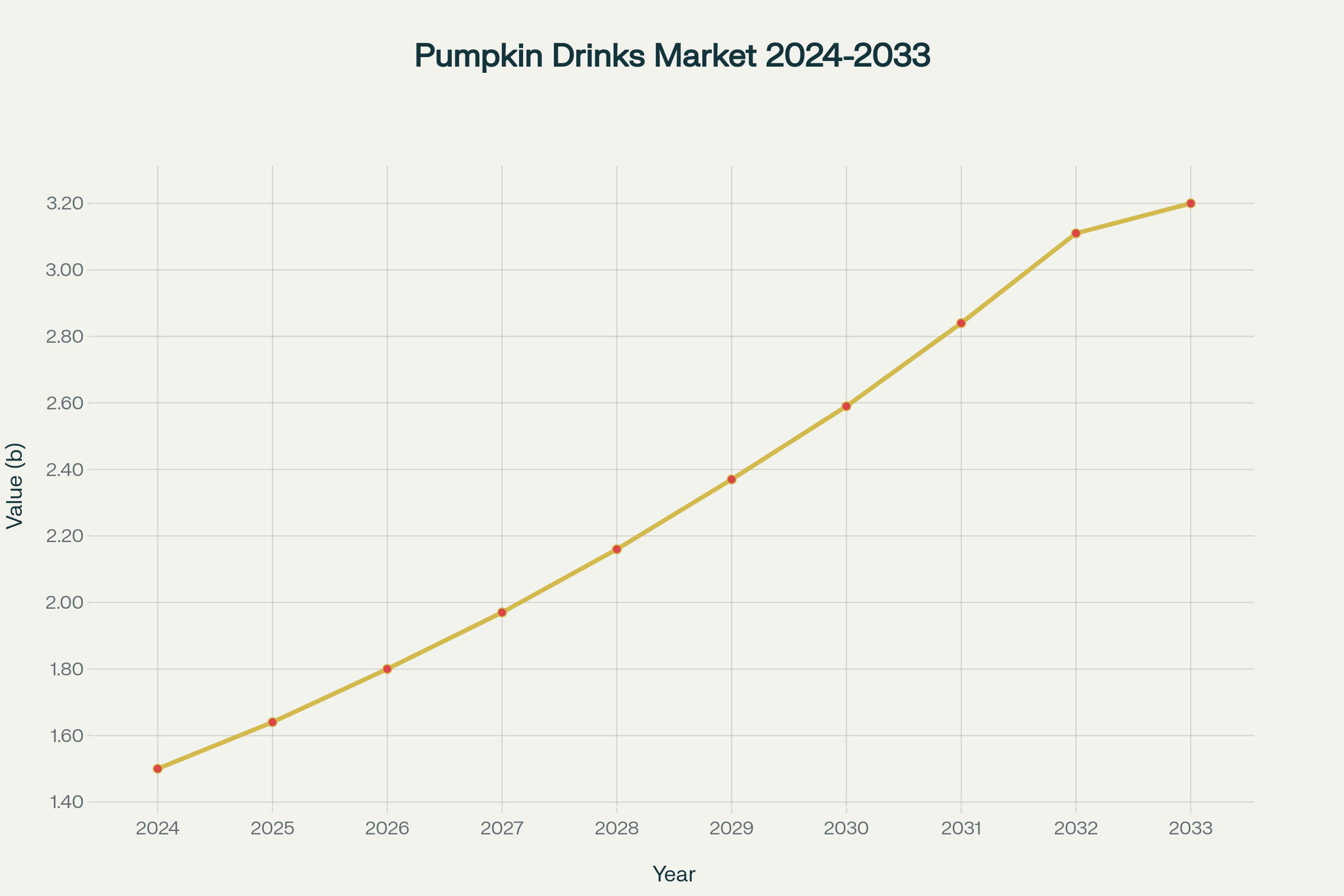

In the vast landscape of modern beverage innovation, perhaps no trend has captured consumer imagination quite like the pumpkin beverage phenomenon. What began as a simple seasonal offering has evolved into a $1.5 billion global market in 2024, projected to reach $3.2 billion by 2033 with a remarkable compound annual growth rate of 9.5%.

The Psychology of Pumpkin: Understanding Consumer Connection

The psychological appeal of pumpkin beverages extends far beyond simple flavor preferences, tapping into deep-seated emotional connections that drive consumer behavior in remarkable ways. Research indicates that pumpkin spice creates “associative feelings of nostalgia and warmth” through its sensory dimensions, triggering memories of autumn traditions, family gatherings, and seasonal transitions.

The “Fear of Missing Out” (FOMO) effect plays a crucial role in pumpkin beverage consumption patterns. The time-bound nature of seasonal availability creates urgency that drives purchasing decisions, with consumers feeling compelled to experience pumpkin flavors before they disappear. This psychological phenomenon has proven so powerful that 27% of consumers express desire for year-round pumpkin spice availability, particularly among the 18-24 age demographic where 32% want extended seasonal availability.futuremarketinsights+2

Consumer sentiment analysis reveals consistently positive engagement with pumpkin beverages, maintaining approximately 70% positive sentiment with only 13.6% negative conversation. This overwhelmingly favorable reception demonstrates that pumpkin beverages have successfully transcended initial skepticism to become genuinely beloved products.

Demographic data shows that 22% of U.S. adults are favorable toward pumpkin spice lattes, while 41% remain unfavorable and 38% are neutral or have not tried them. Among pumpkin spice latte fans, purchasing behavior follows predictable patterns: 23% purchase as soon as products become available in summer, 36% start in September, 34% wait until October, and only 8% hold off until November.

Global Pumpkin-Derived Drinks Market Growth Projection 2024-2033

Market Dynamics and Growth Trajectories

The pumpkin-derived drinks market represents one of the fastest-growing segments within the broader specialty beverage industry. The market encompasses a diverse range of products including pumpkin spice lattes, pumpkin smoothies, pumpkin juices, pumpkin ales, and innovative functional beverages incorporating pumpkin as a primary ingredient.accio+1

North America dominates the global market with approximately 41% market share, driven by strong cultural associations between pumpkins and autumn celebrations. However, Asia-Pacific represents the fastest-growing regional market, with countries like China and Japan showing rapidly expanding interest in Western-style seasonal beverages.

The broader pumpkin spice products market, valued at $1.251 billion in 2025, is projected to reach $2.841 billion by 2035 with an 8.5% compound annual growth rate. This growth reflects expanding applications beyond beverages into dairy products, confectioneries, breakfast cereals, and even personal care products.civicscience

Seasonal demand patterns show remarkable consistency, with pumpkin-flavored beverages surging to peak interest in September, aligning with Halloween and fall celebrations before declining sharply afterward. However, market data indicates growing year-round interest as consumers embrace pumpkin flavors beyond traditional seasonal boundaries.

Innovation and Product Development Trends

Beverage manufacturers are pushing creative boundaries with pumpkin-based innovations that extend far beyond traditional spice blends. Modern pumpkin beverages incorporate actual pumpkin content, providing nutritional benefits including vitamins A and C, antioxidants, and fiber. This shift toward incorporating real pumpkin addresses consumer demands for functional beverages with genuine health benefits.

Craft breweries have embraced pumpkin ales as signature seasonal offerings, with the global pumpkin ale market valued at $1.37 billion in 2024 and expected to reach $2 billion by 2032 at a 5.5% compound annual growth rate. Seasonal demand contributes to a 38% spike in consumption during fall, with 65% of millennials preferring craft pumpkin ales.

Innovation extends into premium and specialty segments, with breweries producing barrel-aged pumpkin ales and high-ABV alternatives to capture specialized markets and increase product value. Flavor innovation combines traditional pumpkin with spices like cinnamon, nutmeg, clove, and ginger, creating unique profiles that appeal to both casual consumers and flavor enthusiasts.

The development of convenient ready-to-drink formats addresses consumer demands for accessibility and portability. Major brands including Suntory Holdings, The Coca-Cola Company, and PepsiCo are investing heavily in pumpkin-derived drink innovations , recognizing the segment’s substantial growth potential.

Health and Wellness Integration

Consumer health consciousness is driving significant innovation in pumpkin beverage formulations. Pumpkins provide substantial nutritional benefits, containing high levels of beta-carotene, vitamin C, potassium, and dietary fiber. These nutritional advantages position pumpkin beverages as functional drinks that deliver both flavor satisfaction and health benefits.

Plant-based diet trends are fueling demand for pumpkin-based alternatives to dairy beverages. The growing adoption of vegan and vegetarian lifestyles creates opportunities for pumpkin-based milk alternatives, protein drinks, and smoothie bases. Research shows that plant-based beverage market size exceeded $16 billion in 2022 and is expanding at 8% compound annual growth rate, creating substantial opportunities for pumpkin-based products.

Low-calorie and sugar-free pumpkin beverage formulations address consumer demands for healthier indulgence options. Manufacturers are developing products that maintain authentic pumpkin spice flavors while reducing sugar content and incorporating natural sweeteners. This trend reflects broader consumer preferences for clean-label products perceived as natural and wholesome.

Functional beverage trends are incorporating pumpkin with superfoods and adaptogens to create premium health-focused products. These innovations target health-conscious consumers willing to pay premium prices for beverages that deliver both sensory pleasure and wellness benefits.

Cultural Impact and Brand Positioning

The Pumpkin Spice Latte phenomenon has transcended beverage marketing to become a cultural touchstone representing seasonal transition and comfort. Starbucks’ 2003 introduction of the Pumpkin Spice Latte corresponds with millennial emergence as a consumer demographic, creating lasting brand associations that continue driving consumption patterns.

Social media engagement around pumpkin beverages demonstrates remarkable consistency and growth. Google Trends data indicates that current search levels for pumpkin spice are likely to meet or eclipse previous high points of 2016 and 2017. This sustained interest defies predictions of trend fatigue, suggesting genuine long-term consumer appeal.

Cultural scholars note that pumpkin spice has developed gendered consumption associations, though actual social media data indicates that men post more frequently about pumpkin spice than women. This contradiction suggests that cultural perceptions may not accurately reflect actual consumption patterns.

The DIY trend reflects changing consumer relationships with branded products. Growing numbers of consumers are creating homemade pumpkin spice beverages, driven by both cost considerations and desire for customization. This trend creates both challenges and opportunities for commercial beverage manufacturers.

Supply Chain and Production Challenges

Pumpkin beverage production faces unique challenges related to seasonal ingredient availability and quality consistency. High seasonality of pumpkin harvests creates supply chain complexities, with manufacturers required to secure annual pumpkin supplies during limited harvest windows. Weather events such as droughts and floods can significantly impact pumpkin yields, affecting both ingredient availability and pricing.

The cost volatility of pumpkin ingredients creates pricing pressures for manufacturers. Fluctuations in raw material costs based on harvest yields and environmental factors require sophisticated supply chain management and pricing strategies. Some manufacturers address this challenge through long-term supplier contracts and inventory management systems.

Quality consistency represents another significant challenge, as natural pumpkin flavors can vary based on growing conditions, harvest timing, and processing methods. Manufacturers must implement rigorous quality control systems to maintain consistent flavor profiles across production batches.

Processing infrastructure requirements for handling fresh pumpkin ingredients create additional complexity compared to synthetic flavor systems. However, consumer preferences for natural ingredients continue driving investment in pumpkin processing capabilities.

Competitive Landscape and Market Players

Major beverage corporations are establishing strong positions in the pumpkin drinks market through both internal development and strategic partnerships. Key players including Suntory Holdings Limited, Unilever PLC, The Coca-Cola Company, PepsiCo Inc, and Carlsberg Breweries are actively expanding their pumpkin beverage portfolios.

Craft breweries and specialty beverage manufacturers hold significant market positions in premium segments. The craft beer industry’s embrace of pumpkin ales has created substantial opportunities for smaller producers to compete with major brands through unique flavoring and positioning strategies.

Coffee chains and café operators represent crucial distribution channels for pumpkin beverages, with Starbucks continuing to dominate the pumpkin spice latte category while competitors like Dunkin’ develop their own seasonal offerings. Independent coffee shops increasingly offer pumpkin beverages to compete with major chains during peak seasonal periods.

Retail distribution channels are expanding rapidly, with grocery stores, convenience stores, and online platforms increasing pumpkin beverage availability. This distribution expansion enables year-round availability and reduces dependence on foodservice channels.

Regional Market Variations and Opportunities

North American markets continue leading global consumption, with strong cultural associations between pumpkins and autumn traditions driving consistent seasonal demand. The United States market shows particular strength, supported by Halloween and Thanksgiving celebrations that create extended seasonal consumption periods.

European markets demonstrate growing interest in pumpkin beverages, though adoption rates remain lower than North American levels. Countries including the United Kingdom and Germany are showing increased consumption, particularly among younger demographics exposed to American cultural influences.

Asia-Pacific represents the highest growth potential, with emerging economies showing rapid adoption of Western-style seasonal beverages. Japan and China lead regional growth, driven by expanding coffee culture and increasing disposable incomes among urban consumers.

Latin American markets show modest but growing interest in pumpkin beverages, with Brazil and Mexico leading regional adoption. Cultural acceptance varies significantly across countries, requiring localized marketing and product adaptation strategies.

Future Outlook and Strategic Implications

The pumpkin beverage market’s trajectory toward $3.2 billion by 2033 reflects fundamental changes in consumer behavior and expectations. Growing demand for seasonal comfort foods, functional beverages, and premium experiences positions pumpkin drinks for continued expansion beyond traditional seasonal boundaries.accio+1

Innovation opportunities abound in product development, including organic formulations, sugar-free alternatives, protein-enhanced versions, and premium artisanal offerings. The integration of pumpkin with other trending ingredients such as turmeric, collagen, and plant-based proteins creates opportunities for premium positioning.

Sustainability considerations are becoming increasingly important as environmentally conscious consumers evaluate product choices. Pumpkin beverages offer advantages through plant-based ingredients and potential for local sourcing, though packaging and processing impacts require ongoing attention.

Market expansion strategies should focus on extending seasonal relevance while maintaining authentic connections to autumn traditions. Successful brands will balance innovation with nostalgic appeal, creating products that feel both familiar and novel to consumers.

Conclusion: The Enduring Appeal of Pumpkin Beverages

The pumpkin beverage phenomenon represents far more than a seasonal marketing success story—it embodies a fundamental understanding of consumer psychology, cultural connection, and innovative product development. The market’s growth from $1.5 billion in 2024 to a projected $3.2 billion by 2033 demonstrates the substantial commercial potential of products that successfully combine nostalgia, functionality, and sensory pleasure.

The success of pumpkin beverages offers valuable lessons for the broader food and beverage industry: seasonal products can achieve sustained growth when they tap into deeper emotional connections, health trends can be successfully integrated with indulgent flavors, and consumer education can transform seasonal novelties into year-round opportunities.

As consumer preferences continue evolving toward premium, functional, and experiential beverages, pumpkin drinks are uniquely positioned to capture growing market share. The combination of nostalgia, innovation, and genuine health benefits creates a value proposition that resonates across diverse demographic groups and geographic markets.

The future of pumpkin beverages lies not in replacing the seasonal magic that sparked their initial success, but in extending that magic throughout the year through innovative formulations, creative marketing, and authentic brand storytelling. For beverage manufacturers, retailers, and foodservice operators, pumpkin drinks represent both proven success and untapped potential in an increasingly competitive marketplace where emotional connection often trumps functional benefits.

The pumpkin beverage revolution continues unfolding, promising continued innovation, market expansion, and consumer delight as this remarkable category evolves from seasonal specialty to year-round staple in the global beverage landscape.

About us

Try it for yourself. Freshdi.com

Global Agri B2B Marketplace.