Introduction

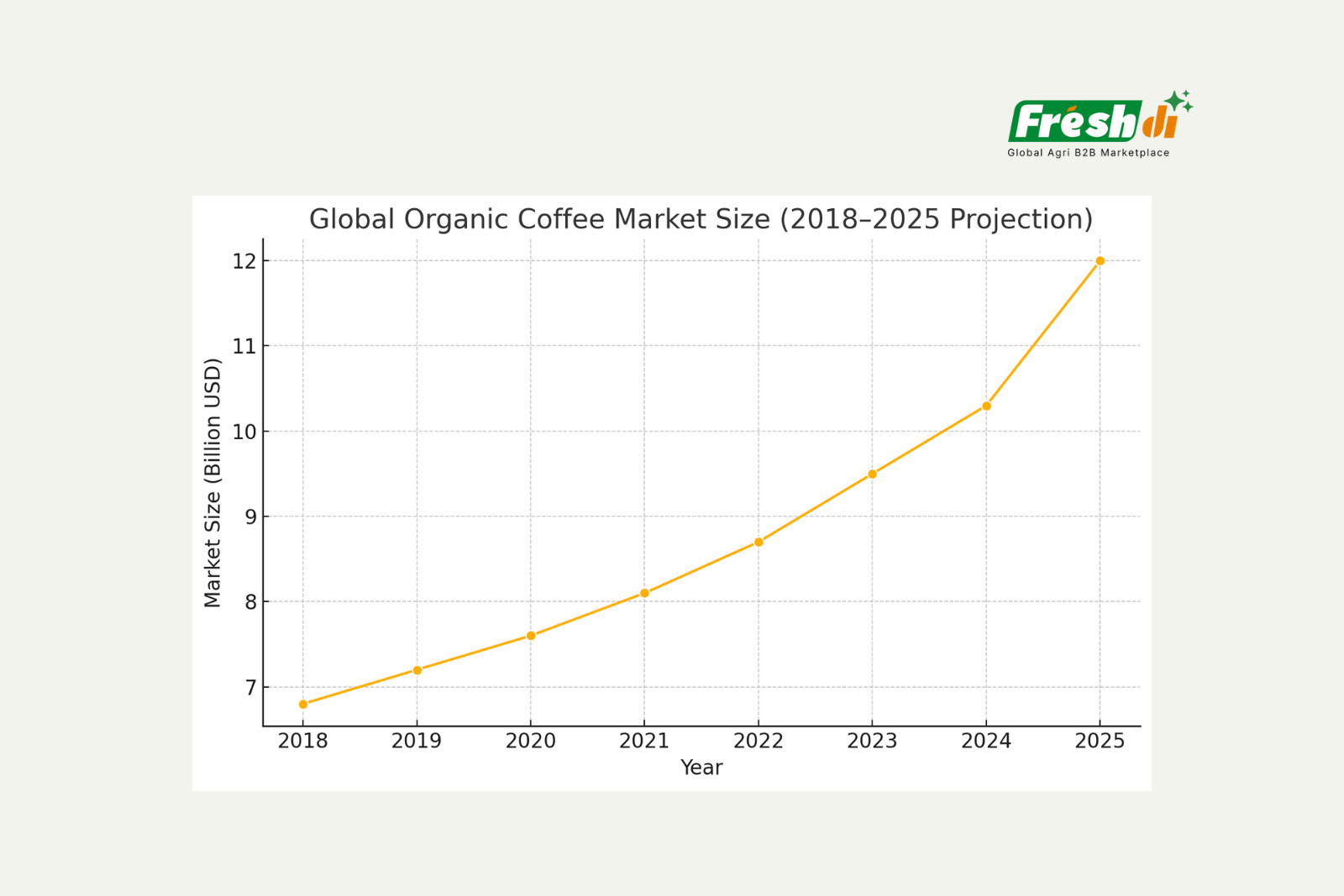

Driven by consumer health consciousness and sustainability concerns, the global organic coffee market is on track to double in value from the late 2010s to the mid-2020s. In 2018, the organic coffee market was valued around $6.8 billion, and by 2025 it is projected to exceed $12 billion. This robust growth – about 10% CAGR in recent years – signals a significant opportunity for importers, distributors, and sourcing managers.

1. Key Producing Countries and Exporters of Organic Coffee

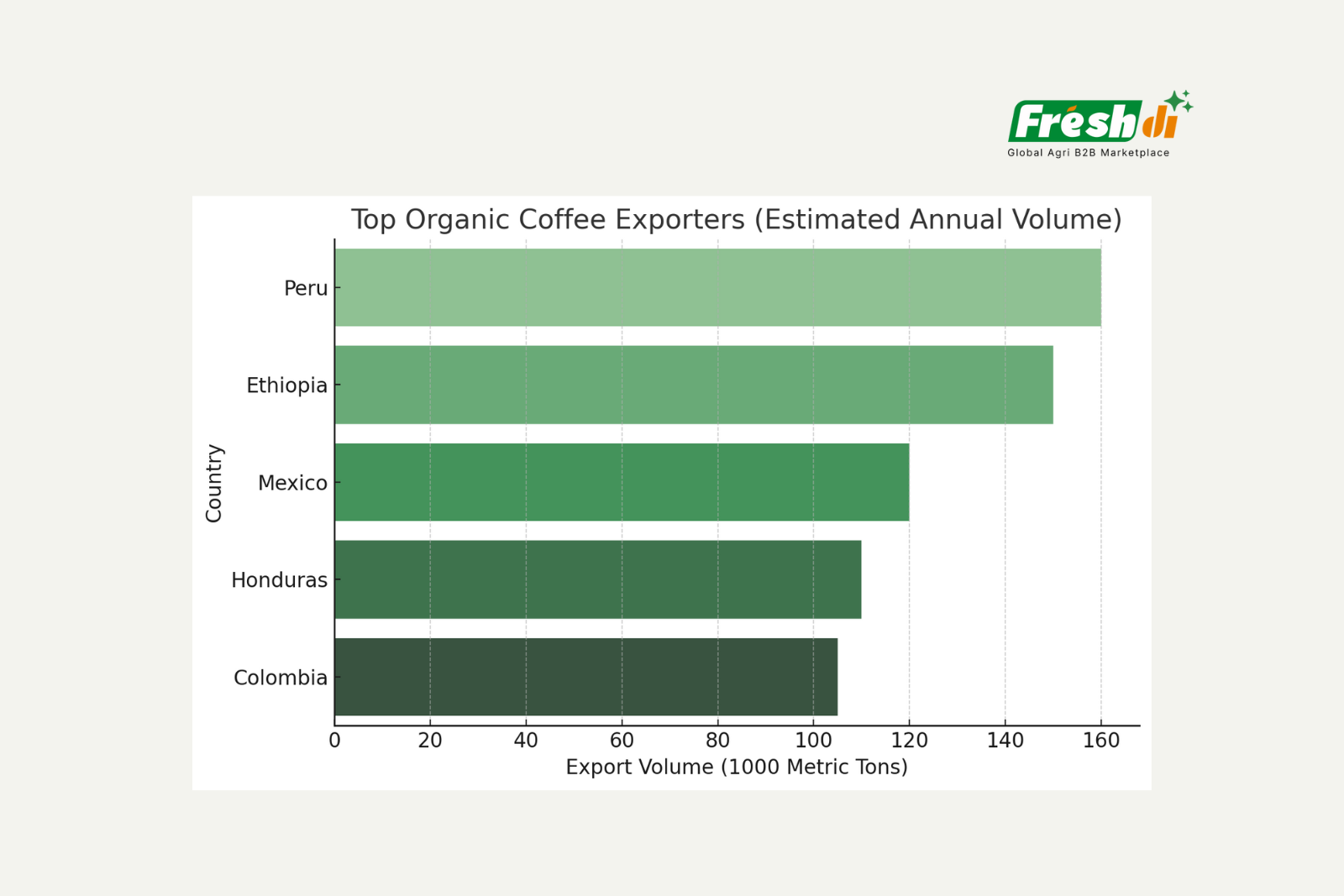

Organic coffee production spans the globe, but it is dominated by a few key regions and countries. Latin America produces 75% of the world’s organic coffee, led by Peru and Ethiopia, where high-altitude farming and traditional, chemical-free methods dominate. Peru alone has 90,000+ hectares of certified organic coffee, cultivated mostly by smallholders. Ethiopia’s forest – grown coffee aligns naturally with organic principles. Other key exporters include Mexico, Honduras, Colombia, and parts of Central America, where small-scale farms and cooperatives drive production. The U.S. and Europe are the top importers – the U.S. buys 40% of global organic coffee – while Asia, especially South Korea, shows fast-growing demand for premium, sustainable beans.

The global network of organic coffee trade now spans over 40 exporting countries and 30 importing countries. This diversification means B2B buyers have many origin options to choose from, and platforms like Freshdi can help filter verified food suppliers by country and certification.

Table 1: Top Organic Coffee Exporters (Select Countries)

| Country | Notable Status in Organic Coffee |

|---|---|

| Peru | #1 exporter (tied), ~90k certified organic ha; 48% of Latin America’s organic area. |

| Ethiopia | #1 exporter (tied) in Africa; traditional wild coffee forests sustain organic production. |

| Mexico | Among top producers; >100k bags/year organic, especially from Chiapas and Oaxaca smallholders. |

| Honduras | Among top producers; >100k bags/year; home to cooperatives like RAOS driving organic growth. |

| Colombia | Major coffee exporter expanding organic acreage; ranks top 3 by number of organic shipments. |

(Data sources: ICO, national reports, and trade data)

These leading sources illustrate the supply diversity. Importantly, many organic coffee farms are certified by international standards (e.g., USDA Organic, EU Organic, JAS) and often overlap with Fair Trade or other sustainability certifications. For B2B buyers, sourcing from these countries means access to a range of varieties (from high-altitude Arabicas in Peru and Ethiopia to specialty microlots from Mexico or Honduras) with the assurance of organic cultivation methods.

2. Supply Chain and Pricing Structure of Organic Coffee

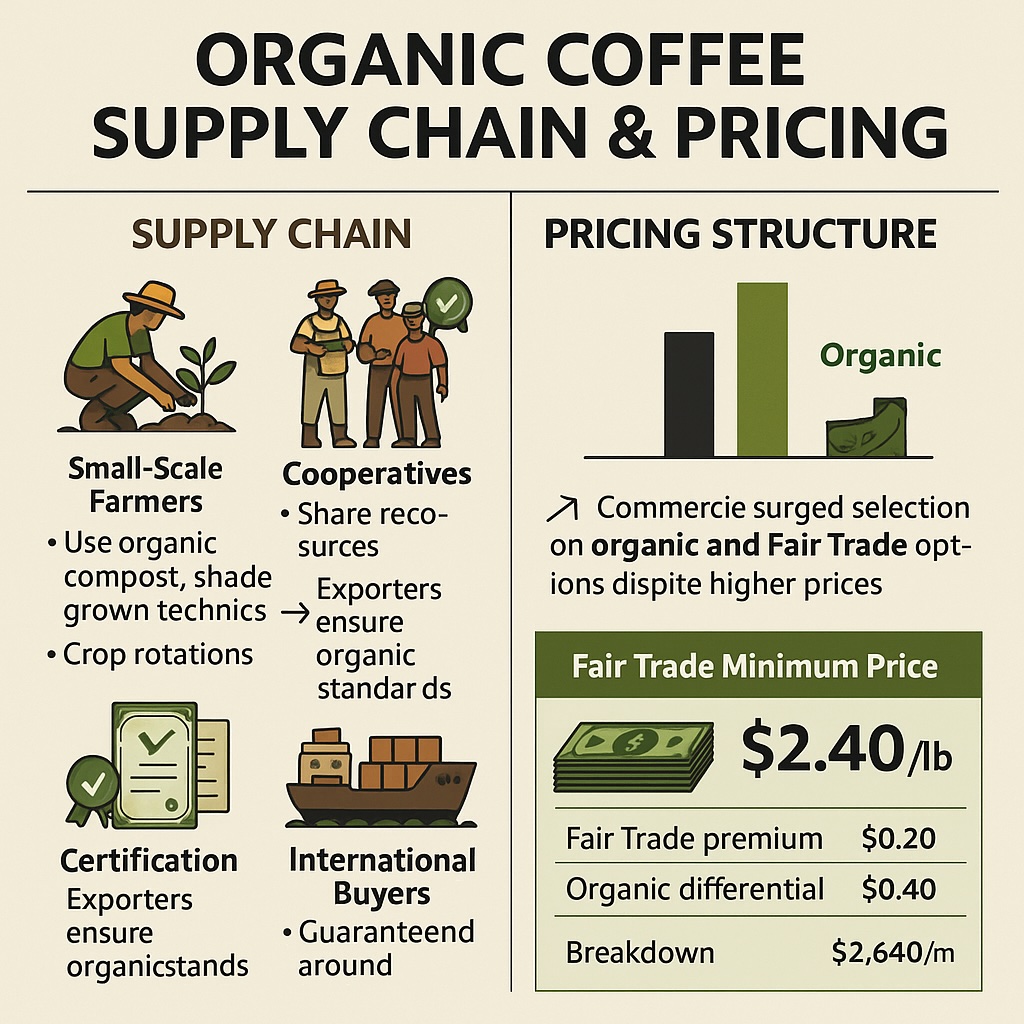

The organic coffee supply chain closely resembles that of conventional coffee but with additional steps for certification and traceability. It typically starts with small-scale farmers who refrain from using synthetic fertilizers or pesticides, instead employing organic compost, shade-grown techniques, and crop rotations to maintain soil health. Because most organic growers are smallholders, they often form cooperatives to share resources and reach international buyers. Cooperatives or exporters coordinate the certification process, ensuring that every lot of coffee meets organic standards through rigorous documentation and inspections.

Pricing Structure: Organic coffee generally commands a premium price relative to standard coffee, reflecting both its higher production costs and its added value to consumers. For instance, in Q2 2025, wholesale buyers on Freshdi.com showed an uptick in selecting organic and Fair Trade coffee options despite higher prices, a sign that buyers are willing to pay extra for these attributes.

In formal certified programs, the premium is explicitly defined. The Fair Trade minimum price for Arabica coffee, for example, includes a Fair Trade premium of $0.20 per pound plus an organic differential of $0.40 per pound above the base market price. In practice, this means if the international market price is low, Fair Trade Organic coffee growers are guaranteed around $2.40 per pound minimum (roughly $2,640 per metric ton) for their high-grade Arabica – a buffer that can be lifesaving when commodity prices fluctuate.

Table 2: Example Pricing Breakdown – Conventional vs. Organic Coffee (Arabica)

| Pricing Element | Conventional Arabica | Organic/Fair Trade Arabica |

|---|---|---|

| Base Commodity Price (NY Market) | $1.60 per lb (example) | $1.60 per lb (same base) |

| Fair Trade Premium | N/A | + $0.20 per lbsucafina.com |

| Organic Differential | N/A | + $0.40 per lbfairtrade.net |

| Total Farmgate Floor Price | Market-dependent (~$1.60) | $2.20–2.40+ per lb |

(Illustrative purposes only; actual prices vary with market conditions. In high market periods, organic differentials are added on top of prevailing prices.)

Beyond farmgate pricing, supply chain costs for organic coffee can be slightly higher due to dedicated processing (e.g., mills must be cleaned to process organic beans separately) and certification audits. However, these costs are offset by the willingness of wholesale product buyers and consumers to pay more for organic. The key for B2B buyers is to ensure the supply chain is well-managed so that quality and certifications are preserved – which again underscores the importance of traceable origin systems and trust in suppliers.

Sources:

- International market data on organic coffee production and trade

- Industry analyses and reports on organic coffee market size and growth

- Freshdi Coffee Market Report Q2/2025 and platform data

- Allied Market Research and Business Research Company insights on consumer trends and health benefits

- Fair Trade USA pricing standards for organic coffee premiums

- UNESCO and USDA reports on leading organic coffee exporters and farming practices

About us

Freshdi.com is the world’s leading global B2B Marketplace for global agricultural products and food, connecting directly between buyers and suppliers by Empowering Freshdi AI. Freshdi.com has over 3M+ suppliers, 2M+ active buyers, and 1,000+ buying requests updated daily in agri-food.