1. Export Prices: Multi-Year Lows Despite Tight Spot Spikes

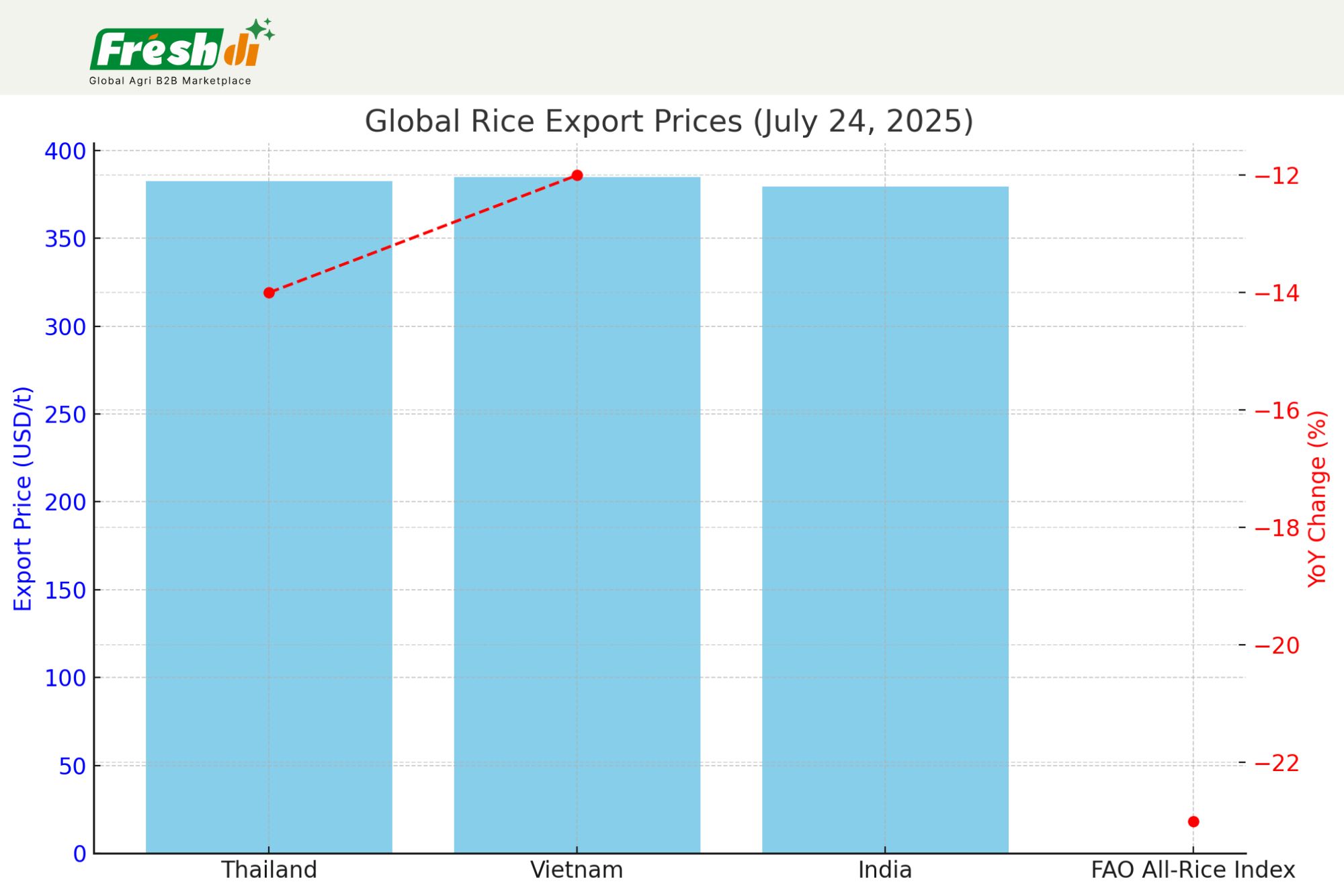

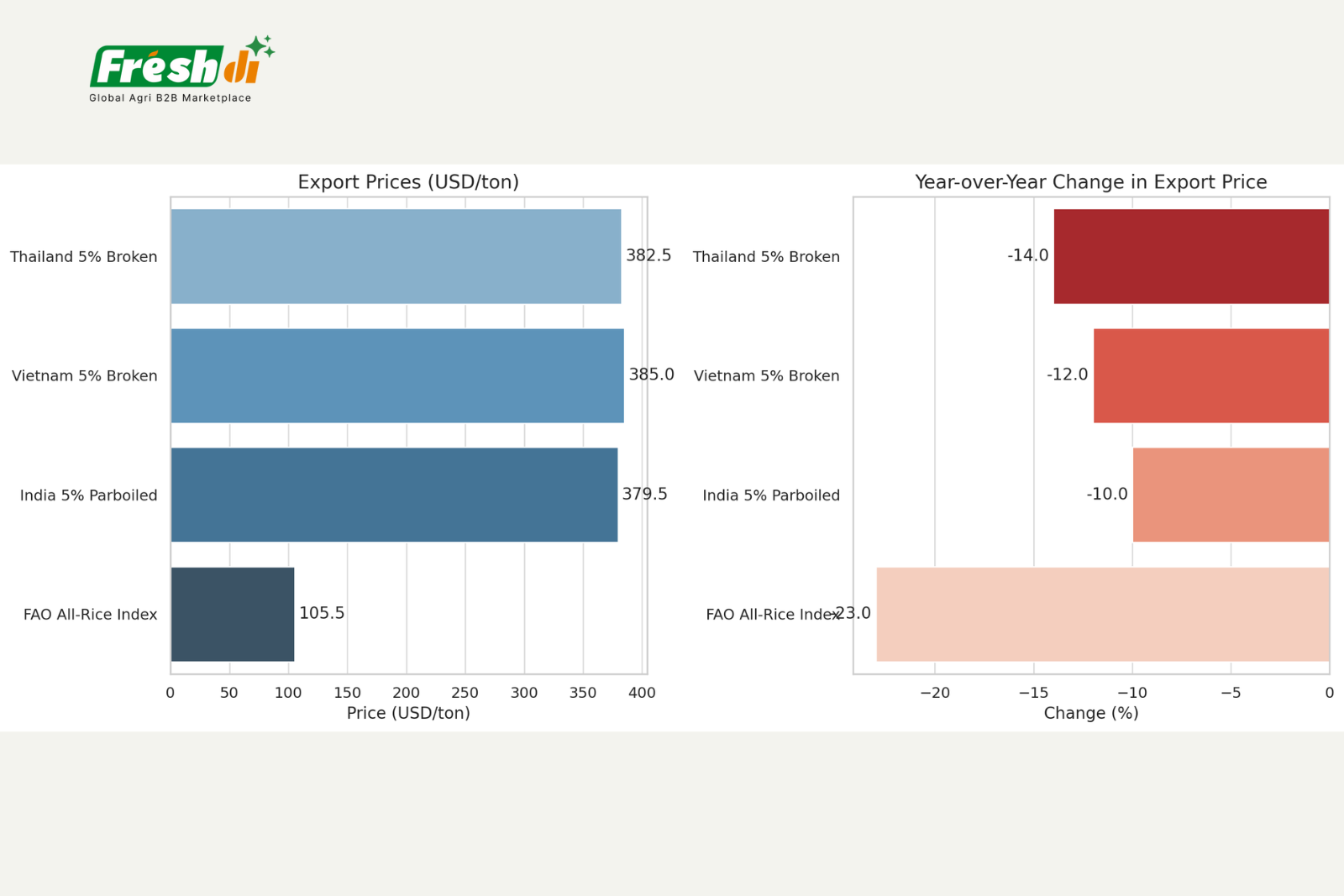

| Benchmark (FOB) | 24 Jul 2025 Price | Weekly Δ | 12-Mth Trend | Main Driver |

|---|---|---|---|---|

| Thailand 5% Broken | USD 380-385 t | ≈ flat | -14% YoY; 8-yr low | Lukewarm demand, strong baht |

| Vietnam 5% Broken | USD 380-390 t | +1-3 USD | -12% YoY | Summer-autumn crop peaking |

| India 5% Parboiled | USD 377-382 t | -3 USD | Lowest since 2022 | Record stocks after MEP shift |

| FAO All-Rice Index | 105.5 (Jun) | -0.8% m/m | -23% YoY | Softer Indica buying, cheaper freight |

Surplus Indian supplies released after the US $490/t Minimum Export Price and large South American maize harvests are pressuring cereal prices overall. Importers are largely hand-to-mouth, waiting for Thailand’s new crop in August, while freight volatility keeps containerised trade thin.

2. Climate Snapshot of the 2025 Growing Season

- 90% of the world’s rice regions now register yield swings linked to heat spikes, erratic rains or flood–drought whiplash.

- El Niño 2023-24 cascaded into 2025:

– Brazil’s southern paddies shed 4.4% of output after severe drought.

– Vietnam’s Mekong saw a 20% harvest collapse in 2023-24, easing to a projected 5% shortfall in 2025-26 as rains normalise .

– Philippines keeps 15% import tariff (down from 35%) until local harvests stabilise after 2024 dryness. - Counter-trend: India’s monsoon arrived nine days early; rainfall is 6-9% above average, pushing kharif rice sowing +12.4% YoY and pointing to a possible 151 Mt record crop.

- FAO projects a record 555.6 Mt global milled rice in 2025/26 but warns hot, dry episodes in parts of Thailand, the EU and U.S. could trim yields late in the season.

3. Frontier High-Yield & Resilient Rice Strains Released in 2024-25

| Variety / Tech | Region & Trait | Yield Gain | Added Benefit |

|---|---|---|---|

| ADT 59 & ADT 53 (Tamil Nadu, India) | Short-duration delta rice | +15-20% vs local checks | Salinity & pest tolerance, 105-115 d maturity |

| CRISPR OsDREB1C “knock-up” lines (China) | Gene-edited elite lines | +21-28% | Maintains grain quality; transgene-free |

| Clearfield MR CL3 / MR CL4 (Malaysia BASF-MARDI) | Herbicide-tolerant | >7 t ha⁻¹ (≈ +25%) | 99-day maturity, controls weedy rice |

| Spoorthi (GNV 1906) high-zinc, India | Bio-fortified for nutrition | 4.5-6.5 t ha⁻¹ (par with IR64) | 26 ppm Zn (≈ +60% over popular varieties) |

| NIPGR Phosphate-Uptake CRISPR (India) | Better P-use efficiency | +20% (40% when fertiliser cut 90%) | Reduced fertiliser need |

| DRR Dhan 100 “Kamala” & Pusa DST Rice 1 (ICAR) | Genome-edited drought & salt tolerant | Field testing shows stable high yields | Fast SDN-1/2 editing pathway |

| UC Davis multi-pathogen resistant line | CRISPR-Cas broad disease resistance | 5× grain vs controls in disease plots | Cuts fungicide use |

| Bangladesh BRRI dhan 109/111 + 15 others | Climate-smart Boro/Aman hybrids | 5-8 t ha⁻¹ | Flood-prone & heat-tolerant niches |

These releases share common themes: CRISPR precision editing, herbicide-tolerant production systems, micronutrient bio-fortification and short-duration phenology—all geared to cushion climate shocks while raising on-farm profitability.

Unlike traditional sourcing directories, Freshdi.com focuses on agricultural categories, especially rice — from Basmati and Jasmine to Broken, Glutinous and Brown Rice… The platform features over 3,500 verified rice suppliers and connects with 5,800+ active global buyers, enabling direct trade based on real-time inquiries and quotations. Every 24 hours, Freshdi records more than 50 buyer requests, and currently highlights over 150 hot suppliers and across regions.

4. Outlook to Harvest 2025/26

- Price floor: Abundant Indian carry-over stocks and early Asian harvests cap upside; CBOT rough-rice futures reflect sideways bias unless drought deepens in Thailand or U.S. Gulf.

- Climate watchpoints: August–September heatwaves in East Asia and Gulf of Mexico hurricane tracks; any late-season shock could tighten supplies quickly given thin exporter buffers outside India.

- Technology adoption: Seeds such as Clearfield MR CL3/CL4 and Spoorthi are scaling through government seed hubs; ICAR’s SDN-edited lines await fast-track approval under India’s 2022 genome-editing guidelines, signalling faster commercial pipelines.

- Policy signal: EU’s 2026 CBAM pilot and ASEAN RCEP Phase II tariff cuts will increasingly reward low-carbon, high-traceability rice—pushing breeders to couple yield genes with sustainability traits.

About us

Freshdi.com is the world’s leading global B2B Marketplace for global agricultural products and food, connecting directly between buyers and suppliers by Empowering Freshdi AI. Freshdi.com has over 3M+ suppliers, 2M+ active buyers, and 1,000+ buying requests updated daily in agri-food.