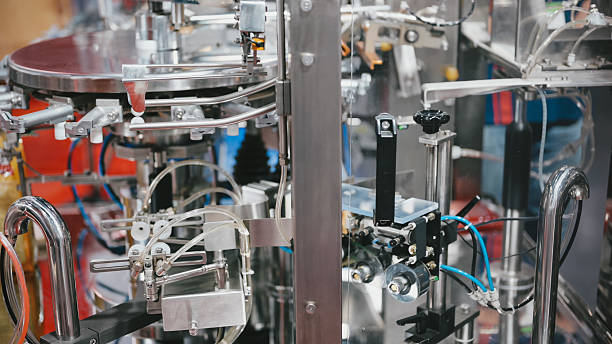

Introduction – Turkey’s Bag Machinery Market by the Numbers

Turkey has quietly become a global powerhouse in the bag machinery sector. From humble beginnings just a few decades ago, the country now stands tall among leading exporters of packaging machinery — especially bag packaging systems. And the numbers? They speak for themselves.

As of 2025, Turkey’s packaging machinery market hit a solid value of USD 346.86 million, with projections pointing toward USD 507.14 million by 2034, growing at a CAGR of 4.31%. That’s not just healthy growth — it’s a sign that Turkey is doubling down on innovation, automation, and quality in this space.

Even more impressive is the country’s export performance. In 2024 alone, Turkey recorded $6.5 billion in packaging exports — a 26% jump from the year before. The bag packaging machinery segment is a key driver of this growth, with exports reaching over 16 countries. The United States, Kazakhstan, and Russia account for half of these exports, making them crucial markets for Turkish manufacturers.

A significant turning point came in September 2024, when over 120 Turkish packaging companies showcased their tech at FachPack 2024 in Germany — a clear display of Turkey’s ambition to dominate European markets. And it’s not just about quantity — the focus is shifting toward sustainable, biodegradable solutions, like the nonwoven production line launched by Teknomelt Teknik Mensucat in 2024.

So, what does all this mean for global buyers? It means Turkey isn’t just competing — it’s leading. But with so many suppliers out there, how do you choose the right one?

Let’s break it down.

Deep Dive – Key Production, Export Statistics & Current Demand Data

To understand why Turkey stands out in the bag machinery market, let’s zoom in on the core production and export data.

- Export Growth: In 2024, Turkey’s packaging exports soared to $6.5 billion, with bag machinery forming a significant part of this figure.

- Top Destinations: The U.S., Kazakhstan, and Russia lead the import charts, accounting for 50% of Turkey’s bag packaging machinery exports.

- Production Expansion: Local manufacturers are not just scaling up; they’re innovating fast — pivoting toward eco-friendly machinery and automated systems.

On platforms like Freshdi, the demand data tells a similar story. High RFQ (Request For Quotation) volumes for Turkish bag machinery, especially from North America and Central Asia, reflect strong buyer interest. Verified reviews and buyer activity trends affirm that Turkey’s bag machinery suppliers are delivering both performance and reliability.

Freshdi also provides real-time RFQ trends, helping buyers see what’s hot and what’s not in the market — straight from the source.

Top 5 Verified Bag Machinery Suppliers in Turkey – Proven Export Performers

Choosing a supplier can feel like finding a needle in a haystack. But worry not — we’ve done the heavy lifting for you. Based on export volume, certifications, global reach, and buyer feedback on Freshdi, here are the Top 5 Bag Machinery Suppliers in Turkey for November 2025.

1. Doan Can Yıldız

- Why They Stand Out: Known for state-of-the-art bag filling and sealing machines, Doan Can Yıldız is a preferred name for buyers from the U.S. and Eastern Europe.

- Certifications: ISO 9001, CE Certified.

- Strengths: Customization capabilities, energy-efficient systems, and fast after-sales support.

- Buyer Feedback: Consistently rated highly on Freshdi for communication and delivery timelines.

2. Makitech Ambalaj Sistemleri

- Why They Stand Out: With a strong presence in the Middle East and North Africa, Makitech offers versatile bag machinery suited for food and chemical packaging.

- Certifications: ISO 14001, HACCP-compliant designs.

- Strengths: Compact machine designs and modular upgrades.

- Buyer Feedback: Noted for excellent installation services and robust build quality.

3. PaketMak Makine Sanayi

- Why They Stand Out: A trusted exporter to Russia and Eastern Europe, PaketMak specializes in fully automatic bagging machines.

- Certifications: CE, TÜV Rheinland.

- Strengths: Bulk production capacity and reliable spare parts support.

- Buyer Feedback: Rated highly for long-term reliability and technical support.

4. Erpak Machinery Co.

- Why They Stand Out: Erpak focuses on heavy-duty bagging systems for industrial applications like cement, fertilizer, and grains.

- Certifications: ISO 45001, ATEX compliance.

- Strengths: Durability under tough conditions and automation integration.

- Buyer Feedback: Known for flexible payment terms and fast international shipping.

5. TEKNO Makina

- Why They Stand Out: TEKNO is popular among European buyers for eco-friendly, biodegradable bag machinery solutions.

- Certifications: GreenTech Certified, ISO 50001.

- Strengths: Innovation in sustainability and low energy consumption.

- Buyer Feedback: Buyers love the intuitive UI of their control systems.

Dynamic Ranking Note

Platforms like Freshdi offer dynamic supplier rankings based on recent export activities, certifications, RFQ wins, and buyer ratings. Check out the “Supplier of the Month” or “Top Exporters by Quarter” sections to stay updated on who’s leading the pack in real time.

Market Navigation – Statistical Trends, Value Dynamics & Export Dynamics

Now let’s talk strategy. Buying machinery isn’t just about specs — it’s about timing, pricing, and market dynamics.

Export Trends

Turkey’s overall machinery exports hit $26 billion in the first 11 months of 2025, up 0.8% year-over-year. This is especially impressive considering there was a 6.9% drop in shipment volumes. In short: prices went up while volumes dipped — a clear sign of strong pricing power.

The average price per kilogram? A hefty $8.10 — one of the highest on record.

Top Importers

- Germany: $2.9 billion (up 5.3%)

- USA: $1.7 billion (up 6.7%)

These figures show that demand from developed markets remains strong, especially for high-quality, automated bag machinery systems.

Challenges & Competition

- China: Chinese manufacturers have redirected their exports toward Turkey and Europe, increasing competition. Exports to Turkey surged by 13.4%, making it tougher for local makers to maintain dominance.

- Domestic Pressure: Machinery production in Turkey contracted 6.1% in 2025, and capacity utilization dipped to 63.9% — pointing to underused factories and potential delays.

Pricing Dynamics

The Producer Price Index (PPI) for Turkish machinery rose 29.6% over the year, driven by inflation and raw material costs. For buyers, this means planning purchases ahead can help avoid price spikes.

Platforms like Freshdi help you track historical pricing data, understand seasonal trends, and even receive RFQ forecasts, so you can strike while the iron’s hot.

Conclusion – Leveraging Data for Informed Procurement

Turkey’s rise in the bag machinery market is no fluke. It’s the result of consistent innovation, export-friendly policies, and a strong manufacturing backbone. From the $6.5B export milestone to top-tier suppliers like Doan Can Yıldız, the country is proving it can compete with the best.

For businesses looking to source from Turkey, the key is to make data your compass. Use platforms like Freshdi to:

– Verify suppliers

– Analyze export data

– Track RFQ trends

– Compare certifications and reviews

This isn’t just smart buying — it’s strategic procurement in action.

Key Takeaways

- Turkey is a top global exporter of bag machinery, with strong demand from the US, Europe, and Central Asia.

- Top suppliers like Doan Can Yıldız and Makitech are leading innovation and export performance.

- Freshdi offers real-time data, supplier verification, and market insights tailored to your sourcing needs.

- Price dynamics suggest buying earlier in the year may provide better deals due to seasonal cost fluctuations.

- Domestic challenges mean some suppliers may face production delays — always vet capacity and timelines.

Buyer’s Checklist – Sourcing Bag Machinery from Turkey

✅ Check supplier certifications (ISO, CE, GreenTech)

✅ Use Freshdi to verify export performance and buyer reviews

✅ Compare RFQ trends to spot high-demand machinery types

✅ Discuss lead times and capacity limitations due to domestic production issues

✅ Track seasonal pricing to avoid peak-cost periods

Future Outlook – Where Is This Market Headed?

The next few years will likely bring:

– Increased automation in bag machinery

– Growth in biodegradable and sustainable systems

– Tighter competition from Chinese and European manufacturers

– Greater reliance on platforms like Freshdi to make informed sourcing decisions

For buyers, the key will be agility — staying ahead of trends and choosing partners that evolve with the market.

How Freshdi Empowers Buyers

Freshdi isn’t just a platform — it’s your sourcing advantage. With features like:

– Verified supplier databases

– RFQ trend dashboards

– Export performance rankings

– Real buyer reviews

– Seasonal pricing alerts

You can move beyond guesswork — and into data-driven decision making.

FAQs

1. Why is Turkey a leading exporter of bag machinery?

Turkey combines low production costs, skilled labor, and a strategic export strategy. Its manufacturers focus on both quality and sustainability, making them highly competitive worldwide.

2. How can I ensure a supplier is reliable?

Use platforms like Freshdi to check certifications, buyer reviews, export history, and RFQ response rates. Don’t just rely on catalogs — look at the data.

3. Are Turkish bag machinery prices stable?

Not always. The PPI rose nearly 30% in 2025, so prices can fluctuate. Buying during low-demand seasons or locking in prices early can help.

4. What kind of bag machinery does Turkey export the most?

Primarily automatic bag filling and sealing machines, used in food, chemicals, textiles, and industrial packaging.

5. Can I request custom machinery designs from Turkish suppliers?

Absolutely. Many suppliers like Doan Can Yıldız offer custom engineering services, especially for bulk orders or niche applications.

References

- packagingmarketinsights.com

- ambalaj.org.tr

- volza.com

- matbaateknik.com.tr

- nonwovensnews.com

- turkiyetoday.com

- ainvest.com

- Freshdi