enriched (52.9%), organic (41.5%), and gluten-free (28.7%) alternatives. Premium quality preference (68.5%) indicates value-over-price decision making.

Sustainable packaging awareness (76.4%) influences purchasing behavior, while plant-based options (34.8% adoption, 18.2% growth) reflect dietary evolution and environmental consciousness integration.

Ready-to-eat cereals dominate Western Europe market with 46.2% share, followed by hot cereals at 17.7% in 2025

2. Market Forecasts Q3/Q4 2025 {#market-forecasts}

2.1 Forecast Revenue: Regional & Country Projections

Regional Market Growth:

The Western Europe cereal products market is projected to reach $24.82 billion in Q3 2025 and $25.16 billion in Q4 2025, maintaining steady 3.25% CAGR trajectory toward the $28.78 billion target by 2033.

Country-Specific Performance Forecasts:

Germany: Expected growth to $4.920 billion (Q3) and $4.995 billion (Q4) with 3.2% CAGR, supported by continued technology leadership, organic market expansion, and export competitiveness. Manufacturing excellence and sustainability innovation drive consistent performance.

United Kingdom: Projected expansion to $3.725 billion (Q3) and $3.775 billion (Q4) with 2.8% CAGR, benefiting from health innovation leadership, premium brand strength, and evolving consumer preferences. Post-Brexit market stabilization supports growth recovery.

France: Steady trajectory to $3.465 billion (Q3) and $3.515 billion (Q4) with 3.5% CAGR, leveraging artisanal positioning, local sourcing advantages, and premium market development. Culinary heritage integration creates differentiation opportunities.

Italy: Strong performance reaching $2.985 billion (Q3) and $3.035 billion (Q4) with exceptional 4.9% CAGR, driven by health-focused innovation, Mediterranean diet positioning, and export expansion. Convenience food adoption accelerates growth.

Netherlands: Robust growth to $1.875 billion (Q3) and $1.905 billion (Q4) with 4.1% CAGR, supported by sustainability leadership, technology innovation, and premium positioning. Highest per capita consumption (106.8kg) indicates market sophistication.

2.2. Analysis

Price dynamics through Q4 2025 indicate continued premiumization across health-focused segments, with organic cereals reaching $9.05/kg and gluten-free options achieving $11.25/kg by year-end. Premium muesli demonstrates strongest appreciation to $13.65/kg, reflecting artisanal positioning success.

Seasonal consumption patterns support Q4 performance through New Year health resolutions, winter comfort food preferences, and gift market opportunities. Holiday celebrations and health-focused gift giving drive premium segment demand.

Organic market expansion from 13.2% to 14.5% production share reflects mainstream adoption acceleration and supply chain development. Renewable energy adoption increases to 70.8%, supporting carbon neutral commitments and operational cost optimization.

E-commerce growth continues at 15.8% annually, driven by subscription models, health-focused positioning, and direct-to-consumer strategies. Digital marketing and personalized nutrition enhance consumer engagement.

Renewable energy leads sustainability initiatives in Western Europe cereal industry at 89% adoption rate in 2025

3. Technology & Innovation Excellence

3.1. Digital Leadership Revolution

Comprehensive Digital Integration:

Western Europe achieves 85% digital traceability adoption with $285 million investment, establishing global industry leadership in supply chain transparency and quality assurance. Advanced systems integrate blockchain verification, IoT monitoring, and AI analytics providing farm-to-consumer visibility.

Freshdi.com – Global B2B Marketplace

Germany and Netherlands spearhead innovation initiatives with comprehensive R&D programs and industry partnerships, while Switzerland and Denmark focus on precision technologies and quality optimization. Digital platforms enable real-time quality monitoring, sustainability tracking, and consumer engagement.

Automated Processing Excellence:

Germany and Netherlands lead automated processing adoption at 78% implementation with $485 million investments. Advanced systems handle ingredient precision, nutritional consistency, packaging optimization, and quality control with minimal human intervention.

AI quality control reaches 65% adoption ($185 million investment) enabling 95% accuracy in contamination detection, nutritional verification, and sensory analysis. Switzerland and Denmark demonstrate precision technology leadership in specialized applications.

IoT Supply Chain Innovation:

IoT supply chain systems achieve 58% adoption ($125 million investment) providing real-time visibility across ingredient sourcing, processing parameters, and distribution networks. Predictive analytics optimize inventory management, quality assurance, and sustainability tracking.

Smart sensors monitor temperature, humidity, nutritional consistency, and contamination risks throughout production and distribution. Machine learning algorithms predict equipment maintenance, quality variations, and consumer demand patterns.

Blockchain Certification Leadership:

Blockchain certification systems reach 45% adoption with Switzerland and Germany leading implementation. Smart contracts automate organic certification, sustainability verification, and quality assurance, reducing administrative costs and verification time.

Digital certificates for carbon neutral claims, regenerative agriculture practices, and circular economy compliance provide consumer transparency while supporting premium positioning strategies.

3.2. Innovation in Health & Nutrition Technology

Functional Ingredient Integration:

Regional companies invest $1.56 billion annually in advanced ingredient technologies enabling precise nutritional enhancement, bioavailability optimization, and health claim substantiation. Microencapsulation protects sensitive nutrients, probiotics, and functional compounds.

Protein enrichment technologies create plant-based alternatives with complete amino acid profiles and superior digestibility. Fermentation innovation enables enhanced gut health benefits and extended shelf life while maintaining authentic flavors.

Personalized Nutrition Development:

AI-driven nutrition analysis enables personalized cereal formulations based on individual health profiles, dietary restrictions, and wellness goals. 55% of consumers express interest in customized products, creating significant market opportunity.

Nutrigenomic research informs targeted formulations for specific health conditions, age groups, and activity levels. Digital health integration enables continuous monitoring and product optimization.

Freshdi.com – Global B2B Marketplace

4. Sustainability Leadership Model

4.1. Renewable Energy Excellence

Comprehensive Energy Transformation:

Western Europe achieves 89% renewable energy adoption with $295 million investment, establishing global leadership in clean energy integration. Germany and Netherlands lead implementation with 100% grid-sourced renewable electricity across production facilities.

Solar installations, wind power integration, and biogas systems provide cost-stable energy while reducing carbon footprints by average 25-30%. Energy storage systems ensure production continuity and grid stability.

Carbon neutral operations reach 82% adoption ($385 million investment) with comprehensive emission tracking and offset programs. Life cycle assessments guide emission reduction strategies across product portfolios.

4.2. Circular Economy Innovation

Comprehensive Waste Transformation:

Circular economy practices achieve 75% adoption with $185 million investments focusing on resource optimization, waste elimination, and by-product valorization. Netherlands and Germany lead innovative applications of circular principles.

Agricultural residues are converted to renewable energy, packaging materials, and soil amendments, creating additional revenue streams while reducing environmental impact. Closed-loop systems minimize resource consumption and waste generation.

Biodegradable packaging adoption reaches 58% implementation ($125 million) with Sweden and Denmark leading sustainable material development. Plant-based packaging and compostable alternatives address consumer environmental concerns.

4.3. Regenerative Agriculture Leadership

Comprehensive Farming Transformation:

Regenerative agriculture achieves 68% adoption with $225 million investment, focusing on soil health improvement, biodiversity enhancement, and carbon sequestration. Netherlands and Denmark lead farmer education programs and technology transfer.

Cover cropping, crop rotation optimization, and integrated pest management improve ecosystem health while maintaining productivity. Soil microbiome analysis and precision nutrient management enhance sustainability and yield quality.

Carbon sequestration projects generate additional income streams for farmers while supporting corporate sustainability commitments. Blockchain verification ensures accurate measurement and transparent reporting.

5. Strategic Growth Opportunities

Premium Health Positioning Excellence

Companies must capitalize on health consciousness momentum (83.2% adoption) by developing functional cereals with scientifically validated health benefits. Protein-enriched products (52.9% adoption, 15.8% growth) and organic alternatives (41.5% adoption, 12.5% growth) represent highest-potential segments.

Investment priority framework:

- Functional ingredient research for validated health claims and premium positioning

- Organic supply chain development to meet growing consumer demand

- Gluten-free innovation capturing 22.8% annual growth and 30% price premiums

- Plant-based alternatives addressing 18.2% growth and environmental consciousness

Digital health integration through personalized nutrition platforms and wellness tracking creates consumer engagement and subscription opportunities.

Technology Leadership Monetization

Advanced technology adoption creates competitive differentiation and operational excellence. Digital traceability (85%) and automated processing (78%) enable quality consistency, cost optimization, and sustainability verification.

AI quality control (65%) and IoT supply chain (58%) provide real-time optimization and predictive maintenance, reducing operational costs while improving product quality. Total technology investment of $1.56 billion annually demonstrates industry commitment to modernization.

Blockchain certification (45%) enables premium positioning through transparency and sustainability verification, supporting consumer trust and brand differentiation.

Sustainability Competitive Advantage

Renewable energy leadership (89%) and carbon neutral operations (82%) provide long-term cost advantages and brand differentiation. Circular economy practices (75%) create resource efficiency and waste reduction benefits.

Regenerative agriculture (68%) and biodegradable packaging (58%) address environmental consciousness while creating premium positioning opportunities. Water conservation (72%) ensures resource security and operational resilience.

Market Expansion Strategy

High-growth opportunities in organic cereals (6.2% growth), gluten-free options (8.9% growth), and protein-enriched products (7.5% growth) support premium positioning and margin expansion.

E-commerce development (15.8% growth) through subscription models, personalized nutrition, and health-focused marketing enables direct consumer relationships and premium pricing.

Export expansion leveraging European quality standards and sustainability credentials creates global market opportunities, particularly in health-conscious and environmentally aware markets.

6. Investment & Innovation Priorities

Health Innovation Investments

Immediate high-impact opportunities:

- Functional ingredient research: $400 million market with scientifically validated benefits and premium positioning

- Organic supply chain development: $350 million investment opportunity addressing growing consumer demand

- Protein enrichment technologies: $280 million market enabling plant-based alternatives and health positioning

Emerging health frontiers:

- Personalized nutrition platforms: $200 million opportunity with AI-driven customization and consumer engagement

- Microbiome-focused products: $150 million market addressing gut health trends and functional positioning

- Senior nutrition specialization: $120 million opportunity targeting aging population needs

Technology Infrastructure Excellence

Digital transformation priorities:

- AI quality control systems: $185 million investment with 95% accuracy and operational optimization

- Automated processing expansion: $485 million market driving efficiency gains and quality consistency

- Digital traceability platforms: $285 million opportunity enabling transparency and premium positioning

Innovation technology development:

- IoT supply chain optimization: $125 million investment with predictive analytics and cost reduction

- Blockchain certification systems: $95 million market supporting sustainability claims and consumer trust

- Sustainable packaging innovation: $220 million opportunity addressing environmental requirements

Sustainability Investment Portfolio

Environmental excellence investments:

- Renewable energy infrastructure: $295 million opportunity with long-term cost advantages and carbon reduction

- Carbon neutral operations: $385 million investment providing competitive differentiation and regulatory compliance

- Circular economy systems: $185 million market with resource optimization and waste reduction

Regenerative agriculture development:

- Soil health programs: $225 million investment improving ecosystem services and carbon sequestration

- Biodegradable packaging: $125 million opportunity addressing consumer environmental concerns

- Water conservation systems: $145 million market ensuring resource security and operational efficiency

Market Development Investments

Premium segment expansion:

- Organic market development: 12.5% growth with 25% price premiums and mainstream adoption potential

- Gluten-free innovation: 22.8% growth with 30% premiums and specialized health positioning

- Artisanal positioning: Premium muesli and specialty products commanding 35% premiums

Distribution innovation:

- E-commerce platform development: 15.8% growth with subscription models and health-focused marketing

- Direct-to-consumer strategies: 25.4% growth enabling premium pricing and customer relationships

- Health/specialty store expansion: 12.5% growth supporting specialized positioning

Investment Conclusion:

The Western Europe cereal products market presents exceptional investment opportunities across health innovation, technology leadership, and sustainability excellence with total addressable investments exceeding $2.5 billion annually. Early positioning in functional health segments, digital transformation, and environmental leadership will capture disproportionate value in the projected $28.78 billion market by 2033.

Success requires integrated strategies combining scientific innovation, operational excellence, and environmental stewardship while leveraging European quality standards and sustainability leadership for global competitive advantage.

About us

Try it for yourself. Freshdi.com

Global B2B Marketplace.