Executive Summary

The global meat and poultry industry stands at a pivotal juncture in Q2/2025, characterized by unprecedented technological transformation, shifting consumer preferences, and evolving regulatory landscapes. This comprehensive analysis reveals a market valued at USD 1.43 trillion in 2024, projected to reach USD 1.8 trillion by 2030 with a robust 5.5% CAGR.

Curious how CRISPR meat & poultry market analytics will rewrite Q3–Q4 prices? Read on.

3. Innovations (Trends in Long & Short Term)

3.1. Technology Transformation

Biotechnology Advancements:

The meat and poultry industry is experiencing a biotechnology renaissance in 2025, with genome editing emerging as a transformative solution for livestock production. Breakthrough applications include tuberculosis-resistant cattle, SLICK cattle adapted for warmer climates, and gene-edited calves with reduced susceptibility to Bovine Viral Diarrhea (BVD). Precision fermentation technologies are expanding beyond alternative proteins into broader applications including flavorings, bioactives, and functional ingredients.

Cultured meat technologies are approaching commercial viability, with the global market projected to reach USD 229 billion by 20501. Advanced developments in 2025 include plant-based scaffolding and 3D bioprinting techniques making cultivated meat virtually indistinguishable from traditional products. Companies are focusing on cost reduction and scaling production to achieve wider market adoption.

Feed innovation represents a critical biotechnology application, with companies like Cargill developing solutions such as Biostrong™ Dual, combining postbiotics and phytogenics to enhance animal performance. Field trials demonstrate significant improvements, including 100g extra bodyweight per broiler and 4-point feed conversion ratio reductions.

Digital Revolution:

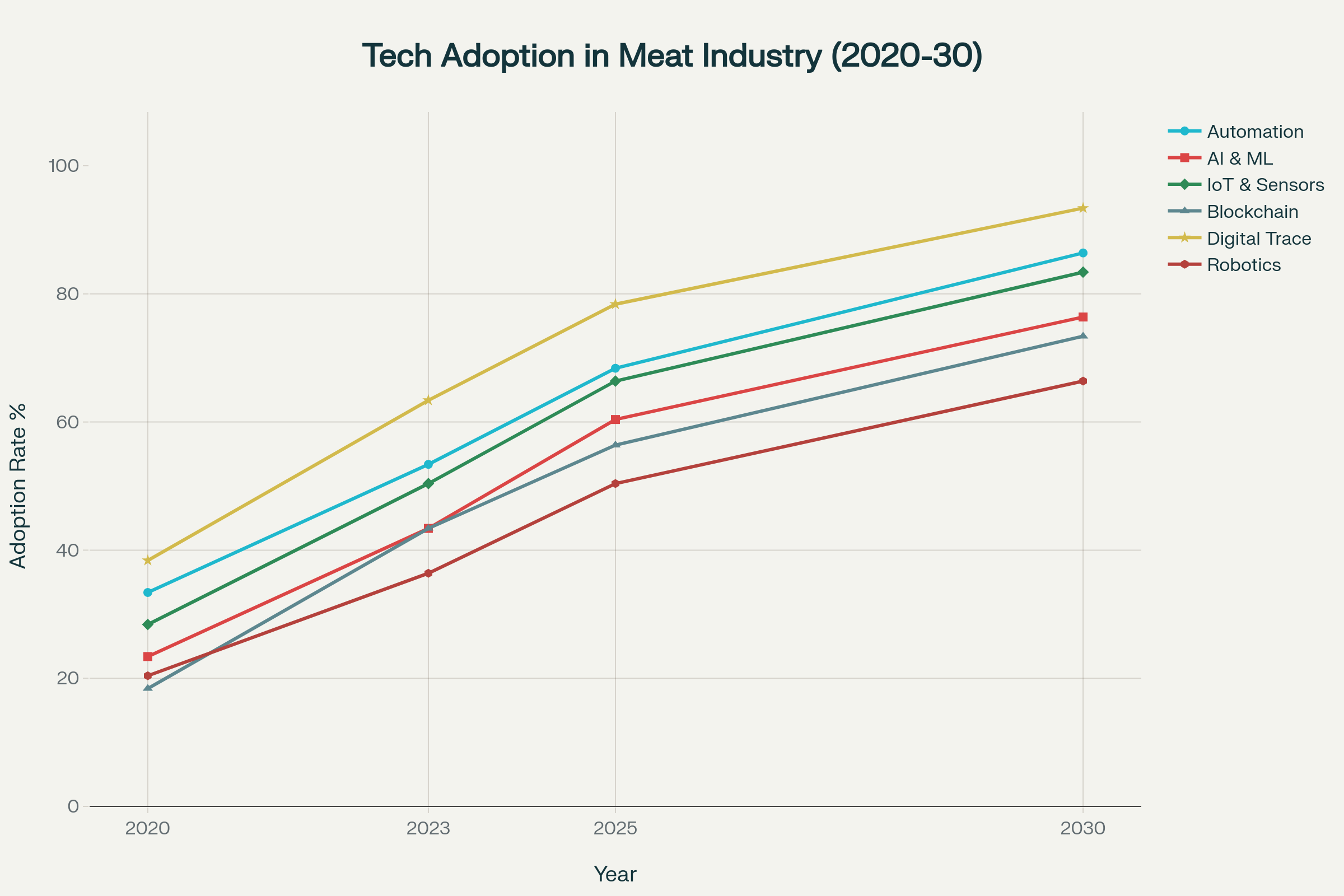

Technology adoption in meat industry shows rapid acceleration, with digital traceability leading at 70% adoption in 2025

Digital transformation has accelerated dramatically, with automation adoption reaching 60% across major processing facilities by 20251. AI-powered quality control systems now achieve 90% accuracy in defect detection, while IoT sensors enable real-time monitoring of animal health and environmental conditions.

Blockchain traceability adoption reached 48% in 2025, with 60% adoption projected across wholesale supply chains. This technology enables end-to-end supply chain transparency, supporting food safety compliance and consumer trust. Digital traceability tools have achieved 70% adoption, driven by regulatory requirements and consumer demand for transparency.

Robotics integration has expanded significantly, with 42% adoption in 2025, addressing labor shortages and improving processing efficiency. Advanced robotics applications include automated cutting systems, packaging operations, and facility cleaning, reducing labor dependency by up to 40%.

Precision Livestock Farming (PLF) embeds farms with IoT sensors, automated cameras, and AI-driven analytics monitoring everything from feed intake to real-time stress indicators. These systems optimize production efficiency while supporting animal welfare standards increasingly demanded by consumers and regulators.

Artificial Intelligence Applications:

AI deployment in 2025 focuses on optimizing food production, predicting market trends, and enhancing supply chain management. Machine learning algorithms analyze vast datasets to improve breeding programs, optimize feed formulations, and predict disease outbreaks before clinical symptoms appear.

Smart farming technologies integrate AI with sensor networks to monitor animal behavior, environmental conditions, and feed efficiency in real-time. These systems enable proactive management decisions that improve both productivity and animal welfare outcomes.

3.2. Environment (ESG; Sustainability; Green Initiatives)

ESG Framework Implementation:

Environmental, Social, and Governance (ESG) principles have become central to meat industry operations in 2025, driven by investor requirements and regulatory mandates. The meat industry faces particular scrutiny due to its environmental impact, with livestock production responsible for 14.5% of global greenhouse gas emissions.

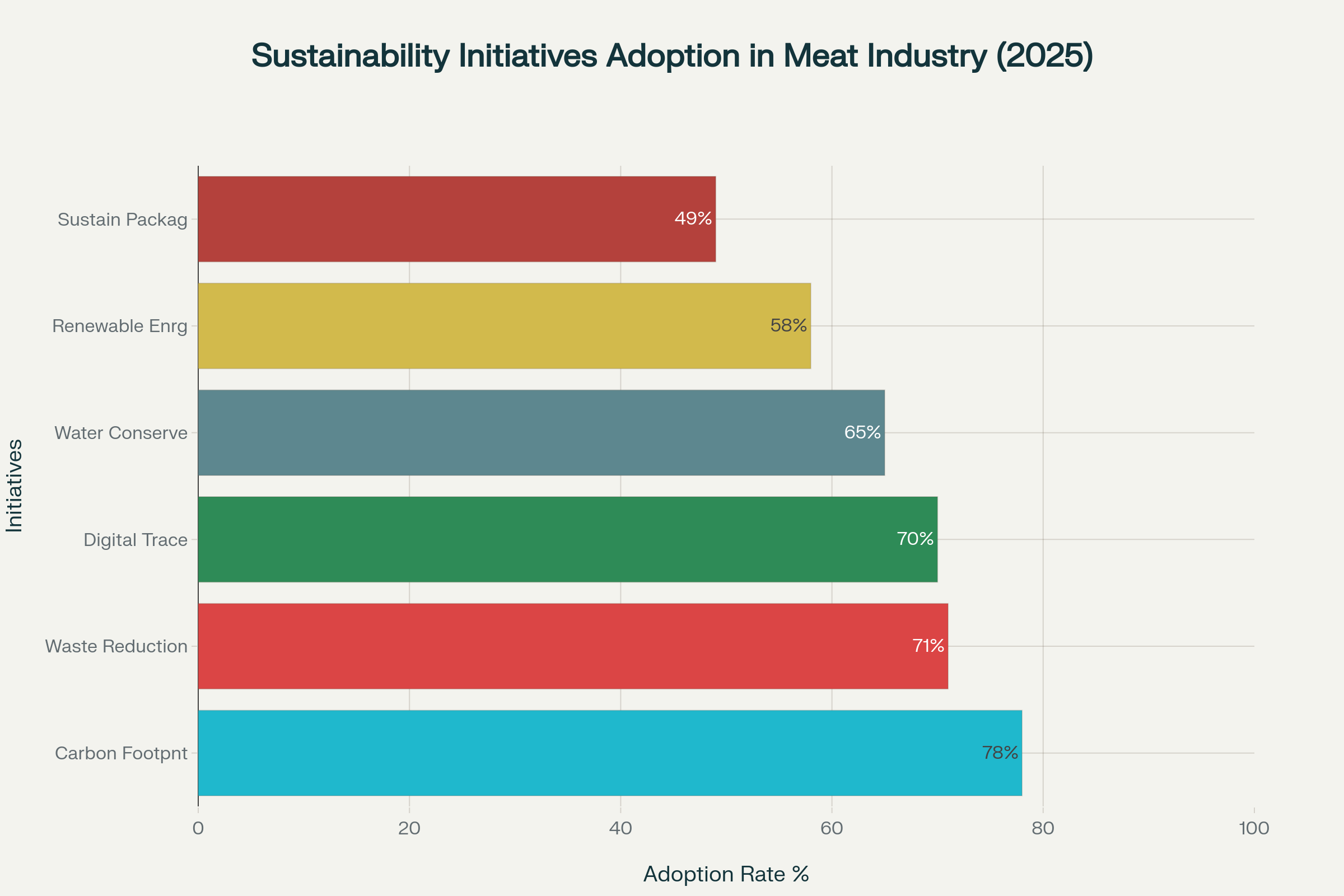

Carbon footprint reduction leads sustainability initiatives with 78% adoption rate across meat industry companies in 2025

Carbon footprint reduction leads sustainability initiatives with 78% adoption across meat industry companies. Companies are implementing methane capture technologies reducing emissions by 30%, feed optimization using additives and precision nutrition, and renewable energy adoption in processing facilities. Carbon sequestration through improved grazing management represents an emerging opportunity for additional emission reductions.

Water conservation initiatives have reached 65% implementation, addressing critical resource scarcity challenges. Advanced technologies include precision irrigation systems, water recycling in processing facilities, and drought-resistant feed crop development. These initiatives are essential given agriculture’s significant water consumption requirements.

Waste reduction programs achieve 71% implementation across the industry, focusing on nose-to-tail utilization, by-product valorization, and packaging optimization1. Circular economy approaches transform waste streams into valuable inputs, including converting meat processing by-products into protein ingredients and biogas production.

Sustainable Packaging Evolution:

Sustainable packaging adoption has reached 49% with biodegradable materials gaining market acceptance1. Innovation focuses on reducing plastic usage, developing compostable alternatives, and improving recyclability of packaging materials. These efforts address growing consumer and regulatory pressure for environmental responsibility.

Renewable Energy Integration:

Renewable energy adoption in meat processing facilities has reached 58% implementation. Solar panel installations and biogas systems not only reduce energy costs but generate income through excess power sales to electrical grids. These systems appeal to environmentally conscious consumers and often qualify for government incentives.

Regenerative Agriculture:

Regenerative agriculture practices have been adopted by 52% of producers, focusing on soil health improvement, biodiversity enhancement, and carbon sequestration. These practices not only address environmental concerns but often improve long-term productivity and resilience of agricultural operations.

Alternative Protein Impact:

The alternative protein market is projected to reach USD 36.17 billion by 2030, expanding at 8.84% CAGR1. This growth creates both competitive pressure and collaboration opportunities for traditional meat producers. Many companies are developing hybrid strategies, incorporating both conventional and alternative protein offerings to meet diverse consumer preferences.

4. Strategic Recommendations

Technology Integration Strategy:

Companies must prioritize digital transformation investments, particularly in automation, AI-powered quality control, and blockchain traceability systems. The 70% of companies reporting cost savings within 18 months of technology implementation demonstrate clear ROI potential. Priority areas include:

- Automated processing systems to address labor shortages and improve efficiency

- AI-powered quality control and predictive maintenance systems

- Blockchain traceability platforms to meet regulatory and consumer transparency demands

- IoT sensor networks for real-time monitoring and optimization

- Digital platforms for B2B connectivity and supply chain coordination

Market Entry and Expansion:

Emerging markets across Asia-Pacific and Latin America present compelling growth opportunities, driven by rising consumption, expanding middle classes, and supportive trade frameworks. Strategic approaches include:

- Asia-Pacific Focus: Target urbanizing populations in China and India with affordable poultry and processed meat products. Leverage the region’s 6.31% CAGR growth trajectory and establish local production capabilities.

- Latin American Partnerships: Capitalize on the region’s 6.1% CAGR and competitive export positioning. Develop strategic alliances with established exporters in Brazil and Argentina.

- Digital-First Approach: Leverage B2B platforms like Freshdi.com offering access to 100,000+ buyers across 150+ countries, AI-powered matching, and real-time market intelligence.

Sustainability and ESG Alignment:

Carbon neutrality commitments and regenerative agriculture adoption are becoming critical differentiators. Strategic priorities include:

- Implement comprehensive carbon footprint reduction programs (78% industry adoption rate indicates market leadership opportunity)

- Develop water conservation initiatives to address scarcity challenges

- Invest in renewable energy systems for cost savings and environmental positioning

- Establish circular economy practices to transform waste streams into value-added products

- Obtain relevant certifications (organic, Halal, sustainability) to access premium market segments

Risk Management and Resilience:

Supply chain diversification and climate risk adaptation are essential for operational continuity. Key strategies include:

- Geographic Diversification: Reduce concentration risk through multi-regional sourcing and production capabilities

- Technology Hedging: Utilize digital platforms for real-time price monitoring and commodity hedging

- Climate Adaptation: Invest in drought-resistant feed crops and climate-controlled production facilities

- Regulatory Preparedness: Implement digital documentation systems and blockchain verification for compliance readiness

Innovation Investment:

Strategic investments in alternative proteins, precision fermentation, and cellular agriculture position companies for long-term market evolution. Collaboration with research institutions and agri-tech startups can accelerate product development and commercialization timelines.

Workforce Development:

Address the 73% millennial influence in B2B purchasing by developing digital-native sales and marketing capabilities. Invest in workforce training for technology adoption and create career pathways that attract younger talent to the industry.

5. Conclusion

The global meat and poultry industry enters the second half of 2025 positioned for continued growth despite facing unprecedented challenges. The market’s resilience, demonstrated by strong Q2 2025 performance reaching USD 1.49 trillion, reflects fundamental demand drivers including population growth, urbanization, and rising protein consumption in emerging markets.

Critical Success Factors:

Digital transformation emerges as the primary competitive differentiator, with companies achieving 70% cost savings within 18 months of implementation leading market performance. The acceleration of technology adoption – from 50% automation in 2025 to projected 78% by 2030 – indicates that early adopters will capture significant competitive advantages.

Sustainability initiatives have transitioned from optional corporate responsibility programs to essential business imperatives. The 78% adoption rate of carbon footprint reduction programs and consumer willingness to pay 8% premiums for verified sustainable products demonstrate clear market validation of ESG strategies.

Regional Dynamics:

Asia-Pacific’s dominance with 40.1% market share and 6.31% CAGR growth trajectory makes it the critical battleground for global expansion. Companies that establish strong positions in China and India’s urbanizing markets, while adapting to local preferences and regulatory requirements, will capture disproportionate growth opportunities.

Market Evolution:

The industry’s future will be shaped by the convergence of traditional meat production with alternative proteins, digital technologies, and sustainability practices. Companies that develop integrated strategies addressing all three dimensions—rather than viewing them as separate initiatives—will emerge as market leaders.

The projected USD 1.8 trillion market valuation by 2030 represents not just growth, but fundamental transformation. Success will favor organizations that embrace change, invest in technology and sustainability, and maintain agility in responding to evolving consumer preferences and regulatory requirements.

Investment Priorities:

Immediate priorities for 2025-2026 include automation implementation, sustainable packaging adoption, and digital traceability systems. Medium-term investments should focus on alternative protein development, regenerative agriculture practices, and Asia-Pacific market expansion. Long-term strategic positioning requires preparation for cellular agriculture commercialization and circular economy integration.

The meat and poultry industry’s journey through Q2 2025 demonstrates that traditional protein producers can successfully navigate transformation while maintaining growth. Companies that align technology adoption, sustainability initiatives, and market expansion strategies will not only survive industry evolution but emerge stronger and more competitive in the global marketplace.

About us

Freshdi.com is the world’s leading global B2B Marketplace for global agricultural products and food, connecting directly between buyers and suppliers by Empowering Freshdi AI. Freshdi.com has over 3M+ suppliers, 2M+ active buyers, and 1,000+ buying requests updated daily in agri-food.

Try it for yourself.

Join a global network of verified agri-food buyers and suppliers.