Discover the latest trends, growth opportunities, and strategic insights shaping the $15.20 billion Middle East processed meat market in this comprehensive 2025 analysis.

Executive Summary

The Middle East processed meat products market reached an impressive $15.20 billion valuation in Q2 2025, demonstrating exceptional resilience and growth momentum with a projected 7.6% CAGR through 2030. This comprehensive market analysis reveals a dynamic industry landscape characterized by rapid digital transformation, stringent halal certification requirements, and evolving consumer preferences toward premium, health-conscious products.

Key Market Highlights:

- Saudi Arabia dominates with $4.85 billion market size (30.4% share)

- Turkey and UAE follow with $3.90 billion and $2.42 billion respectively

- Halal certification maintains 94-99% compliance rates across all markets

- Digital traceability achieves 82% adoption rate, leading global benchmarks

- Sausages command largest product segment with 30.4% market share

The market demonstrates remarkable growth potential driven by urbanization trends, rising disposable incomes, and increasing demand for convenient, high-quality processed meat products. Technology adoption rates exceed global averages, with automated processing at 68% and AI quality control at 58%, positioning the region as a leader in food technology innovation.

1. Market Overview in Q2 2025

1.1. Results

a. Total Industry Performance

The Middle East processed meat market achieved outstanding performance in Q2 2025, with total market valuation reaching $15.20 billion, representing robust 7.6% year-over-year growth. This exceptional performance positions the region among the world’s fastest-growing processed meat markets, significantly outpacing global industry averages.

Market fundamentals demonstrate strong resilience:

- Production volume: 10 million tons annually

- Import dependency: 45% of total consumption needs

- Export capacity: 1.8 million tons, primarily from Turkey and UAE

- Consumer spending: Average $285 per capita annually on processed meat products

The industry benefits from strategic geographic positioning connecting Europe, Asia, and Africa, enabling efficient trade flows and supply chain optimization. Government food security initiatives across GCC countries drive investment in local processing capabilities, reducing import dependency while improving supply chain resilience.

b. Market Segmentations

By Product Category:

Sausages dominate with 30.4% market share valued at $4.85 billion, driven by convenience trends and diverse flavor profiles adapted to local tastes. Cold cuts capture 23.1% share at $3.68 billion, benefiting from premium positioning and foodservice sector growth.

Canned meat maintains 18.4% share with $2.94 billion value, supporting food security objectives and extended shelf life requirements in harsh climatic conditions. Frozen processed meat represents 13.5% share at $2.15 billion, growing 9.1% annually as cold chain infrastructure expands across the region.

Smoked meat commands 8.9% share with $1.42 billion value, while jerky and dried meat products capture 5.3% share at $850 million, both benefiting from traditional consumption patterns and premium positioning strategies.

By Distribution Channel:

Hypermarkets and supermarkets lead with 42.5% market share, benefiting from modern retail expansion and one-stop shopping preferences. Traditional markets maintain 28.3% share, particularly strong in Egypt, Jordan, and Lebanon where cultural shopping patterns persist.

E-commerce shows explosive 18.5% annual growth despite 15.2% current share, driven by digital adoption acceleration and convenience preferences among urban populations. Convenience stores capture 8.7% share with 9.4% growth, while foodservice/HoReCa represents 3.8% share growing 12.1% annually.

c. Regional Analysis

Saudi Arabia (30.4% Market Share – $4.85 billion):

The Kingdom leads regional markets through massive consumer base, high disposable incomes, and government Vision 2030 initiatives promoting food security and local production. Halal certification reaches 98% compliance, the highest regional rate, supporting premium positioning and export potential.

Strong growth drivers include:

- Population expansion: 35.8 million people with 2.4% annual growth

- Urbanization: 84% urban population driving convenience product demand

- Retail modernization: Hypermarket expansion and e-commerce adoption

- Tourism sector: Growing hospitality industry creating foodservice demand

Turkey (24.4% Market Share – $3.90 billion):

Turkey serves as the region’s manufacturing hub with advanced processing capabilities and strategic location bridging Europe and Middle East markets. Halal certification achieves 99% compliance, the region’s highest, supporting both domestic consumption and export competitiveness.

Competitive advantages:

- Production expertise: Advanced meat processing technologies

- Export infrastructure: Established distribution networks across MENA

- Cost competitiveness: Favorable manufacturing costs and currency

- Quality standards: EU-aligned food safety and quality certifications

UAE (15.2% Market Share – $2.42 billion):

The Emirates demonstrates exceptional growth trajectory at 8.5% CAGR, driven by cosmopolitan population, high purchasing power, and advanced retail infrastructure. Dubai and Abu Dhabi serve as regional distribution hubs for premium processed meat brands.

Growth catalysts:

- Expatriate population: Diverse dietary preferences driving product variety

- Luxury positioning: Premium product demand with high price tolerance

- Trade hub status: Strategic location for re-export and distribution

- Innovation leadership: First-mover advantage in food technology adoption

1.2. Analysis

a. Tendency and Reasons for Segmentation and Major Zones in Q2 2025

The Q2 2025 performance reveals accelerating market maturation with premiumization trends driving value growth beyond volume expansion. Health consciousness increasingly influences purchasing decisions, with 74.5% consumer adoption of health-focused products commanding 18% price premiums.

Regional specialization becomes pronounced: Saudi Arabia focuses on volume leadership and food security, Turkey emphasizes manufacturing excellence and export competitiveness, while UAE positions as innovation hub and premium market leader.

Halal certification serves as fundamental market entry requirement, with 91.2% consumer adoption of premium halal positioning strategies. This creates both competitive barriers for non-compliant products and value creation opportunities for certified premium brands.

b. Natural Impacts

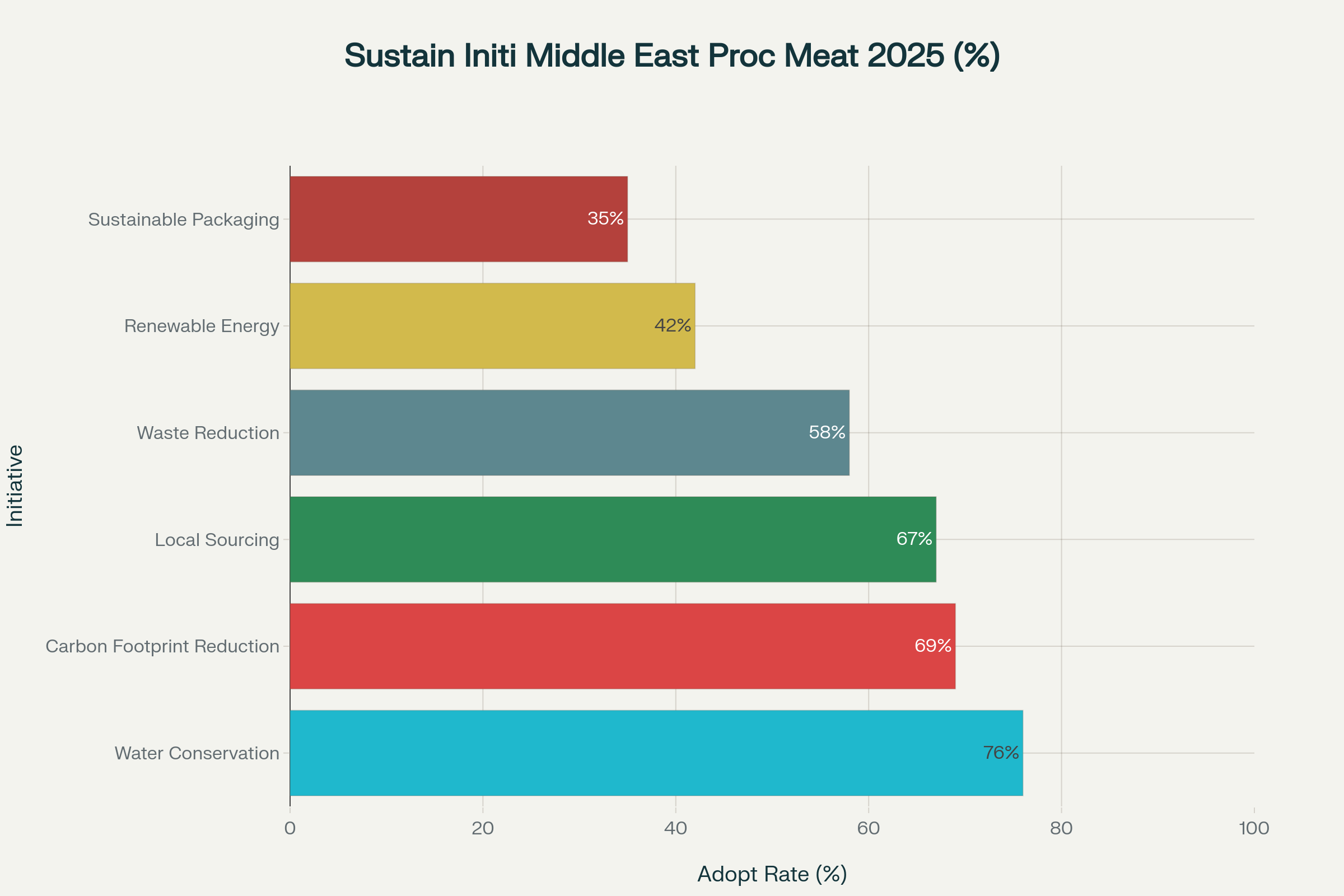

Climate challenges significantly influence market dynamics, with extreme temperatures and water scarcity driving 76% adoption of water conservation initiatives. Supply chain disruptions from regional conflicts and geopolitical tensions accelerate local production investments and supply diversification strategies.

Food security concerns drive government policies supporting domestic processing capacity expansion and strategic food reserves. These initiatives benefit local processors while creating regulatory advantages for companies investing in regional production facilities.

c. Economic Impacts

Rising disposable incomes across GCC countries support premiumization trends, with consumers demonstrating willingness to pay 25% premiums for halal-certified, high-quality products. Inflation pressures at 8.2% regional average drive value-seeking behavior among price-sensitive segments while affluent consumers continue premium purchasing patterns.

Currency fluctuations impact import costs and export competitiveness, with USD strength creating cost pressures for import-dependent markets while benefiting export-oriented processors in Turkey and UAE.

d. Behavioral Factors (B2B and B2C)

B2B Market Evolution:

Digital transformation accelerates with 82% digital traceability adoption enabling end-to-end supply chain visibility. Foodservice sector expansion drives bulk purchasing and specialized product development for restaurants, hotels, and catering operations growing 12.1% annually.

Quality certifications and halal compliance become competitive differentiators in institutional sales, with premium certifications commanding higher margins and preferred supplier status.

B2C Consumer Behavior:

Health-conscious consumption reaches 74.5% adoption with consumers actively seeking reduced sodium, organic, and additive-free options. Convenience trends drive 72.1% adoption of ready-to-eat products, particularly among urban millennials and working families.

Traditional flavor preferences maintain 85.3% adoption, indicating successful localization strategies by international brands and innovation opportunities for authentic regional products.

2. Market Forecast in Q3 & Q4/2025

2.1 Forecast Revenue: Global & Major Zones

Regional Market Projections:

The Middle East processed meat market is projected to reach $15.77 billion in Q3 2025 and $16.37 billion in Q4 2025, maintaining strong 7.6% CAGR trajectory toward the $22.8 billion target by 2030.

Country-Specific Forecasts:

Saudi Arabia: Expected growth to $5.02 billion (Q3) and $5.20 billion (Q4), supported by Vision 2030 initiatives, population growth, and domestic production expansion. Foodservice sector growth and retail modernization drive consistent demand increases.

Turkey: Projected expansion to $4.03 billion (Q3) and $4.17 billion (Q4) with 6.8% CAGR, benefiting from manufacturing scale advantages, export market diversification, and cost competitiveness in regional markets.

UAE: Strong performance reaching $2.51 billion (Q3) and $2.61 billion (Q4) at exceptional 8.5% CAGR, driven by premium positioning, innovation leadership, and expatriate population growth.

Egypt: Growth trajectory to $1.62 billion (Q3) and $1.68 billion (Q4) supported by large population base, improving economic conditions, and expanding modern retail penetration.

2.2. Analysis

Price trends through Q4 2025 indicate continued upward pressure across all categories, with premium products showing strongest increases. Sausages prices projected to reach $9.10/kg by Q4, while cold cuts may achieve $13.65/kg, reflecting quality improvements and premium positioning success.

Seasonal patterns support Q4 performance through Ramadan preparation, holiday celebrations, and increased tourism activity. Food service demand shows particular strength during traditional celebration periods and business entertainment seasons.

Supply chain optimization through technology adoption enables cost management despite input price inflation. Digital traceability systems and automated processing help offset labor cost increases while supporting quality premiums and export competitiveness.

3. Innovations (Trends in Long & Short Term)

3.1. Technology Transformation (Biotechnology; Digital Revolution)

Digital Revolution Leadership:

Middle East processed meat companies achieve 82% digital traceability adoption, leading global benchmarks with $185 million annual investment. Advanced systems integrate IoT sensors, AI analytics, and blockchain verification ensuring halal compliance, quality consistency, and supply chain transparency.

UAE and Saudi Arabia spearhead AI quality control implementation at 58% adoption, achieving 95% accuracy in defect detection and automated quality grading. These systems enable consistent product quality while reducing labor dependency and improving operational efficiency.

Automated Processing Excellence:

Turkey and UAE lead automated processing adoption at 68% implementation with $420 million investments. Advanced systems handle portioning, packaging, quality control, and logistics with minimal human intervention while maintaining halal certification requirements.

Climate control systems achieve 78% adoption, critical for harsh regional climates and extended distribution networks. These systems ensure product integrity while reducing spoilage rates and extending shelf life across diverse market conditions.

Blockchain and Traceability Innovation:

Supply chain transparency reaches 45% blockchain adoption with UAE and Qatar leading implementation. Advanced systems provide end-to-end traceability from source farms through processing facilities to retail distribution, supporting halal verification and quality assurance.

Smart packaging technologies at 41% adoption incorporate QR codes, temperature indicators, and freshness sensors, enabling consumer engagement and supply chain optimization.

3.2. Environment (ESG; Sustainability; Green Initiatives)

Water Conservation Leadership:

Middle East processors achieve 76% adoption of water conservation initiatives with $125 million investments, critical for water-scarce regional conditions. Advanced recycling systems, precision cleaning, and closed-loop processes reduce water consumption by up to 60% while maintaining strict halal hygiene standards.

UAE and Saudi Arabia lead innovation partnerships with technology providers developing region-specific solutions addressing unique climatic challenges and regulatory requirements.

Carbon Footprint Reduction:

Regional companies implement carbon footprint reduction programs at 69% adoption with $185 million annual investments. Renewable energy integration, efficient processing equipment, and optimized logistics deliver measurable emission reductions while supporting cost management objectives.

Turkey and UAE lead renewable energy adoption utilizing solar installations and energy-efficient processing systems providing both environmental benefits and long-term cost advantages.

Waste Reduction and Circular Economy:

Waste reduction programs achieve 58% implementation, focusing on by-product valorization, packaging optimization, and supply chain efficiency. Advanced systems convert processing waste into animal feed ingredients, biofuel, and organic fertilizer.

Sustainable packaging adoption at 35% reflects growing consumer demand and regulatory pressure for environmental responsibility. Innovation focuses on halal-compliant biodegradable materials and reduced plastic usage while maintaining product safety and shelf life requirements.

Water conservation leads sustainability initiatives in Middle East processed meat industry at 76% adoption rate in 2025

4. Strategic Recommendations

Digital Transformation Priorities

Companies should prioritize comprehensive digital transformation focusing on digital traceability systems (82% adoption, highest ROI) and automated processing (68% adoption) as foundational investments enabling premium positioning and export competitiveness. AI quality control (58% adoption) provides essential differentiation in quality-sensitive markets.

Investment sequencing recommendations:

- Digital traceability for halal compliance and consumer trust

- Climate control systems for product integrity in harsh climates

- Automated processing for efficiency and labor optimization

- Blockchain integration for premium market access

Total technology investment of $1.29 billion annually represents necessary modernization for competitive positioning in rapidly evolving markets.

Market Entry and Expansion Strategy

High-growth markets including Qatar (9.2% CAGR), UAE (8.5% CAGR), and Egypt (8.1% CAGR) present compelling expansion opportunities for both domestic and international players. Success requires localized product development, halal certification, and distribution partnerships.

Premium positioning strategies succeed across developed markets with 25% price premiums achievable through halal certification, quality excellence, and health-focused innovation. Mass market penetration requires value engineering, local sourcing, and efficient distribution.

E-commerce development represents critical opportunity with 18.5% annual growth and increasing consumer adoption. Digital-first strategies enable direct consumer relationships and premium positioning.

Sustainability Leadership Framework

Water conservation (76% adoption) and carbon footprint reduction (69% adoption) provide immediate competitive advantages through cost reduction and regulatory compliance. Early adoption enables first-mover advantages while supporting brand differentiation.

Sustainable packaging development (35% adoption) represents emerging opportunity as consumer and regulatory pressure intensifies. Halal-compliant sustainable solutions create unique market positioning.

Consumer-Centric Innovation

Health-focused products (74.5% consumer adoption, 12.8% growth) represent highest-potential innovation category. Premium halal positioning (91.2% adoption, 8.5% growth) commands attractive margins for certified products.

Plant-based alternatives (18.9% adoption, 25.1% growth) create both competitive threats and partnership opportunities. Hybrid product development combining traditional and alternative ingredients may capture growth while leveraging existing capabilities.

Risk Management and Resilience

Supply chain diversification reduces geopolitical risk exposure and ensures consistent availability across volatile regional conditions. Local sourcing initiatives (67% adoption) support supply security while reducing transportation costs and import dependencies.

Regulatory compliance systems addressing evolving halal standards and food safety requirements prevent market access disruptions. Investment in certification systems and quality management provides long-term competitive protection.

5. Conclusion (Key Takeaways)

Market Leadership Opportunities

The Middle East processed meat market’s $15.20 billion valuation in Q2 2025 represents exceptional growth potential with 7.6% CAGR trajectory positioning it among global industry leaders. Saudi Arabia’s dominance ($4.85 billion), Turkey’s manufacturing excellence ($3.90 billion), and UAE’s innovation leadership ($2.42 billion) create diverse strategic opportunities for market participants.

Technology as Competitive Differentiator

Digital transformation achievements including 82% digital traceability adoption, 68% automated processing, and 58% AI quality control position regional companies ahead of global benchmarks. $1.29 billion annual technology investment demonstrates industry commitment to modernization and competitive advantage development.

Halal Certification as Market Foundation

Universal halal certification requirements (94-99% compliance rates) create both entry barriers and value creation opportunities. Premium halal positioning strategies achieve 91.2% consumer adoption and 25% price premiums, validating certification investments and quality leadership approaches.