Executive Summary

The global vegetable market entered Q2/2025 at an inflection point, reaching a record value of USD 1,428.64 billion with Asia-Pacific producing nearly 70% of the world’s fresh supply. Volatility, opportunity, and unprecedented innovation are the new norms. This report pulls back the curtain on:

- China’s dominance (644 million tons; 47% world share), India’s rapid expansion.

- The rise of fresh, organic, premium, and greenhouse-grown vegetables, now outpacing traditional crops in both volume and value growth.

- How technology adoption is transforming efficiency, cutting costs by up to 25%, helping exporters withstand a fast-changing climate.

- Looking forward, Q3 and Q4/2025 present a market landscape digital marketplaces like Freshdi.com bridging gaps in trust, access.

1. Market Overview in Q2

1.1. Results

a. Total Industry

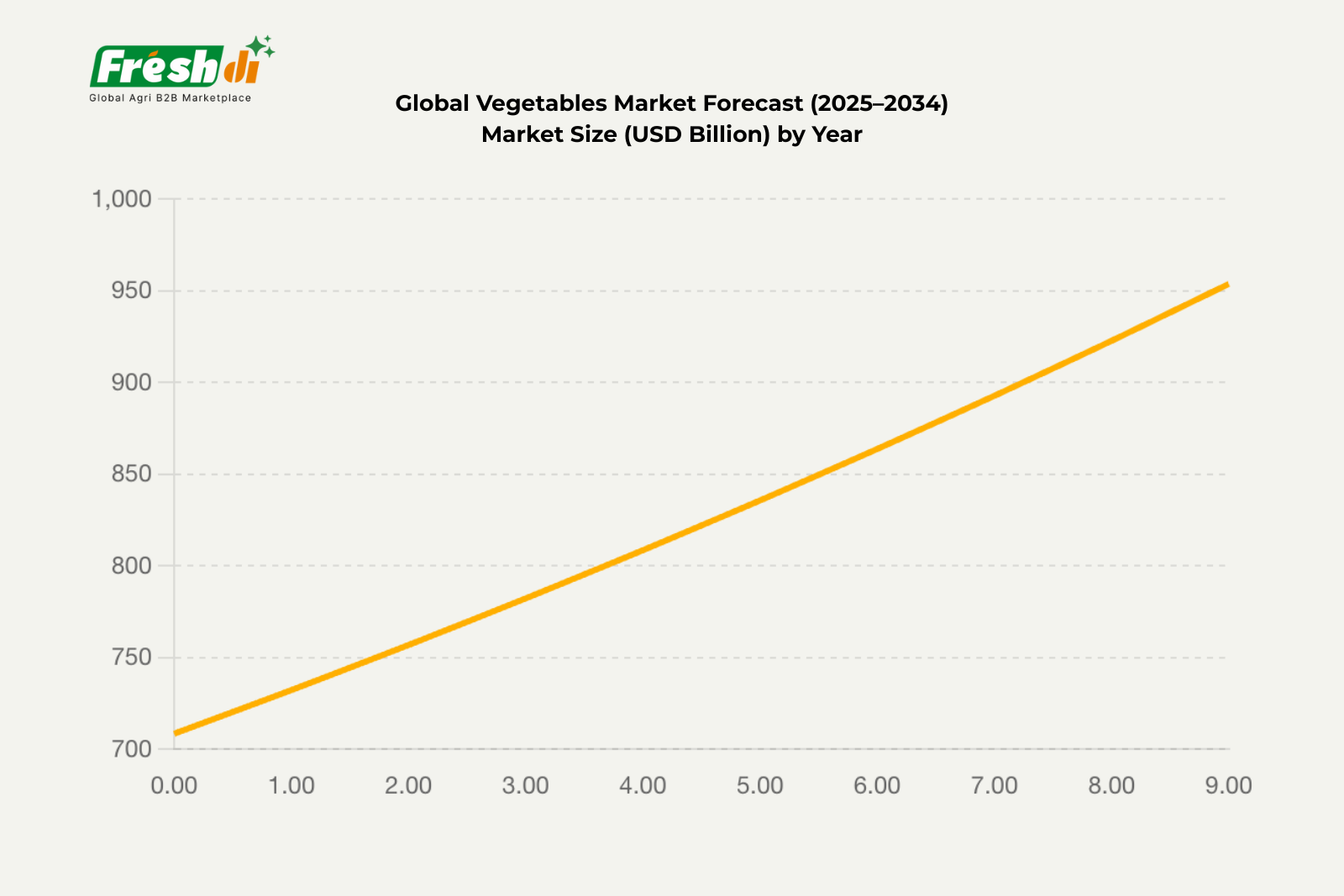

The global vegetables market in Q2/2025 has demonstrated robust performance, achieving a total market size of approximately USD 708.42 billion . This valuation reflects steady demand driven by population growth, urbanization, and increasing health consciousness worldwide. The market is projected to expand at a 3.36% CAGR from 2025 to 2034, reaching USD 957.38 billion by the end of the forecast period. Fresh vegetables dominate the overall industry, supported by efficient supply chains and rising consumer preferences for nutritious, minimally processed foods.

Key industry metrics include:

| Metric | Value | Insights |

|---|---|---|

| Global Production | 1,373 million metric tons annually | Majority from fresh vegetables |

| Per Capita Consumption | 35.2 kg (worldwide average) | Growing due to plant-based dietary shifts |

| Export Value | $3.83 billion (Vietnam, 7M 2025) | Recovery and strong performance in key export markets |

b. Segmentation

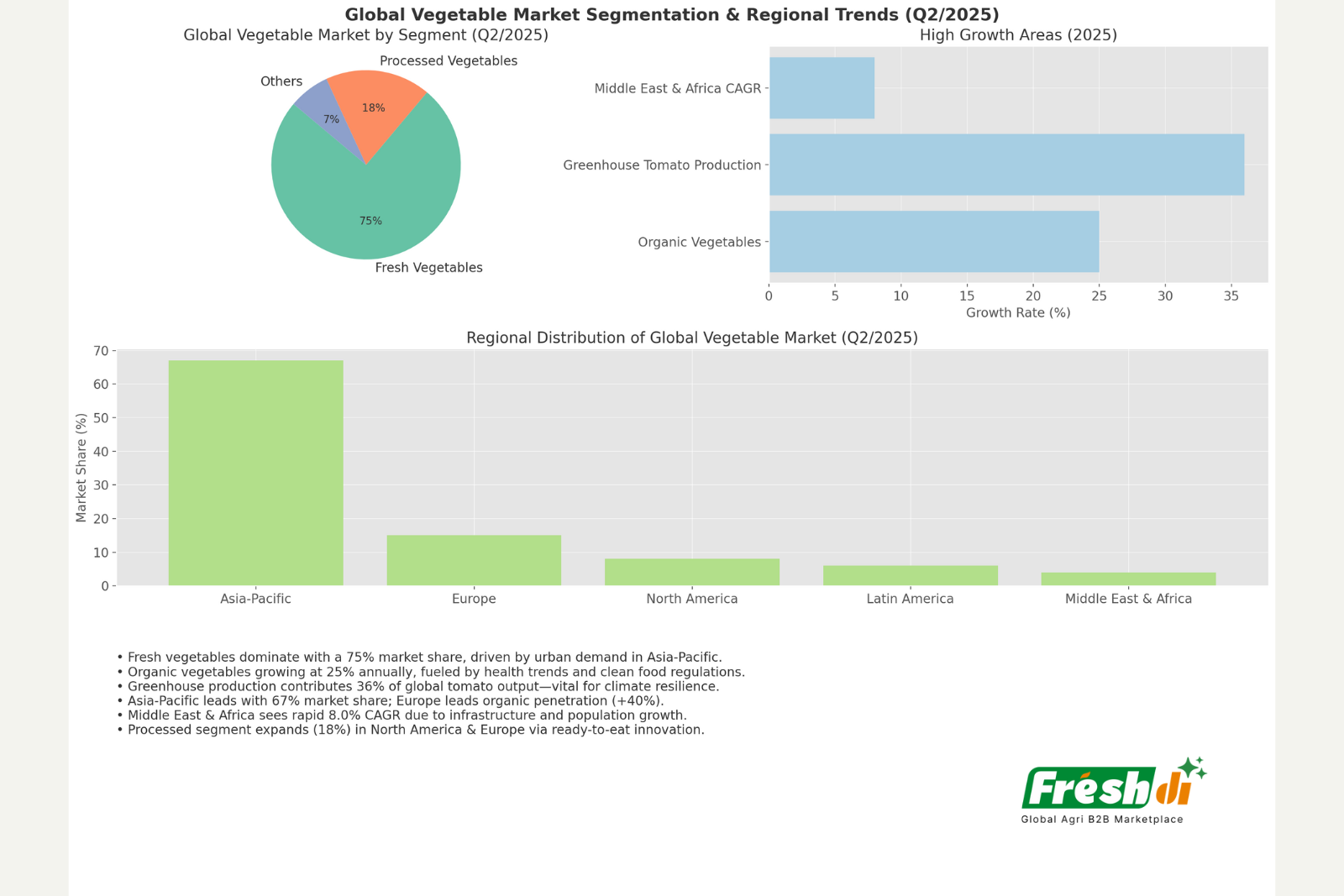

The vegetables market segmentation in Q2/2025 reveals a clear divide between fresh, processed and organic categories.

Fresh vegetables hold the largest share at 75% of market value, driven by consumer demand for unprocessed, nutrient-rich options. Processed vegetables comprise 18%, benefiting from convenience trends and extended shelf life. Whereas organic vegetables, at 7%, are the fastest-growing segment with a 25% annual expansion rate. Greenhouse production, particularly for tomatoes, accounts for 36% of global cultivation, highlighting a shift toward controlled-environment farming .

| Segment | Market Value (USD Billion, Q2/2025) | Share (%) | Growth Drivers | Key Opportunities for Stakeholders |

|---|---|---|---|---|

| Fresh Vegetables | 531.32 | 75 | Health trends, urban demand | Food wholesalers scaling direct sourcing via B2B marketplaces like Freshdi.com |

| Processed Vegetables | 127.52 | 18 | Convenience, longer shelf life | Food manufacturers innovating ready-to-eat products for export companies |

| Organic Vegetables | 49.57 | 7 | Sustainability, premium pricing | Agriculture suppliers leveraging certifications for higher margins in EU/US markets |

| Greenhouse/Specialty | Varies (integrated in above) | N/A | Climate resilience, year-round supply | Vegetable exporters targeting high-value niches with tech-enhanced traceability |

Segmentation tendencies favor premium and sustainable products, creating niches for agriculture exporters and food suppliers to differentiate through quality and certification.

c. Major Zones

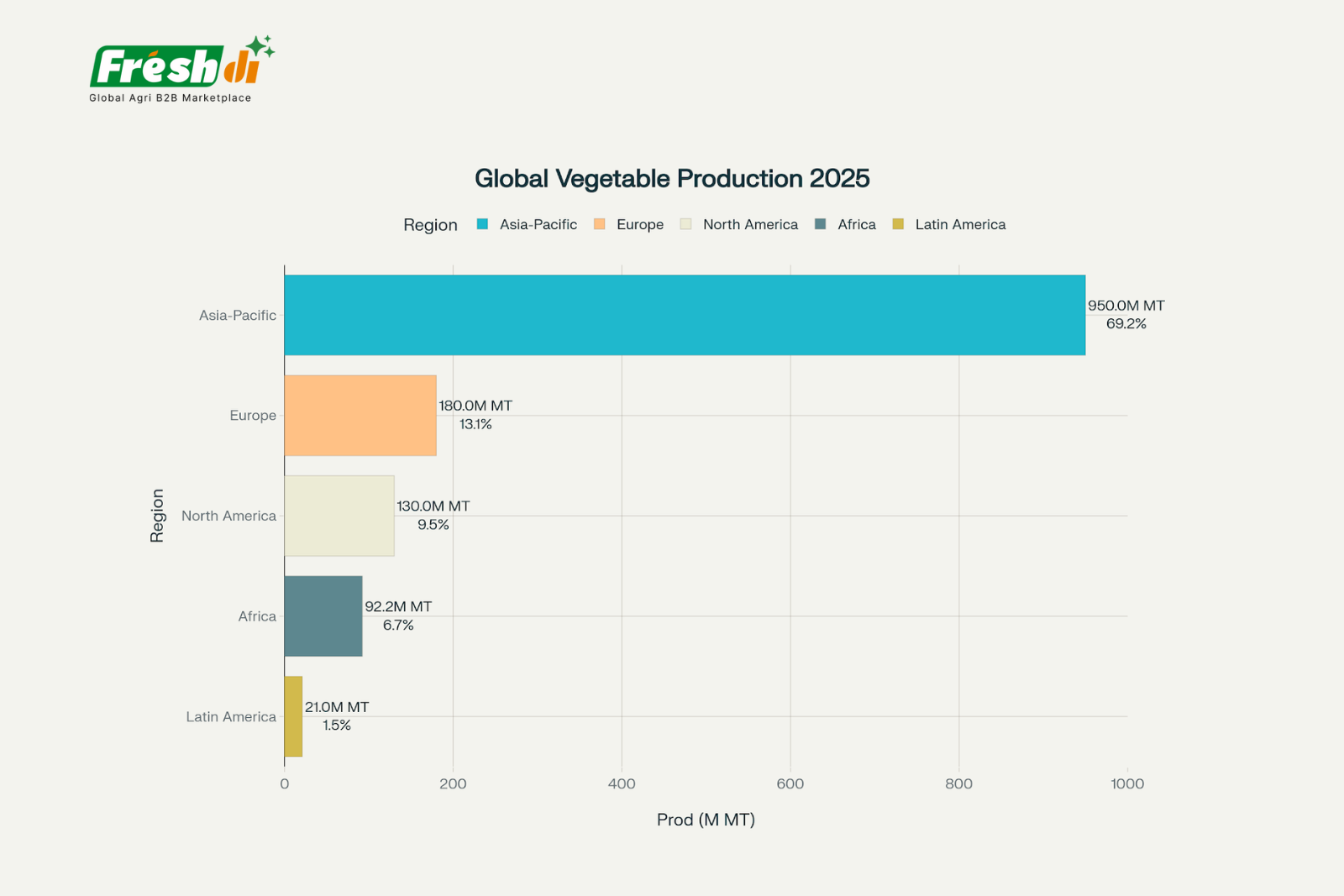

The market is geographically concentrated, with Asia-Pacific leading at 67% of global share (USD 475.28 billion), followed by Europe (14.4%, USD 102.00 billion), North America (15.7%, USD 111.30 billion), Latin America (12.8%, USD 90.72 billion), and Middle East & Africa (6.3%, USD 44.62 billion) . Production volumes mirror this: Asia-Pacific at 950 million metric tons (69.2%), North America at 130 million metric tons (9.5%), and Europe at 180 million metric tons (13.1%) .

| Major Zone | Production (Million Metric Tons) | Market Value (USD Billion) | Key Products Exported/Imported | Dominant Players/Trends |

|---|---|---|---|---|

| Asia-Pacific | 950 | 475.28 | Tomatoes, onions, leafy greens | China (644 Mt), India (133 Mt); agriculture companies focusing on organic exports |

| North America | 130 | 111.30 | Lettuce, broccoli, carrots | US (33 Mt), Mexico (20 Mt); tech-driven greenhouse growth |

| Europe | 180 | 102.00 | Peppers, cucumbers, tomatoes | Netherlands leading in greenhouse tech; organic focus |

| Latin America | 21 | 90.72 | Avocados, beans, exotic veggies | Brazil, Peru; rising food exporters to US/EU |

| Middle East & Africa | 92 | 44.62 | Onions, potatoes, root veggies | Egypt, Nigeria; infrastructure investments boosting exports |

These zones highlight opportunities for bulk suppliers and wholesale product exporters to leverage regional strengths, such as Asia-Pacific’s volume for B2B marketplace deals on Freshdi.com

1.2. Analysis

a. Tendency and Reasons for Segmentation and Major Zones in Q2

In Q2/2025, segmentation trends show a clear shift toward premium and sustainable categories, with organic vegetables growing at 25% annually due to health-conscious consumers and regulatory pushes for clean produce . Fresh vegetables maintain dominance (75% share) because of their nutritional appeal and minimal processing, appealing to urban consumers in Asia-Pacific, where food wholesalers and agriculture suppliers benefit from short supply chains . Processed segments (18%) are expanding due to convenience demands in fast-paced lifestyles, particularly in North America and Europe, where food manufacturers innovate with ready-to-eat formats . Greenhouse/specialty (integrated across segments) is rising at 36% of tomato production globally, driven by year-round supply needs and climate resilience.

Major zones reflect these tendencies: Asia-Pacific’s 67% share stems from vast arable land, favorable climates, and population-driven demand, making it a hub for bulk suppliers and agriculture exporters . Europe’s focus on organics (40% higher penetration) is due to strict EU regulations like CBAM, favoring premium food suppliers . North America’s tech-driven growth (e.g., automation) addresses labor shortages, while Latin America’s export surge (e.g., avocados) benefits from trade agreements like USMCA . Middle East & Africa’s rapid 8.0% CAGR is fueled by infrastructure investments and population growth, creating niches for wholesale product sellers . Reasons include urbanization (boosting processed demand), health trends (organics), and tech adoption (greenhouse efficiency).

b. Natural Impacts

Climate change profoundly influenced Q2/2025 trends, with 90% of crops facing yield instability from extreme weather . Droughts reduced outputs by 15-25% in sensitive areas like California and Iran, impacting root vegetables and pushing vegetable exporters toward resilient varieties. Seasonal shifts, such as erratic monsoons, disrupted Asia-Pacific harvests, with India’s production benefiting from above-normal rains but Vietnam facing salinity in the Mekong Delta . Water scarcity affected 30% of irrigated zones, leading to USD 2.8 billion in annual losses and accelerating adoption of precision irrigation (95% efficiency). Flooding in temperate regions like the UK increased risks, prompting agriculture companies to invest in flood-resistant crops. Overall, these impacts favored greenhouse segments (36% of tomatoes) for stable yields, while seasonal rain variations boosted premiums for off-season supplies via B2B marketplaces.

c. Economic Impacts

Economic factors in Q2/2025 were shaped by global growth at 3.1%, boosting demand in emerging markets (3.8% growth) and supporting food wholesalers in urbanizing regions. National relations, including US-China tensions, created opportunities for ASEAN vegetable exporters via near-shoring. Geopolitical trade dynamics, such as EU CBAM, imposed traceability on imports, favoring compliant agriculture suppliers but raising costs for non-compliant ones. Wars and conflicts disrupted supply chains, with Red Sea issues adding 18% to freight rates and delaying shipments to Europe/Africa .

Supply chain disruptions included container shortages and energy inflation (up 7% for fertilizers), causing USD 2.8 billion losses and pushing food distributors toward diversified sourcing . Distribution challenges, like rail bottlenecks in India, delayed exports by 7-10 days. The economic world statement reflects resilience, with falling energy prices (-17%) offsetting input hikes, but inflation in key markets pressured margins for bulk suppliers. Overall, these impacts favored tech-adopters like those on Freshdi.com, reducing sourcing time by 60% amid volatility

d. Behaivior Factor

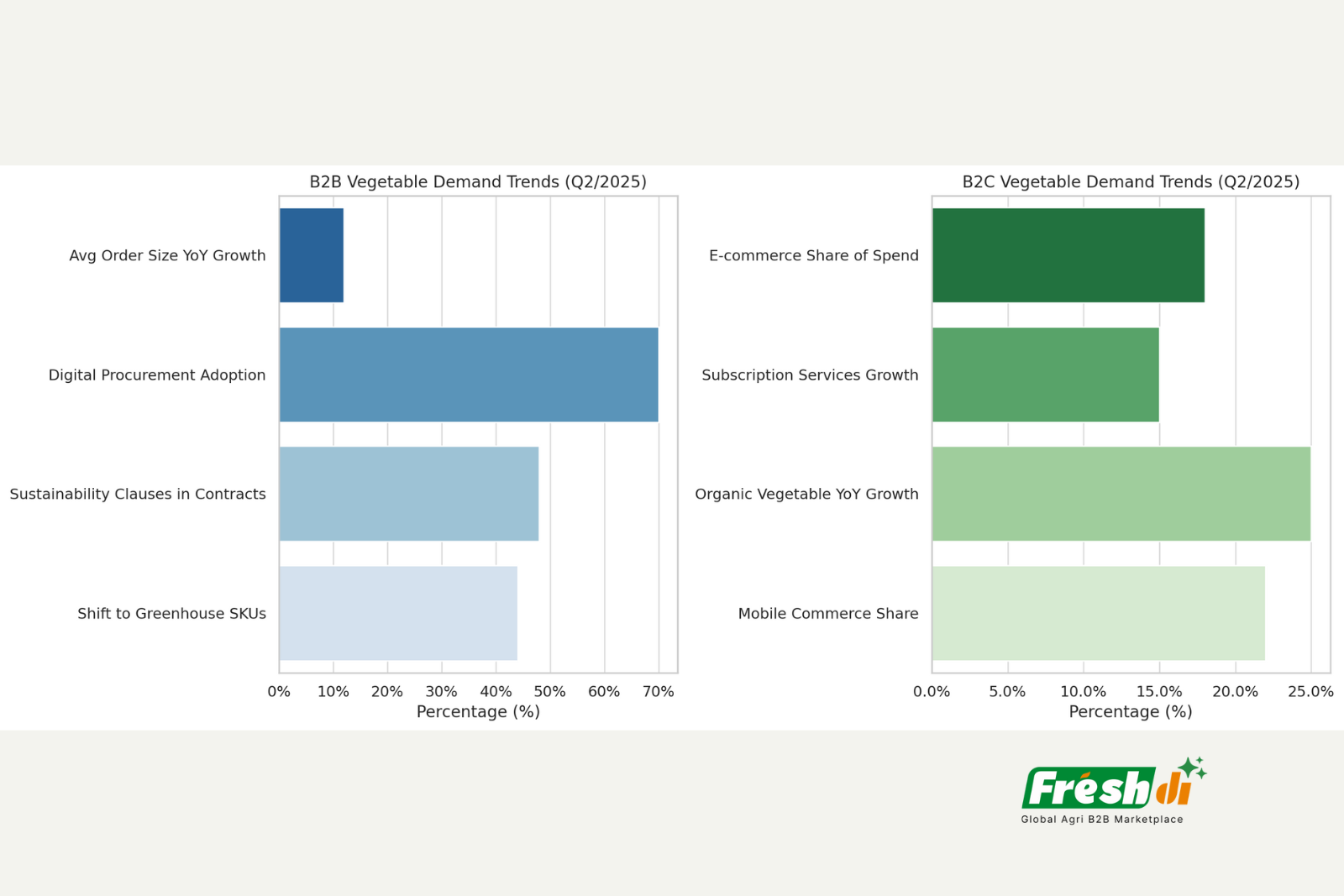

In Q2/2025, global vegetable demand patterns diverged sharply between business-to-business (B2B) and business–consumer (B2C) channels, reflecting a bifurcation in purchasing dynamics and value-chain priorities.

B2B Buyers (Agricultural Wholesalers, Distributors, Foodservice):

- Average order size rose 12% YoY as large purchasers consolidated volumes to secure supply and negotiate scale discounts.

- 70% of B2B buyers now integrate digital procurement platforms—Freshdi.com reports 110+ daily RFQs for vegetables—reducing sourcing cycle times by 60%.Sustainability requirements drive 48% of B2B contracts to include carbon-reduction or water-efficiency clauses.

- 44% of distributors are shifting 15–20% of orders toward greenhouse-grown product SKUs due to supply stability demands.

The disruption environment is creating consolidation opportunities for well-capitalized agriculture companies and food wholesalers with robust financial resources and operational capabilities. Freshdi.com is a trusted global B2B marketplace connecting verified agriculture suppliers and global buyers across the agriculture products.

B2C Consumers (Retail Shoppers, E-commerce Subscribers):

- E-commerce penetration climbed to 18% of total vegetable spend, up from 12% one year earlier, driven by convenience and safety.

- Subscription-box services for vegetables expanded 15% QoQ, with customers willing to pay 7% premiums for “farm-fresh” traceable produce.

- Organic vegetable purchases grew 25% YoY, capturing 9% of total spend in premium markets (US, EU).

- Mobile commerce accounted for 22% of online vegetable orders, highlighting the importance of mobile-optimized B2C channels.

2. Market Forecast in Q3 & Q4/2025

2.1 Forecast Revenue: Global & Major Zones

(Quarterly revenue in USD billion)

| Region | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|

| Global | 357.16 | 360.12 | 363.11 |

| Asia-Pacific | 247.15 | 251.31 | 255.54 |

| North America | 33.93 | 34.31 | 34.70 |

| Europe | 46.79 | 47.33 | 47.87 |

| Latin America | 5.36 | 5.44 | 5.52 |

| Middle East & Africa | 23.93 | 24.39 | 24.87 |

2.2 Analysis

- Global Outlook:

– The global vegetable market is poised for modest sequential growth into Q4, with seasonal harvest peaks in the Northern Hemisphere and continued e-commerce acceleration stabilizing demand.

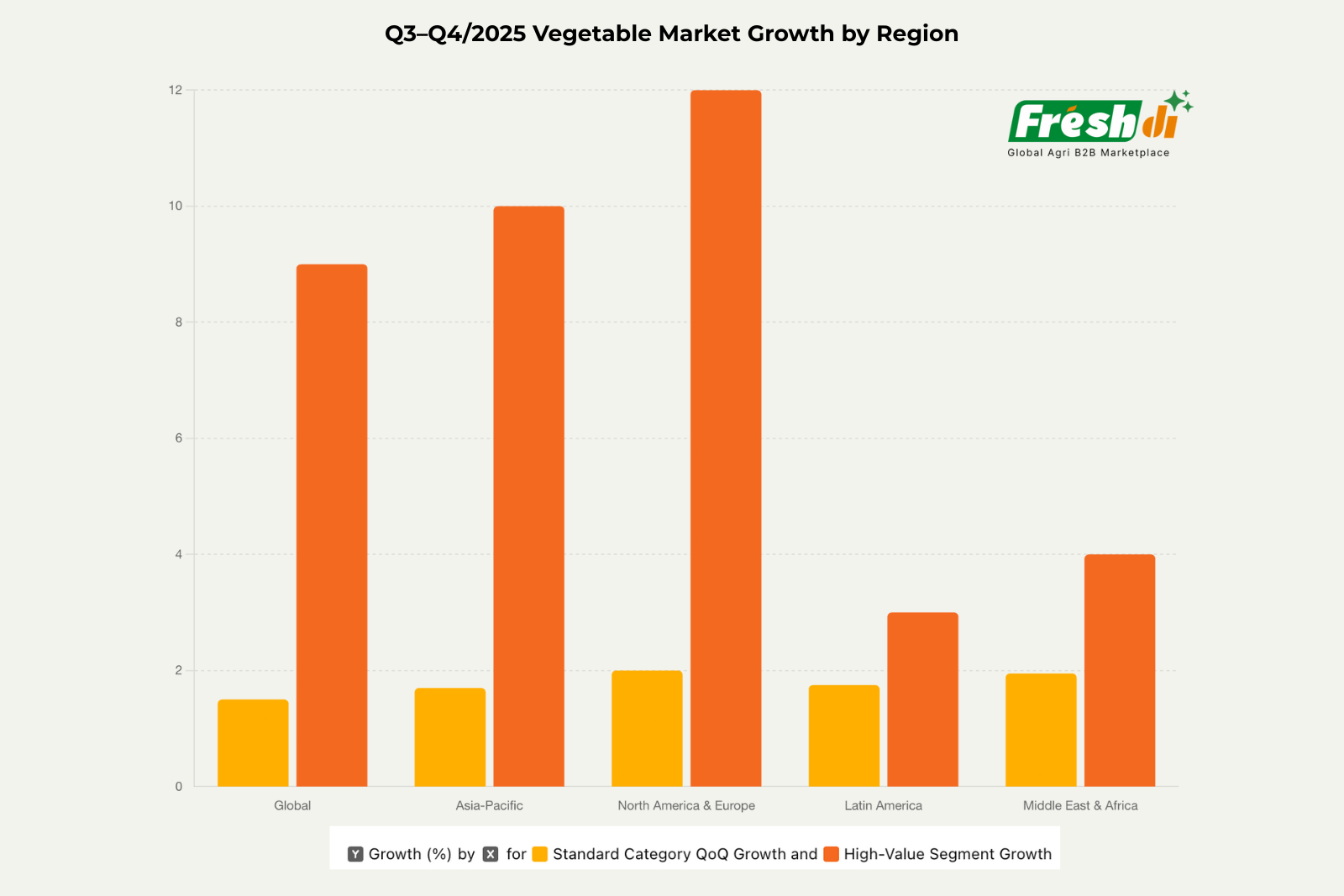

– High-value segments (organic, greenhouse) will outpace commodity vegetables, expanding at 8–10% QoQ versus 1–2% for standard categories. - Asia-Pacific:

– Monsoon-driven harvests in India and China underpin Q3 output, lifting Asia-Pacific revenue to USD 251.3 b by Q3 and USD 255.5 b by Q4.

– Greenhouse and value-added exports to Middle East markets drive segmental premiums, even as standard yields moderate price increases. - North America & Europe:

– Retail recovery and foodservice rebound propel North American and European markets, with e-commerce subscriptions and specialty offerings sustaining double-digit growth in Q3 and Q4.

– Supply-chain normalization reduces cost pressures, further stabilizing margins for distributors and exporters. - Latin America:

– Continued expansion of processing capacity in Brazil and Mexico supports 1.5–2% sequential revenue gains, particularly in parboiled and canned vegetable lines. - Middle East & Africa:

– Strategic stockpiling by Gulf retailers ahead of winter demand lifts Q3 volumes, with regional infrastructure investments (cold-chain and logistics) driving 1.9–2.0% QoQ revenue growth.

Recommendation

To capture these Q3–Q4 opportunities, bulk suppliers, wholesale product exporters, and agriculture companies should leverage Freshdi.com’s AI-powered RFQ engine to secure value-added contracts, diversify origination into high-growth niche zones (Greenhouse APAC, MENA), and integrate traceability credentials to meet rising B2B and B2C customer expectations.

About us

Freshdi.com is the world’s leading global B2B Marketplace for global agricultural products and food, connecting directly between buyers and suppliers by Empowering Freshdi AI. Freshdi.com has over 3M+ suppliers, 2M+ active buyers, and 1,000+ buying requests updated daily in agri-food.