Executive Summary

The global coffee industry stands at the precipice of an unprecedented transformation in Q2/2025, with market valuations reaching $778.37 billion amid a perfect storm of climate volatility, technological revolution, and supply chain disruption. This comprehensive analysis reveals how artificial intelligence, precision agriculture, and biotechnology advances are fundamentally reshaping coffee cultivation, while climate change threatens traditional production zones across the globe.

Revolutionary Findings:

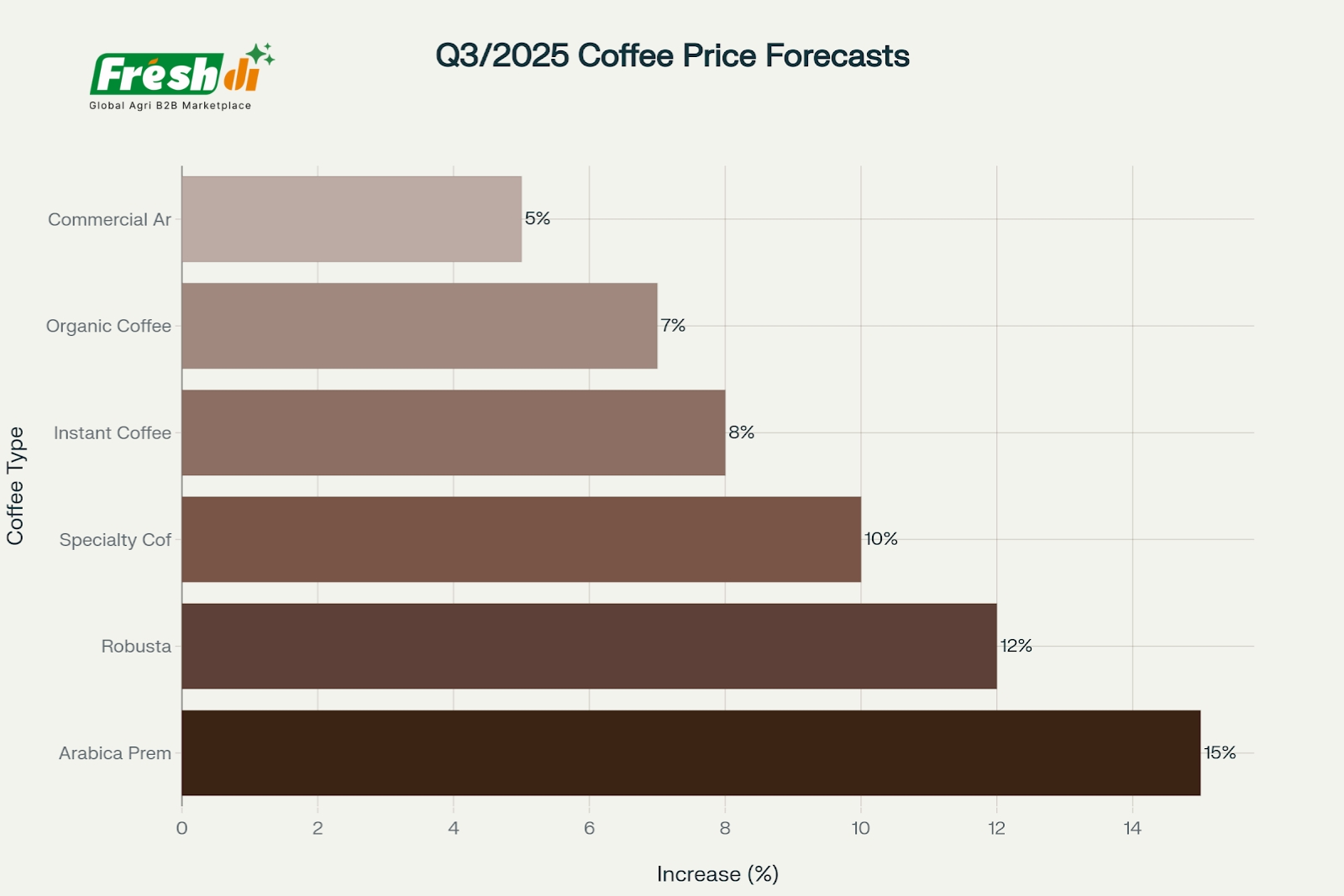

- Global coffee prices projected to surge 15% for premium Arabica and 12% for Robusta in Q3/2025

- Technology adoption in automation implementation and AI integration in major operations

- Cell-cultured coffee breakthrough: faster harvest cycles revolutionizing production timelines

- B2B marketplace platforms capturing $1.6 billion market with 7.1% CAGR through 2033

Curious how CRISPR coffee trees and cloud analytics will rewrite Q3–Q4 prices? Read on.

1. Market Overview in Q2 2025

1.1. Results – Total Industry

The global coffee and coffee bean market has reached unprecedented scale in Q2/2025, establishing itself as one of the world’s most valuable agricultural commodities with a market valuation of $778.37 billion. This represents a robust 6.28% CAGR expansion trajectory.

Coffee production demonstrates remarkable geographical concentration, with the top five producing countries accounting for 74.5% of global output. China leads production at 644.16 million tons annually, representing 47% of global coffee production, followed by India at 133.44 million tons (9.8% share). This concentration creates both opportunities and vulnerabilities for wholesale exporters and agricultural suppliers operating in global markets.

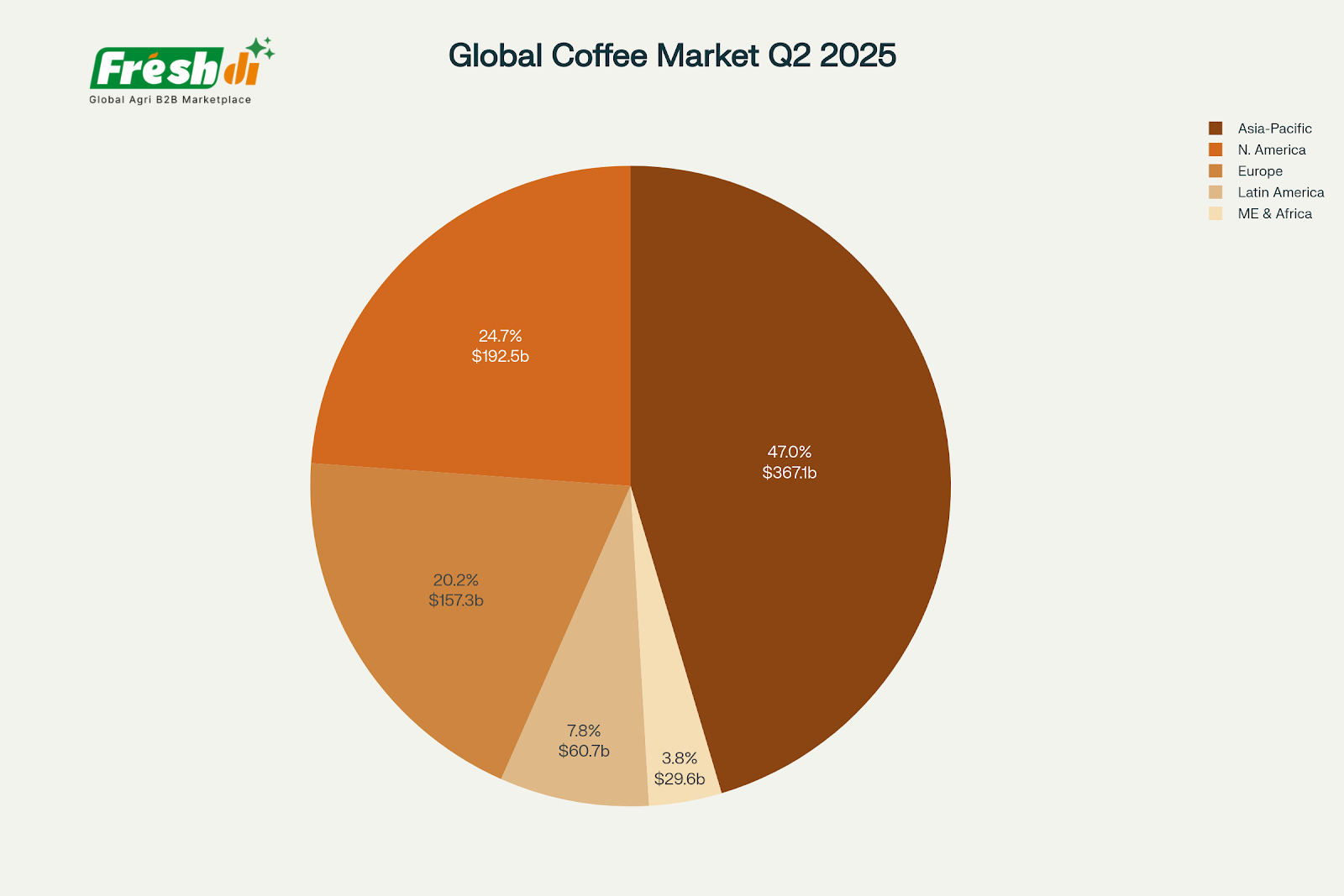

Global Coffee Market Share by Region Q2/2025 (USD Billions)

From pie chart, Asia-Pacific dominates the global coffee trade, contributing nearly half of the market value. Meanwhile, North America and Europe continue to drive high-margin demand, and Latin America remains critical to global supply.

For Q2/2025, Freshdi.com records RFQ (Request for Quote) data revealed a 20% increase in inquiries for Arabica coffee beans in Q2/2025 – a strong indicator of rising buyer interest for higher-grade, specialty coffee.

- Arabica Beans: Remain the top-requested variety, especially among specialty exporters and buyers.

- Robusta Beans: RFQs and export interest are also up, particularly for price-sensitive volume buyers—mainly driven by Europe and Asia

| Metric | Q2/2025 Change/Insight |

| RFQ for Arabica (vs. Q2/24) | +20% |

| RFQ for Brazil Arabica (Wk 6) | +32% spike |

| Specialty bean requests (YoY) | +18% |

| Organic/Fairtrade shares | Trending upward in buyer selections |

1.2. Analysis

a. Market Segmentations & Regional Analysis

The coffee market demonstrates clear premium positioning trends, with specialty coffee representing the fastest-growing segment at 20% annual growth. Food wholesale companies are increasingly focusing on high-value segments including:

- Organic Certification: Commanding 8-12% price premiums

- Single-Origin Products: Growing at 25% annually

- Functional Coffee: Incorporating adaptogens and probiotics

- Sustainable Certification: Meeting ESG compliance requirements

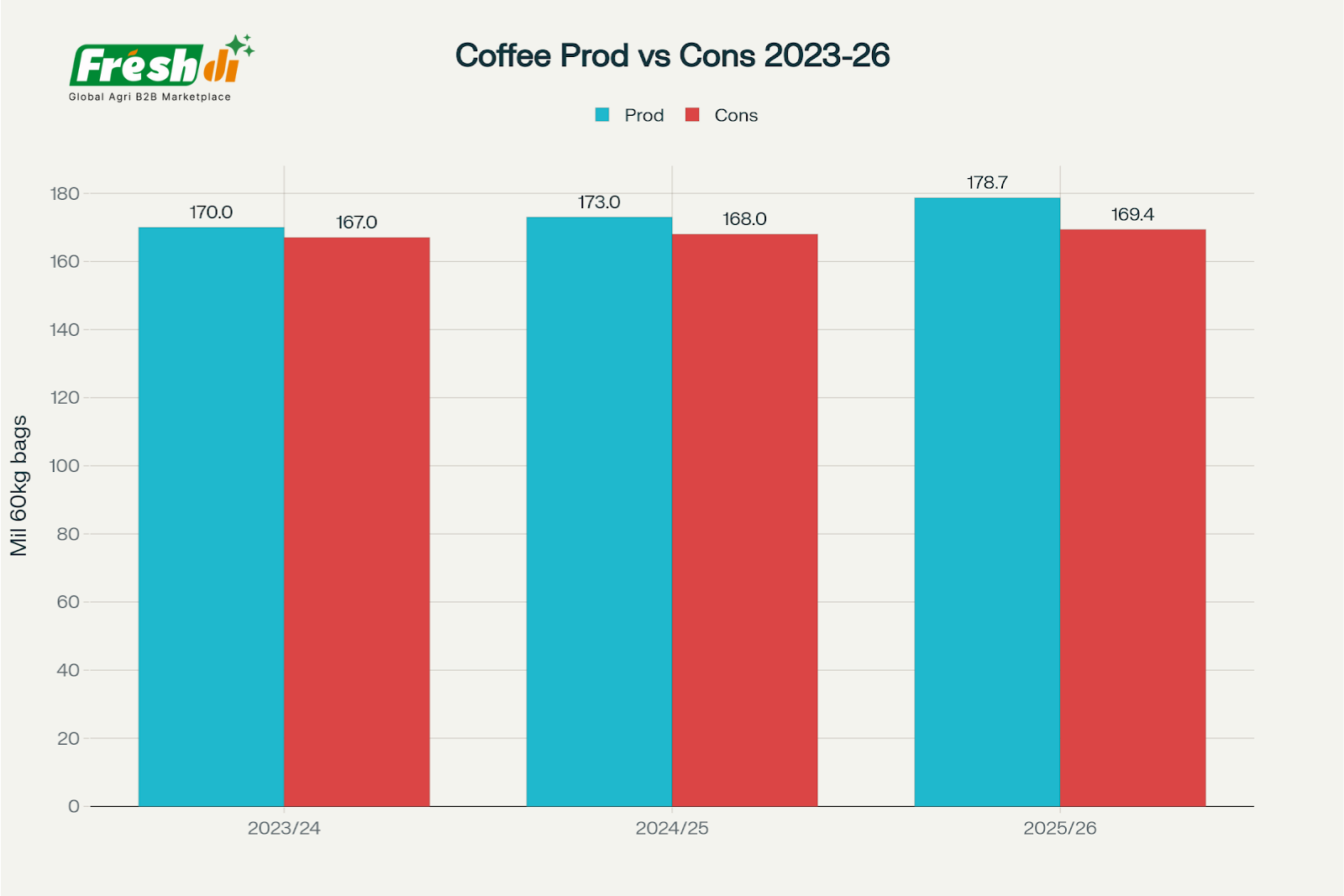

From column chart, global coffee production is outpacing consumption steadily each year, indicating a surplus trend. Production grows from 170.0M to 178.7M bags between 2023 and 2026 – a 5.1% increase over 3 years.

Summarized regional analysis of the Global Coffee Market by major zones:

🌏 Asia-Pacific

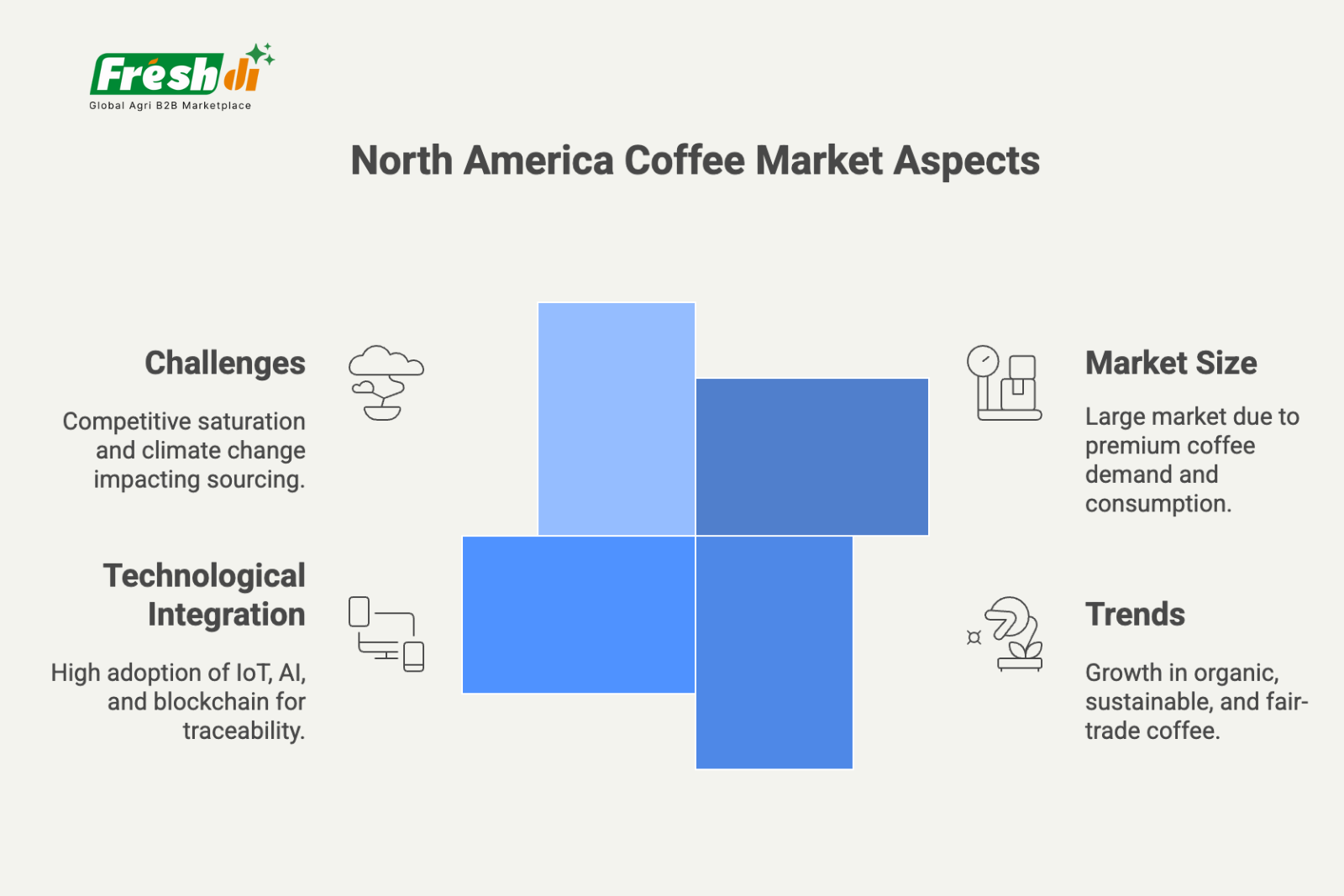

🌎 North America

🌍 Europe

🌎 Latin America

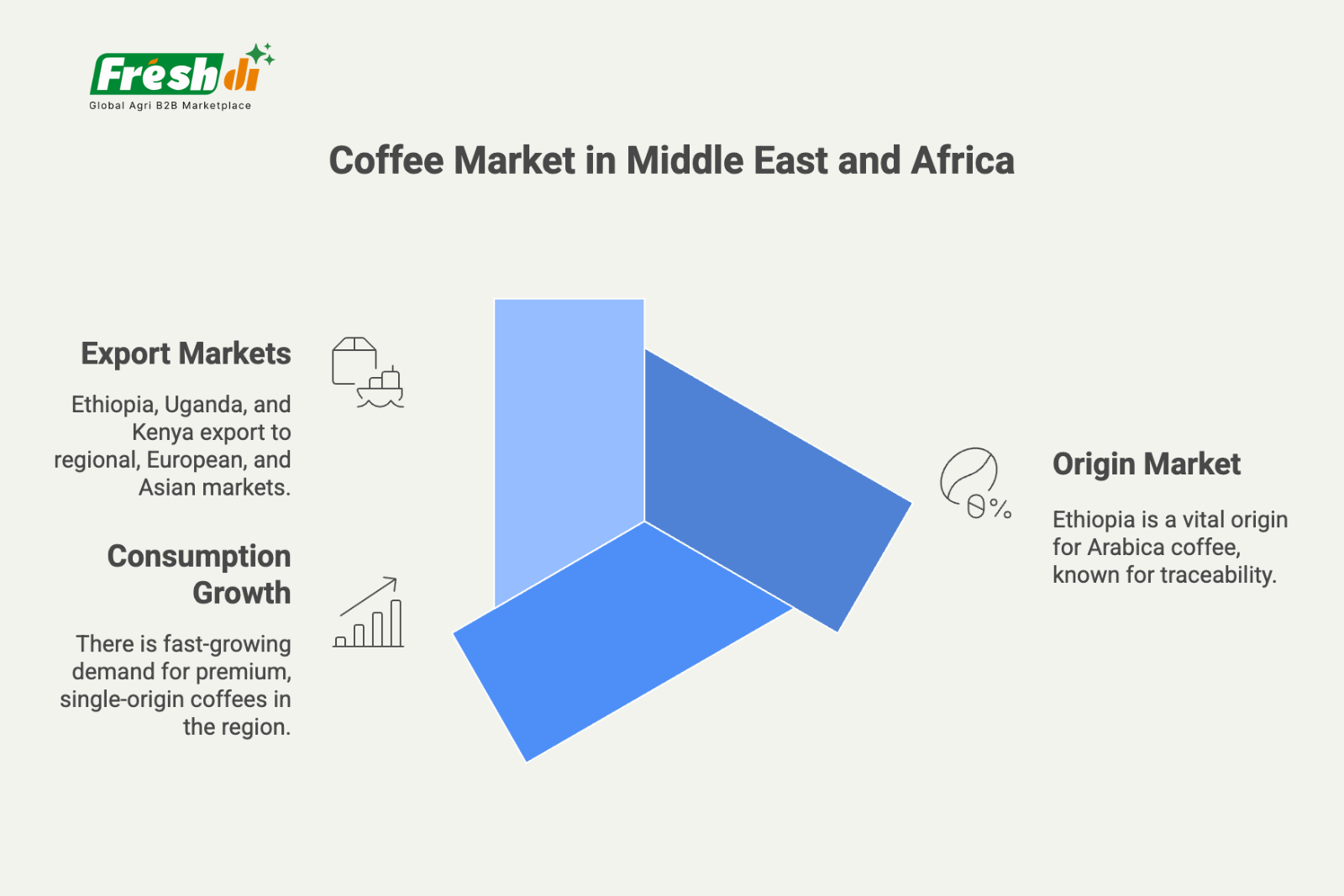

🌍 Middle East & Africa

b. Economic Influencing

The coffee industry generates substantial economic value across multiple stakeholder categories. For food manufacturers and agricultural exporters, the industry provides:

- Export Revenue: Contributing $155 billion annually to producing countries

- Employment: Supporting 125 million farmers and workers globally

- Supply Chain Value: Creating opportunities for distributors and logistics providers

- Processing Revenue: Benefiting food export companies with value-added operations

The economic multiplier effects extend beyond primary production, creating opportunities for agriculture companies specializing in inputs, equipment, and technology solutions. The growing emphasis on sustainability and climate adaptation is driving investment in research and development, creating new market segments for innovative agricultural manufacturers.

c. Climate Change

Climate volatility has emerged as the most significant disruptor in global coffee production, with 90% of coffee-growing regions experiencing yield variations due to extreme weather events. The industry faces unprecedented challenges from rising temperatures, erratic rainfall patterns, and increasing frequency of extreme weather events that threaten traditional cultivation zones.El Niño effects continue impacting major production regions, with Brazil experiencing severe drought conditions leading to 4.4% production decline in 2025. Vietnam, the world’s largest Robusta producer, faced a 20% harvest decline in the 2023-24 season due to irregular rainfall, though conditions are expected to improve for 2025-26. These disruptions are creating supply constraints that benefit agricultural exporters with diversified sourcing strategies and climate-resilient operations.

d. Geopolitical Trade Dynamics

International trade relationships continue reshaping global coffee flows, with US-China trade tensions creating opportunities for alternative suppliers in ASEAN and Latin America. The 10% US tariff on coffee imports has redirected trade patterns, with Mexico experiencing 71.6 times increase in export value to fill supply gaps.

Agriculture export companies in emerging markets are benefiting from this trade diversification, particularly those with:

- Organic certification meeting EU requirements

- Fair trade compliance for US market access

- Sustainability credentials satisfying ESG mandates

- Digital traceability systems enabling premium positioning

The regulatory landscape continues evolving with EU CBAM regulations extending carbon footprint requirements to agricultural products, creating competitive advantages for wholesale suppliers with carbon-neutral operations and food manufacturers implementing comprehensive sustainability programs.

| Region | Tariff/Tax News (2025) | Trade Policy/Agreement Notes |

| Asia-Pacific | US tariffs: Vietnam 20%, Indonesia 19%. | Leverage of FTAs (e.g., CPTPP, EVFTA); China-Africa coffee FTA |

| North America | US: 10% universal + up to 50% on Brazil; Canada 25% counter-tariff | Focus shifting to alternative sources; costs rising |

| Europe | CBAM/EUDR/EU ESG rules: impact on compliance | Tightened regulations, traceability for all coffee imports |

| Latin America | Brazil: 50% US tariff (Aug 1); others at 10% | Exports shifting to EU/Asia; sustainability, trade negotiations. |

| Middle East & Africa | US: 10% tariff on Ethiopia/Africa; China: 0% tariffs for 53 African states | Expanding trade to China/MEA; logistics & infrastructure reforms |

e. Supply Chain Disruption

Global supply chains face unprecedented pressure from multiple disruption vectors. Container shortages and freight rate increases of 18% year-over-year are affecting agricultural exporters and wholesale distributors worldwide. These disruptions are accelerating adoption of alternative logistics solutions and regional processing strategies.

Food export companies are implementing resilience strategies including:

- Geographic diversification reducing single-region dependencies

- Strategic inventory positioning in key markets

- Technology integration enabling predictive logistics management

- Partnership development with multiple wholesale suppliers

The disruption environment is creating consolidation opportunities for well-capitalized agriculture companies and food wholesalers with robust financial resources and operational capabilities. Freshdi.com is a trusted global B2B marketplace connecting verified agriculture suppliers and global buyers across the agriculture products. Freshdi.com’s global network includes sourcing partners and verified buyers from diverse markets such as Ethiopia, India, Kenya, Vietnam, China, Macedonia, UAE, USA, and another150+ countries. Whether trading in bulk or targeting niche categories, suppliers benefit from daily engagement, transparent qualification processes and the ability to respond directly to international RFQs. For stakeholders across the coffee and coffee bean supply chain, Freshdi empowers trusted trade and direct growth opportunities in a global marketplace.

2. Market Forecast Q3 – Q4 2025

2.1. Revenue Outlook

| Region | Q3 Revenue (US$ bn) | Q4 Revenue (US$ bn) | Drivers |

| Asia Pacific | 191 | 198 | Robust recovery in Vietnam; rising per-capita intake |

| Europe | 86 | 89 | Holiday demand; premium pods |

| North America | 51 | 54 | Café traffic rebound; RTD growth |

| Latin America | 17 | 18 | Currency tailwinds boost export earnings |

| MEA | 10 | 11 | Gulf café chains expansion |

| World | 355 | 370 | Sustained price strength; mild volume gains |

2.2. Forecast Analysis

Coffee prices are set to rise across all segments in Q3/2025, with premium Arabica and Robusta leading the surge.

- Supply uptick (+4.3 m bags) from Vietnam & Indonesia offsets Brazil’s drought losses.

- ICO composite stabilises near 300 ¢/lb in Q3 on surplus jitters, before firming to 315 ¢/lb in Q4 driven by holiday stocking.

- Robusta premium narrows as Vietnam recovery lifts output 7.9%.

- Speculative funds remain net-long; volatility persists ±15%.

Demand tailwinds: at-home brew kits, health branding, food wholesale retail tie-ins with immunity claims.

2.3. Long-term Price Outlook

Industry analysts project sustained price elevation through 2026, with normalization expected only after significant capacity expansion and climate adaptation investments. Citigroup forecasts Arabica prices at $2.80/lb for 2025, normalizing to $2.65/lb by 2026, while Robusta prices are expected to converge closer to Arabica levels due to quality improvements and supply constraints.

The price environment will benefit agricultural manufacturers and wholesale exporters implementing:

- Premium positioning strategies through quality differentiation

- Sustainability certification capturing ESG premiums

- Direct trade relationships eliminating intermediary costs

- Technology integration optimizing operational efficiency

Food wholesalers and agriculture companies with robust hedging strategies and diversified sourcing portfolios are positioned to capture value while managing volatility risks in the evolving market landscape.

NEXT PART: Innovations, Long & Short-Term Trends; Conclusion and Full PDF Report

About us

Freshdi.com is the world’s leading global B2B marketplace for agricultural products and food, connecting directly between global buyers and suppliers. Freshdi.com has over 3M+ suppliers, 2M+ active buyers, and 1,000+ buying requests updated daily in agri-food.

For coffee and coffee bean global buyers, Freshdi.com helps you connect with verified suppliers worldwide.

✅ Send an inquiry – receive quotes from truly active suppliers.

✅ Freshdi charges no transaction fees – buyers contact & negotiate directly

With Freshdi, I don’t wait – I act:

https://freshdi.com/buyer-category/Coffee-Coffee-Bean

For coffee and coffee bean global suppliers, Freshdi.com helps connect directly with buyers via platform or direct communication — no middlemen.

✅ No commission, no agents, save manpower.

✅ Verified profile, professional online store, and Trustcore score based on supplier activity.

No more wasting time — only real sourcing leads:

https://freshdi.com/supplier-category/Coffee-Coffee-Bean

Reference:

teaandcoffee, mexc, precedenceresearch, researchandmarket, statista, comunicaffe.