The global sweet potato market, valued at $43.1 billion in 2025 and projected to reach $56.4 billion by 2034, reflects the crop’s transformation from regional staple to global commodity. Understanding the key players in this trade—from export powerhouses to consumption leaders—reveals the complex dynamics shaping one of agriculture’s most promising growth sectors.researchandmarkets

The Global Sweet Potato Suppliers

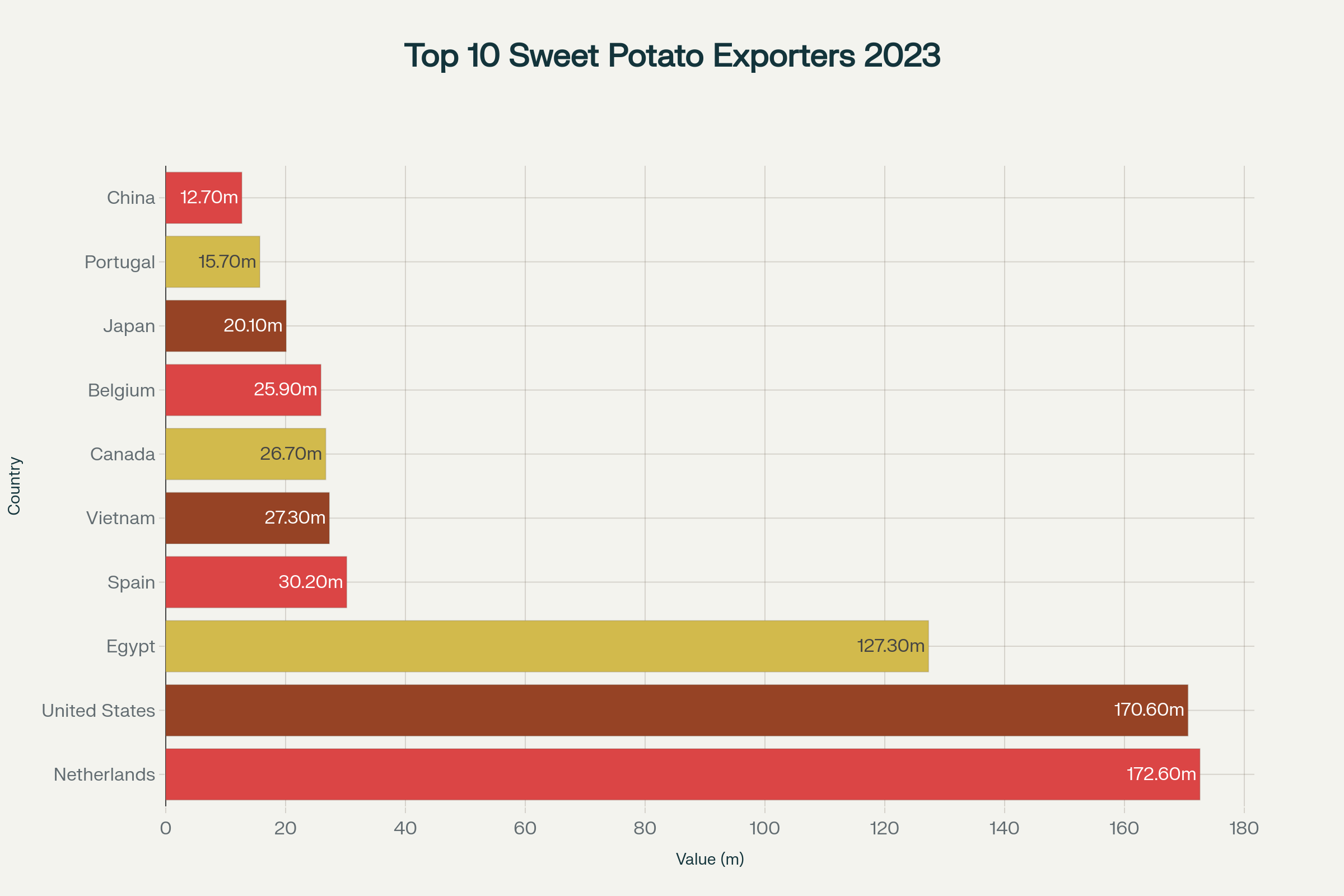

The international sweet potato trade is dominated by a select group of countries that have mastered production, processing, and logistics to serve global markets. The Netherlands leads global sweet potato exports with $172.6 million in export value during 2023, representing approximately 22.2% of worldwide exports. This dominance reflects the Netherlands’ sophisticated agricultural infrastructure, strategic geographic location, and expertise in high-value crop production and distribution.

The United States follows closely as the second-largest exporter with $170.6 million in export value, accounting for 24.5% of global exports by volume at 253.7 million kg. American sweet potato exports have experienced remarkable growth, increasing 1,157% from 2001 to 2021, with annual export values rising from $14 million to $187 million during this period. This expansion reflects strong domestic production capabilities, particularly in North Carolina, which leads U.S. sweet potato production.

Egypt has emerged as a formidable competitor with $127.3 million in exports during 2023, representing a dramatic increase from previous years. Egyptian sweet potato exports to the EU alone grew from 35,224 metric tons in 2020 to 149,551 metric tons in 2024, with export values rising from $28 million to $113 million. Egypt’s success stems from favorable growing conditions, competitive production costs, and strategic geographic proximity to European markets.

Spain holds fourth position with $30.2 million in exports, though the country faces significant challenges. Spanish sweet potato planted area has reduced by 60% over the past two years due to drought conditions, high input costs, labor shortages, and competition from cheaper Egyptian imports. This decline illustrates how market dynamics and environmental factors can rapidly reshape export competitiveness.

Vietnam rounds out the top five exporters with $27.3 million in export value, though exports declined 19.2% from 2021 to 2022. Other significant exporters include Canada ($26.7 million), Belgium ($25.9 million), Japan ($20.1 million), Portugal ($15.7 million), and China ($12.7 million).

Top 10 Sweet Potato Exporters by Value (2023)

Import Powerhouses: Major Sweet Potato Markets

Global sweet potato import patterns reveal the crop’s growing popularity in developed markets where consumers increasingly value healthy, versatile food options. The European Union dominates global imports with $198.2 million in import value during 2023, representing approximately 245.3 million kg. This massive import volume reflects strong consumer demand across EU member states for sweet potatoes as both fresh produce and processed ingredients.

The Netherlands serves dual roles as both a major exporter and importer, with $158.9 million in imports representing 192.3 million kg. This apparent contradiction reflects the Netherlands’ function as a European distribution hub, where sweet potatoes are imported from global suppliers and then re-exported to other European markets after value-added processing or simply logistical handling.

The United Kingdom ranks as the third-largest importer with $88.2 million in imports representing 124.5 million kg. Egyptian exports to the UK have risen dramatically from almost $197 million in 2020 to $331 million in 2024 , demonstrating the strong growth in British sweet potato consumption and Egypt’s success in capturing this market.

Germany imports $64.7 million worth of sweet potatoes annually, representing 52.7 million kg. German markets have been particularly influenced by Egyptian suppliers, with early and large supplies from Egypt causing prices to drop below multi-year averages. Canada rounds out the top five importers with $64.0 million in imports representing 77.6 million kg.

Production Giants: Global Sweet Potato Powerhouses

Sweet potato production remains heavily concentrated in Asia and Africa, with China dominating global production at 48.9 million tons in 2020, representing approximately 55% of worldwide production. Chinese production focuses primarily on domestic consumption, with the country also serving as a significant processor of sweet potatoes for various industrial applications including starch, alcohol, and animal feed.

African countries collectively represent significant global production, with Malawi producing 6.9 million tons, Tanzania 4.4 million tons, Angola 1.7 million tons, and Ethiopia 1.6 million tons in 2020. These countries primarily produce sweet potatoes for domestic food security and local markets, though export opportunities are gradually developing.

The United States ranks seventh globally in sweet potato production, according to FAO data. Top-producing U.S. states more than doubled sweet potato production over the past 20 years to meet growing international and domestic demand, though production plateaued after reaching a record high in 2017.

Sweet Potatoes Biggest Importers

Global sweet potato consumption patterns reveal significant regional and cultural variations. China dominates global consumption with 56.9 thousand metric tons, representing the vast majority of worldwide demand. Chinese consumption has experienced a slight decline of 1.85% in recent years, potentially due to domestic policy shifts or economic constraints.

African nations represent significant consumers, with Malawi consuming 6.11 thousand metric tons (representing a 4.31% increase), Nigeria 4.79 thousand metric tons, Tanzania 4.59 thousand metric tons, and Uganda 2.54 thousand metric tons. These consumption levels reflect sweet potatoes’ importance as food security crops in African diets and their role in addressing malnutrition.

Other significant consumers include Angola (2.16 thousand metric tons), Indonesia (2.13 thousand metric tons), Ethiopia (1.92 thousand metric tons), Vietnam (1.55 thousand metric tons), and India (1.55 thousand metric tons). These figures demonstrate sweet potatoes’ global reach and cultural adaptation across diverse dietary traditions.

Sweet Potato Trends

The global sweet potato trade reflects several key trends reshaping international agriculture. European markets increasingly favor sweet potatoes due to health consciousness, with consumers recognizing their high vitamin A content, fiber, and antioxidant properties. This demand has created premium opportunities for suppliers who can deliver consistent quality and reliable supply chains.

Seasonal supply patterns create trading opportunities, with Egypt’s production season from August to November filling gaps in European markets when other major suppliers are unavailable. This timing advantage has enabled Egyptian producers to capture significant market share despite competition from established suppliers.

Processing and value-addition are becoming increasingly important in sweet potato trade. Innovation in processing technologies enables production of sweet potato-derived ingredients such as resistant starch and functional flours used in health-focused food products. The cosmetic industry is also exploring sweet potato extracts for their antioxidant properties in skincare applications.

Organic and sustainable production methods are gaining market premiums, with consumers willing to pay higher prices for certified organic sweet potatoes. Blockchain traceability systems are being implemented to verify organic and sustainable origins, aligning with consumer expectations for transparency and environmental responsibility.

Challenges and Opportunities

The global sweet potato trade faces several challenges that could impact future growth. Weather disruptions and climate change affect production reliability, with drought conditions in Spain reducing planted area by 60% over two years. Post-harvest handling inconsistencies limit access to premium export markets, highlighting the need for improved storage and distribution infrastructure.

Market standardization remains problematic, with inconsistent global quality grading limiting access to premium export markets. Developing uniform quality standards could unlock significant value for producers while improving buyer confidence in international markets.

Rising competition between suppliers creates pricing pressures, particularly evident in European markets where Egyptian sweet potatoes compete directly with Spanish and other European suppliers. This competition benefits consumers but challenges producers to improve efficiency and differentiation.

Opportunities exist in expanding processing applications, including sweet potato chips, flours, and plant-based snacks that capitalize on health trends. The development of climate-adaptive varieties could expand production into new regions while improving yields under changing environmental conditions.

Future Outlook

The sweet potato trade is positioned for continued growth driven by health consciousness, dietary diversification, and expanding processing applications. Projected market growth to $56.4 billion by 2034 reflects sustained global demand , though success will depend on addressing supply chain challenges and quality standardization issues.

African countries may experience increased export opportunities as infrastructure develops and quality systems improve. Asian markets are showing growing interest in premium sweet potato varieties, particularly purple sweet potatoes valued for their antioxidant content and unique colors.

Technological innovation in production, processing, and distribution will likely determine competitive success in international markets. Companies implementing comprehensive sustainability programs may achieve competitive advantages while meeting evolving consumer and regulatory expectations.

Conclusion

Major importers in Europe and North America drive demand growth through health-conscious consumer preferences, while consumption leaders in China and Africa represent both tradition and opportunity in sweet potato markets. The industry’s projected growth to $56.4 billion by 2034 indicates continued expansion opportunities despite challenges in standardization, climate adaptation, and supply chain optimization.

About us

Try it for yourself. Freshdi.com

Global B2B Marketplace.