Introduction – Malaysia’s Alloy Steel Market by the Numbers

Malaysia’s alloy steel industry isn’t just growing—it’s booming. As of January 2026, Malaysia has become a major player in the global steel scene. With its crude steel production rising from 2.8 million metric tons in 2017 to an impressive 8.8 million metric tons in 2024, the country now ranks 21st among the world’s top crude steel producers. That’s a huge leap from its 39th position back in 2017.

But what’s driving this surge? The answer lies in strategic exports, government-backed trade policies, and increased demand from neighboring countries. In 2023 alone, Malaysia shipped out 8.2 million metric tons of iron and steel products. Key destinations included Turkiye, Hong Kong, and Singapore. Even more impressive? Malaysia accounted for a staggering 75% of global exports of bars and rods made of iron or non-alloy steel. That’s dominance you can’t ignore.

And for businesses looking to tap into this market, data-driven supplier selection is no longer a luxury—it’s a necessity. With tools like Freshdi, companies can now access real-time RFQ trends, supplier credentials, and historical trade data, all in one place.

Deep Dive – Key Production, Export Statistics & Market Signals

Let’s break it down. Malaysia’s steel production has grown at a compound annual growth rate (CAGR) of 17.7% over seven years. That’s not just steady—it’s aggressive growth. The country’s ability to scale up production while maintaining quality has made it a prime hub for alloy steel manufacturing.

When it comes to exports, Malaysia isn’t just sticking to its backyard. Its top buyers include:

- Turkiye – 1.18 million metric tons

- Hong Kong – 1.04 million metric tons

- Singapore – 996,000 metric tons

This geographic spread shows Malaysia’s strategic positioning—not just geographically, but economically.

And guess what? This export behavior aligns strongly with RFQ (Request for Quote) activity trends noted on platforms like Freshdi. Buyers from across Asia, the Middle East, and Europe are increasingly sourcing alloy steel from Malaysia. These RFQ volumes are a strong market signal that demand is not only sustained but expanding.

Top 4 Verified Alloy Steel Suppliers in Malaysia – Leading Exporters by Volume

Choosing the right supplier can make or break your business. That’s why we’ve done the heavy lifting to bring you the top 4 verified alloy steel suppliers in Malaysia for Q4 2025. These companies were selected based on export volume, international reach, certifications, and buyer feedback on Freshdi.

1. SYNERGY HOUSE FURNITURE SDN. BHD.

Don’t let the name fool you—this company has pivoted sharply into alloy steel, leveraging its logistics and sourcing strength. Known for prompt deliveries and high-grade steel products, Synergy House has become a go-to for global buyers looking for reliability and compliance with international standards.

2. YUSEN LOGISTICS (VIETNAM) CO LTD.

While headquartered in Vietnam, Yusen Logistics operates a dynamic steel export arm out of Malaysia. Their cross-border logistics expertise makes them a preferred choice for buyers in need of seamless, end-to-end procurement solutions. Their alloy steel offerings are certified and competitively priced.

3. VS PLUS SDN BHD

VS Plus is a rising star in Malaysia’s alloy steel export scene. With a strong presence in Southeast Asian markets and a reputation for quality material, they’ve won over many large-scale construction and manufacturing firms. Their competitive pricing and consistent product availability make them a top-tier supplier.

4. Great Cost Naveed SDN BHD

Great Cost Naveed has carved out a niche in customized alloy steel solutions. Whether it’s specific tensile strengths or unique alloy compositions, they deliver. Their robust quality control process and excellent client service have earned them a loyal customer base across Asia and the Middle East.

Dynamic Ranking Note: Keep in mind that supplier performance can fluctuate. Platforms like Freshdi offer “Suppliers of the Month” or “Quarter” rankings based on real-time buyer feedback, RFQ activity, and shipment data. It’s smart to check in regularly for the latest updates.

Market Navigation – Statistical Trends, Pricing Analysis & Export Dynamics

So what’s hot in the alloy steel segment right now?

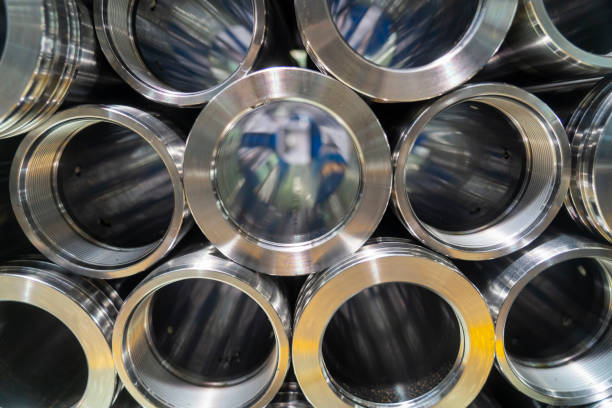

The demand for high-strength, corrosion-resistant alloy variants is on the rise. Think chrome-moly steels for pipelines or nickel-based alloys for aerospace. Malaysia’s suppliers are increasingly catering to these niche needs, and RFQ trends on Freshdi show a clear uptick in such inquiries.

Pricing? Like most commodities, it’s seasonal. Alloy steel prices tend to spike in Q1 and Q3, aligning with infrastructure project cycles in Asia and the Middle East. Historical pricing data indicates that Q4 often presents favorable buying conditions—a sweet spot between demand lulls and pre-holiday shipments.

What’s more, export dynamics show that Malaysia’s alloy steel is gaining traction in Europe and Africa, not just Asia. Tariff advantages, better logistics, and consistent quality are the driving forces here.

Conclusion – Leveraging Data for Informed Procurement

Malaysia has established itself as a powerhouse in the alloy steel export market. With rising production, strategic trade policies, and a growing global footprint, the country is well-positioned to supply top-quality alloy steel at scale.

But here’s the thing—success in sourcing isn’t just about picking a supplier. It’s about picking the right supplier. That’s where platforms like Freshdi come in. From real-time RFQ volumes to verified supplier profiles and trade history, Freshdi equips buyers with the tools to make smarter, faster decisions.

If you’re planning your procurement strategy for 2026, start by analyzing supplier performance data, reviewing seasonal pricing trends, and staying updated with export dynamics. In the world of alloy steel, knowledge truly is power.

Key Takeaways

- Malaysia’s alloy steel industry is growing rapidly, with production hitting 8.8 million metric tons in 2024.

- The country is a global leader in specific steel categories, especially bars and rods not further worked than forged.

- Verified suppliers like Synergy House, Yusen Logistics, VS Plus, and Great Cost Naveed are leading the export scene in Q4 2025.

- Real-time data from platforms like Freshdi can help buyers navigate seasonal trends and supplier performance.

- Anti-dumping policies and trade protections are enhancing the competitiveness of Malaysian alloy steel in global markets.

Checklist for Alloy Steel Buyers

✅ Identify your required alloy steel grade and specifications

✅ Use platforms like Freshdi to verify supplier credentials

✅ Compare RFQ trends to understand market demand

✅ Monitor seasonal pricing before placing large orders

✅ Check for any trade measures or tariffs affecting specific destinations

Future Outlook – What’s Next for Malaysia’s Alloy Steel Industry?

Looking ahead, Malaysia’s alloy steel market is likely to benefit from:

- Continued infrastructure investment, both domestic and overseas

- A shift toward high-tech steel variants for energy and aerospace sectors

- Enhanced digital trade facilitation through platforms like Freshdi

- Stronger supply chain resilience due to anti-dumping policies

As more global businesses look to diversify their suppliers, Malaysia is primed to become a preferred sourcing destination.

How Freshdi Empowers Alloy Steel Buyers

- Real-Time RFQ Tracking: Know what buyers are sourcing across regions

- Verified Supplier Profiles: Get detailed company backgrounds and reviews

- Market Insights: Access regional pricing trends and demand forecasts

- Trade History Analytics: Evaluate supplier consistency over time

- Dynamic Rankings: Stay updated with top-performing suppliers each quarter

Platforms like Freshdi don’t just connect buyers and suppliers—they build confidence, transparency, and smarter trade workflows.

References

- news.metal.com

- theedgemalaysia.com

- miti.gov.my

- spglobal.com

- business-standard.com

- thestar.com.my

- thestar.com.my

FAQs

1. Why is Malaysia becoming a major exporter of alloy steel?

Malaysia has invested heavily in steel production, and its strategic location, competitive pricing, and high-quality standards make it an attractive export hub.

2. How can I verify if a supplier is reliable?

Use platforms like Freshdi, which offer in-depth supplier verification, trade history, and buyer reviews.

3. What’s the best time to buy alloy steel from Malaysia?

Q4 often presents favorable pricing due to decreased demand and pre-holiday inventory clearances.

4. Are there trade restrictions on Malaysian alloy steel?

Currently, Malaysia is implementing anti-dumping duties to protect its industry, but these typically apply to imports, not exports.

5. What’s the advantage of using Freshdi for sourcing?

Freshdi provides real-time RFQ data, verified supplier profiles, and dynamic performance rankings, helping buyers make smarter choices.