Executive Summary

The global meat and poultry industry stands at a pivotal juncture in Q2/2025, characterized by unprecedented technological transformation, shifting consumer preferences, and evolving regulatory landscapes. This comprehensive analysis reveals a market valued at USD 1.43 trillion in 2024, projected to reach USD 1.8 trillion by 2030 with a robust 5.5% CAGR.

1. Market Overview in Q2 2025

Global Meat & Poultry Market Strategic Analysis: Q2 2025 Results & Q3/Q4 2025 Forecast

This comprehensive analysis reveals a dynamic global meat and poultry industry experiencing unprecedented transformation in Q2 2025. The market demonstrates remarkable resilience with a valuation of USD 1.43 trillion in 2024, projected to reach USD 1.8 trillion by 2030 at a robust 5.5% CAGR. Key findings indicate that Asia-Pacific dominates with 40.1% market share, technology adoption is accelerating across all segments, and sustainability initiatives are becoming critical competitive differentiators. The industry faces significant challenges including volatile pricing, supply chain disruptions, and regulatory pressures, while simultaneously capitalizing on opportunities in digital transformation, alternative proteins, and emerging market expansion.

Executive Summary

The global meat and poultry industry stands at a pivotal juncture in Q2 2025, characterized by unprecedented technological transformation, shifting consumer preferences, and evolving regulatory landscapes1. Market performance in Q2 2025 exceeded expectations, with the global market reaching approximately USD 1.49 trillion, driven by strong performance in Asia-Pacific markets and sustained demand for poultry products.

Regional dynamics show Asia-Pacific leading with 40.1% market share, supported by demographic scale and mature agriculture infrastructures, while North America and Europe maintain significant positions at 24.7% and 20.2% respectively. Technology adoption has accelerated dramatically, with automation reaching 60% adoption across major processing facilities and AI-powered quality control systems achieving 90% accuracy in defect detection15.

Critical market drivers include urbanization trends, rising disposable incomes in emerging markets, and increased demand for premium, traceable meat products. Sustainability has companies implementing carbon footprint reduction initiatives and 70% of consumers willing to pay premiums for verified, sustainable products.

1. Market Overview in Q2 2025

1.1. Results

a. Total Industry

The global meat and poultry industry delivered strong Q2 2025 performance, with total market value reaching approximately USD 1.49 trillion, representing a 4.2% increase from Q2 202417. This growth exceeded initial projections despite facing challenges from volatile feed costs, climate impacts, and geopolitical tensions.

Poultry emerged as the standout performer, accounting for approximately 40% of total meat consumption globally1. The global poultry market specifically reached USD 364.5 billion in 2025, with projections to grow at a 5.62% CAGR through 2033. Broiler production in the United States alone was forecast at 11,800 million lbs for 2025, up 75 million lbs from previous projections.

Alternative protein markets also showed significant momentum, with the cultivated meat sector projected to reach USD 229 billion by 2050, while the broader artificial meat market is expected to grow at an extraordinary 51.6% CAGR from 2025-2033.

b. Market Segmentations

By Protein Type:

- Poultry maintained its position as the dominant segment, with global consumption expected to increase by 2.5% to 3% in 2025. The Asia-Pacific poultry market specifically reached USD 131.6 billion in 2025.

- Beef production faced tighter supplies, with U.S. production forecast to decline 2.3% to 2.6% during Q3 2025 and 2.7% to 3.0% during Q4 2025.

- Pork production showed resilience with global production projected at 115.1 million tonnes, though declining 0.8% from 2024.

- Processed meat products demonstrated robust growth at 9.04% CAGR, driven by convenience trends and ready-to-eat demand.

By Processing Type:

- Fresh/chilled meat dominated with consistent demand across all regions.

- Frozen meat products showed strong growth, particularly in Asia-Pacific markets where the processed meat market reached USD 1.82 billion in 2024 with projections to USD 3.51 billion by 2033.

- Value-added products gained traction, with marinated, smoked, and specialty products commanding premium pricing.

By Distribution Channel:

- Traditional retail channels maintained dominance, with supermarkets/hypermarkets holding the largest share

- E-commerce and direct-to-consumer channels expanded rapidly at 8.6% CAGR, driven by subscription models and digital platforms

- B2B platforms showed exceptional growth, with online B2B sales reaching $1.1 trillion in 2020 and expected to grow to $1.8 trillion by 2026

c. Zones, Regional Analysis

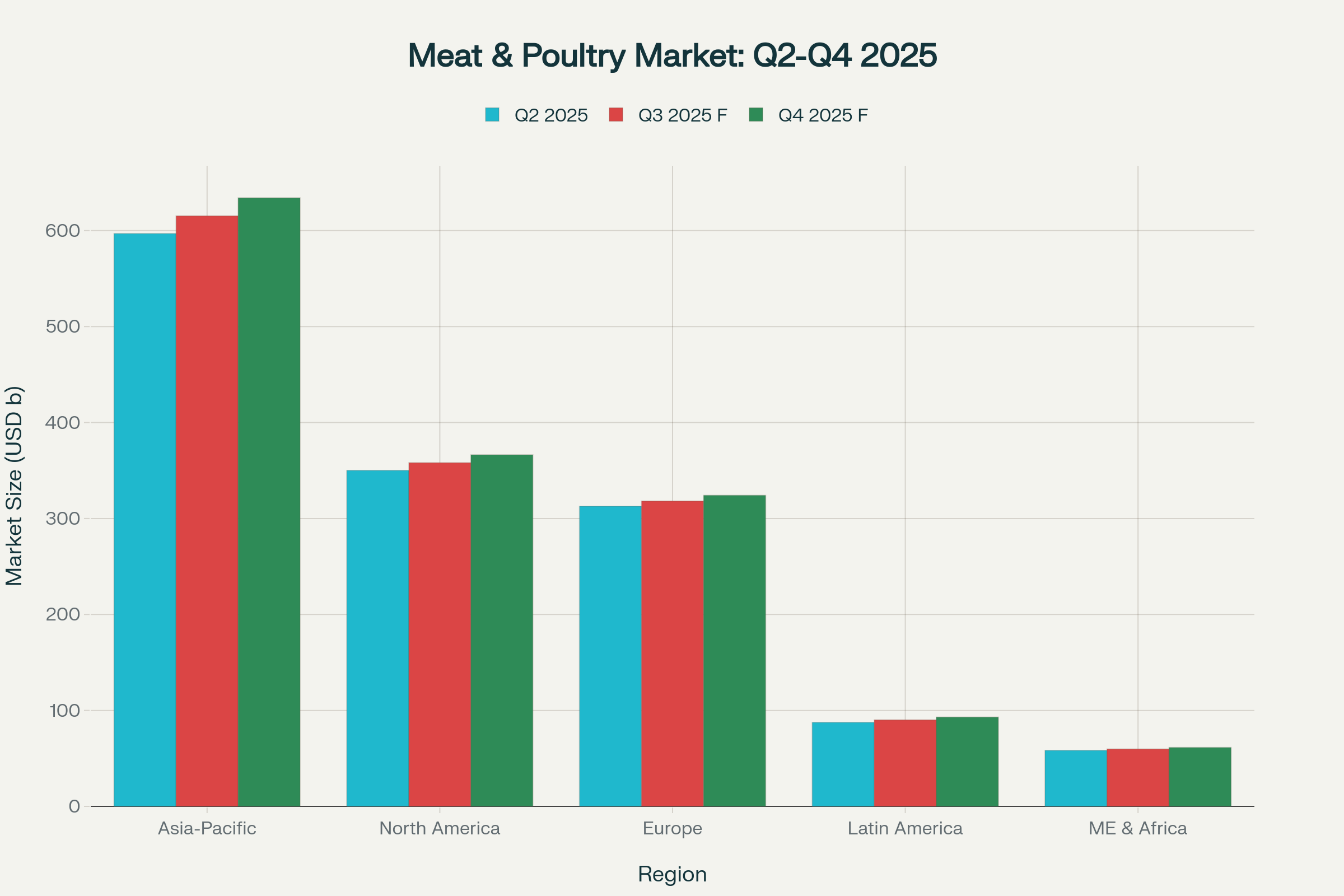

Regional meat and poultry market performance shows Asia-Pacific leading with strongest growth trajectory through Q4 2025

Asia-Pacific (40.1% Market Share):

The region maintained its leadership position with USD 597 billion market size in Q2 20251920. China remained the dominant producer with 644 million tons annual capacity, while India emerged as a key growth market driven by urbanization and dietary transitions1. The region’s meat products market reached USD 812.20 billion in 2025, expanding at a 4.70% CAGR.

North America (24.7% Market Share):

The region demonstrated resilience with USD 350.2 billion market size, supported by strong domestic demand and export capabilities. The processed poultry meat market showed particular strength, with North America accounting for 43.12% of the global processed poultry market in 2024. USMCA integration continued to support cross-border trade while automation adoption addressed labor shortages,

Europe (20.2% Market Share):

European markets focused on sustainability and premium positioning, with consumers increasingly preferring organic meat and sustainable food products. The region’s emphasis on animal welfare standards and traceability requirements supported premium pricing strategies, though production modernization driven by sustainability regulations created some barriers to entry.

Latin America (8.5% Market Share):

The region showed the highest growth projections at 6.1% CAGR through 2030, led by Brazil’s position as the world’s largest beef exporter with 3 million tons annually1. Argentina, Uruguay, and Paraguay expanded market access, with new market openings in China and the United States creating significant growth opportunities.

Middle East & Africa (6.5% Market Share):

Population growth and urbanization drove protein demand, while food security initiatives supported local production development. The growing market for Halal-certified meat products positioned regional players as key participants in global food trade, with the Middle East market projected to reach USD 152 billion by 20331.

1.2. Analysis

a. Tendency and Reasons for Segmentation and Major Zones in Q2 2025

The Q2 2025 market dynamics revealed several critical trends shaping regional and segment performance. Asia-Pacific’s dominance reflected fundamental demographic and economic advantages, including population scale (over 4.3 billion people), rapid urbanization, and rising disposable incomes driving protein consumption. The region’s shift toward protein-rich diets, particularly in China and India, created sustained demand growth that outpaced supply capacity in many markets.

Poultry’s leadership across all regions stemmed from its competitive positioning as an affordable protein source relative to beef and pork, combined with shorter production cycles and lower environmental impact. Market data showed poultry maintained price competitiveness even amid inflation, with Q2 2025 price increases of only 5-7% year-over-year compared to beef’s 12-15% increases.

Regional specialization became increasingly pronounced, with Latin America focusing on export-driven production while domestic consumption rose steadily, North America emphasizing premium positioning and technological advancement, and Europe prioritizing sustainability and organic certification. This specialization reflected comparative advantages in production costs, regulatory environments, and consumer preferences.

b. Natural Impacts

Climate volatility significantly impacted Q2 2025 market performance, with extreme weather events including El Niño affecting agricultural production stability globally. Drought conditions in key cattle-producing regions contributed to herd liquidation and tighter beef supplies, driving the 12-15% price increases observed in Q2 2025.

Highly pathogenic avian influenza (HPAI) remained a persistent threat, with outbreaks continuing to disrupt poultry production and trade flows. The industry responded with increased vaccination programs and enhanced biosecurity measures, though supply disruptions contributed to price volatility in affected regions.

Feed cost pressures from corn and soybean price swings directly impacted profitability across all protein segments. However, lower feed costs in some regions supported higher slaughter weights and improved feed conversion ratios, partially offsetting production challenges.

Water scarcity and quality concerns drove increased adoption of conservation technologies, with 65% implementation of water conservation initiatives across the industry by 2025. These challenges accelerated investment in precision agriculture and sustainable production practices.

c. Economic Impacts

Global economic conditions in Q2 2025 created mixed impacts across regional markets. Rising interest rates and inflation pressures affected consumer purchasing power, particularly in developed markets, leading to increased price sensitivity and demand for value-oriented protein options.

Currency fluctuations significantly influenced export competitiveness, with depreciation of currencies in major exporting countries like Brazil and Argentina providing competitive advantages in global markets. The ongoing Russia-Ukraine conflict continued to impact global grain supplies, inflating feed costs and squeezing profit margins across the livestock sector.

Trade policy uncertainties, including potential U.S. tariff increases and retaliatory measures, created volatility in global trade flows. The World Trade Organization projected potential 0.2% contraction in global trade, with tariff escalation potentially causing up to 1.5% contraction in 2025.

Labor shortages and rising wage costs, particularly in processing facilities, contributed to operational challenges and increased automation adoption. National Insurance changes in key markets like the UK, including rate increases from 13.8% to 15% and reduced thresholds, added cumulative cost pressures throughout the supply chain.

d. Behavioral Factors (B2B and B2C)

B2B Market Dynamics:

The B2B food industry underwent significant digital transformation in Q2 2025, with online B2B sales reaching unprecedented levels18. Millennial and Generation Z buyers, now comprising 73% of B2B purchasing decision-makers, drove demand for digital-first procurement processes, with 44% preferring online transactions over traditional sales interactions.

Digital platform adoption accelerated, with companies like Freshdi.com recording over 130 buyer requests every three days and maintaining nearly 100 active suppliers1. The global B2B food platform market reached approximately $44.49 billion in 2023, with projections to $249.21 billion by 2032 at a 21.1% CAGR.

Supply chain transparency and traceability became critical B2B requirements, with 70% of businesses willing to pay premiums for QR-verified products and blockchain-enabled supply chain visibility. This shift reflected increased regulatory compliance needs and corporate sustainability commitments.

B2C Consumer Behavior:

Consumer preferences in Q2 2025 showed strong preference for premium, traceable meat products, with growing demand for antibiotic-free, grass-fed, and organic options1. Taste remained the primary driver of meat consumption for over 50% of consumers, though health consciousness and sustainability concerns increasingly influenced purchasing decisions.

Direct-to-consumer channels expanded rapidly, with subscription boxes and customized meat product kits gaining popularity. Online meat sales grew at 8.6% CAGR, enabled by improved cold-chain logistics and mobile commerce platforms.

Regional consumer behavior varied significantly, with Asia-Pacific consumers showing rapid adoption of poultry due to affordability and health perceptions, North American consumers maintaining preference for premium beef despite inflation, and European consumers increasingly choosing organic and sustainable options.

2. Market Forecast in Q3 & Q4/2025

2.1 Forecast Revenue: Global & Major Zones

Global Market Projections:

The global meat and poultry market is projected to reach USD 1.52 trillion in Q3 2025, representing a 2.0% sequential growth from Q2 2025, followed by USD 1.55 trillion in Q4 20251. This trajectory maintains the industry’s path toward the projected USD 1.8 trillion valuation by 20301.

Regional Forecasts:

Asia-Pacific: Expected to reach USD 615.4 billion in Q3 2025 and USD 634.2 billion in Q4 2025, maintaining its 6.31% CAGR growth trajectory. China’s continued urbanization and India’s dietary transitions will drive sustained demand growth, while Southeast Asian markets benefit from near-shoring trends.

North America: Projected at USD 358.1 billion (Q3) and USD 366.5 billion (Q4), with growth supported by strong domestic consumption and export demand1. The U.S. beef market faces supply constraints with production forecast down 2.3-3.0% in Q4 2025, while poultry production remains robust.

Europe: Forecasted to reach USD 318.2 billion (Q3) and USD 324.1 billion (Q4), with growth driven by premium positioning and sustainability initiatives1. Organic certification requirements and traceability standards continue supporting premium pricing strategies.

Latin America: Expected strong performance with USD 90.2 billion (Q3) and USD 93.1 billion (Q4), benefiting from competitive export positioning and favorable currency conditions. Brazil’s beef exports and Argentina’s expanding market access drive regional growth.

Middle East & Africa: Projected at USD 59.8 billion (Q3) and USD 61.4 billion (Q4), supported by population growth and increasing Halal-certified product demand.

2.2. Analysis

Forward indicators suggest continued inflationary pressure across protein categories through Q4 20251. Poultry prices are forecast to increase 8-10% in Q3 and 9% in Q4, driven by rising feed costs and strong Asia-Pacific demand. Beef faces the most significant price pressure, with increases of 15-18% projected for Q3 and up to 18% for Q4, reflecting ongoing supply constraints and drought impacts.

Pork markets show more stability with 6-8% price increases expected, supported by export growth and favorable production conditions in key regions. Processed meat products face 10-12% price increases due to labor costs and packaging material inflation.

The fourth quarter traditionally shows stronger performance due to seasonal demand patterns, holiday cooking, and inventory building. However, Q4 2025 faces headwinds from potential trade policy changes, continued climate volatility, and economic uncertainty in key markets.

Geopolitical factors remain the most significant risk to Q4 forecasts, with potential U.S. trade policy changes and ongoing conflicts creating uncertainty in global trade flows. The Middle East conflicts and Russia-Ukraine war continue disrupting supply chains and affecting feed cost stability.

About us

Freshdi.com is the world’s leading global B2B Marketplace for global agricultural products and food, connecting directly between buyers and suppliers by Empowering Freshdi AI. Freshdi.com has over 3M+ suppliers, 2M+ active buyers, and 1,000+ buying requests updated daily in agri-food.

Try it for yourself.

Join a global network of verified agri-food buyers and suppliers.