Introduction – Current State of Play: The Vanilla Sector in Bangladesh

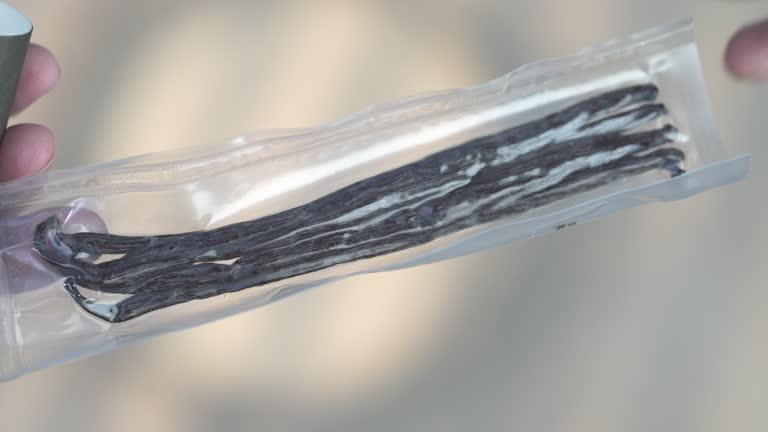

Bangladesh is on the brink of something big—and vanilla is the star of the show. For years, this aromatic bean has been considered too exotic or too complex for local farmers to cultivate. But recent developments are shaking things up. The Bangladesh Agricultural Research Institute (BARI) has spent six years studying vanilla cultivation, and guess what? It works. The country’s tropical climate is perfect for growing natural vanilla, and pending approval from the Ministry of Agriculture, farmers may start planting by April 2026.

Why does this matter now? Because the global demand for natural vanilla is skyrocketing, and artificial alternatives are losing favor due to health concerns. The world wants the real thing, and Bangladesh could be the next big player. But as always, opportunity comes with challenges—supply chains, quality control, market entry, and compliance all demand careful planning.

For businesses looking to get ahead of the curve, staying informed is everything. And that’s where platforms like Freshdi come in, offering real-time supplier verification, RFQ trends, and insights into the evolving vanilla landscape in Bangladesh.

Deep Dive – Breaking News: Critical Updates & Their Effects

Let’s peel back the layers and dig into the biggest updates shaping Bangladesh’s vanilla journey.

Bangladesh’s Entry into the Global Vanilla Market

The headline news? Bangladesh is officially preparing to step into the global vanilla scene. After years of research, BARI has proven that vanilla can thrive in the country’s climate. If the Ministry of Agriculture greenlights this, we could see distribution of vanilla plants to farmers by April 2026. That’s a game-changer.

Why is this a big deal? Natural vanilla fetches a high price globally, and Bangladesh could reduce its dependency on artificial vanilla imports while creating a lucrative export product. Vanilla might just become the country’s next major cash crop.

The Global Vanilla Boom

Globally, the vanilla market is on fire. It was worth around USD 962.3 million in 2022 and is projected to reach USD 1.5 billion by 2031. The surge is driven by what’s called the “clean label movement”—consumers are demanding natural, organic ingredients in everything from ice cream to protein shakes. Vanilla is central to that shift.

Challenges in the Supply Chain

But it’s not all sweet-smelling success. The vanilla supply chain is notoriously tricky. Most of the world’s vanilla—about 70–80%—comes from Madagascar. That’s a problem when storms hit or regulations change. Prices can swing wildly. That’s why companies are diversifying, sourcing from places like Uganda and Indonesia. Bangladesh could be next on that list.

Rising Demand from the MENA Region

Another interesting twist? Vanilla imports to the Middle East and North Africa (MENA) region jumped 220% in 2024. Saudi Arabia and the UAE are leading the charge. This is an opportunity for Bangladeshi suppliers to tap into a fast-growing market that’s hungry for natural vanilla.

Top 6 Verified Vanilla Suppliers in Bangladesh – Adapting to Today’s Market

Looking to source vanilla from Bangladesh right now? These verified suppliers are making waves in July 2025, based on their export performance, certifications, and buyer reviews on Freshdi.

-

M.K International

A trusted name in agricultural exports, M.K International is positioning itself to be a key player in the emerging vanilla trade. Known for quality assurance and timely delivery, this supplier is gaining traction on Freshdi. -

Tajrian Steel Trading Co.

Despite its name suggesting a focus on steel, this diversified trading company is exploring vanilla exports—an example of businesses pivoting to meet rising demand. -

Highbolt Trading And Contracting

With a reputation for handling sensitive commodities and ensuring quality logistics, Highbolt is a go-to choice for buyers seeking reliability. -

Shamir

Shamir has been gaining attention for its focus on organic and natural products. Their early investments in vanilla sourcing make them a standout name in the current landscape. -

Deegau

Deegau is known for supplier transparency and excellent customer service. Their listings on Freshdi are frequently updated, reflecting their active market participation. -

Freshdi Platform

While not a supplier per se, Freshdi deserves a mention here. Its dynamic ranking system highlights “Suppliers of the Month/Quarter,” giving buyers real-time insights into which suppliers are leading the market based on activity, reviews, and buyer engagement.

Dynamic Ranking Note: Rankings on platforms like Freshdi are updated regularly, reflecting supplier performance, product availability, and real-time buyer feedback. Always check for the latest “Suppliers of the Month” to make informed decisions.

Market Navigation – Strategic Responses to The Current Vanilla Landscape in Bangladesh

Let’s cut to the chase—what does all this mean for businesses?

Opportunities Galore

The upside is massive. If Bangladesh enters the vanilla market, it could become a reliable alternative to Madagascar—especially for businesses seeking consistent quality and pricing. With research-backed feasibility and government support on the horizon, early movers can gain a competitive edge.

Challenges to Watch For

But let’s not sugarcoat it. Vanilla farming is labor-intensive. Quality control is crucial. And since Bangladesh is a new player, international buyers might be skeptical at first. This means suppliers need to double down on certifications, traceability, and transparency.

Adjusting Sourcing Strategies

If you’re sourcing vanilla, now’s the time to diversify. Don’t wait for Bangladesh to be “proven”—start small, test batches, and build relationships with emerging suppliers. Platforms like Freshdi can help you identify trustworthy partners who are already preparing for this shift.

Short-Term Outlook

In the short term, vanilla from Bangladesh will likely be limited in volume but competitive in price. Expect more action in late 2025 as trial harvests begin. Early partnerships could lead to priority access once full-scale production starts.

Conclusion – Key Takeaways for Businesses in a Fast-Moving Market

Let’s wrap things up.

Bangladesh’s potential entry into the global vanilla market is more than just another agri-story—it’s a strategic opportunity for buyers, suppliers, and investors. With global demand for natural vanilla rising and supply chain risks in traditional regions like Madagascar, eyes are turning to new producers.

From government-backed research to increasing MENA demand and dynamic supplier activity on platforms like Freshdi, the signs are clear: the vanilla market is shifting.

For businesses, the message is simple—act early, stay informed, and leverage digital platforms like Freshdi to track supplier performance, market trends, and RFQ opportunities in real-time.

Key Takeaways

- Bangladesh is preparing to enter the vanilla export market by as early as 2026.

- Global vanilla demand is booming, projected to reach $1.5 billion by 2031.

- Supply chain issues in Madagascar are pushing buyers to look for new sources.

- Verified suppliers in Bangladesh are already adapting to meet market needs.

- Platforms like Freshdi offer real-time insights, supplier verification, and RFQ alerts.

Buyer’s Checklist: Sourcing Vanilla from Bangladesh

✅ Check supplier certifications on Freshdi

✅ Request sample batches for quality testing

✅ Review Freshdi’s “Supplier of the Month” feature

✅ Monitor government approvals and rollout timelines

✅ Diversify sourcing to reduce risk exposure

Future Outlook – What’s Next for Vanilla in Bangladesh?

Looking ahead, the next 12–24 months will be crucial. If the Ministry of Agriculture approves vanilla cultivation, expect pilot programs, training for farmers, and initial exports by late 2026 or early 2027. Early adopters will benefit the most.

Smart buyers will use this time to test the waters, build supplier relationships, and position themselves ahead of the market curve.

Platforms like Freshdi will continue to be essential—connecting buyers to emerging suppliers, highlighting RFQ trends, and enabling proactive sourcing strategies in a market that’s just beginning to bloom.

References

- Vanilla may become BD’s new cash crop soon – The Financial Express

- Global Vanilla Market Poised for Robust Growth – GlobeNewswire

- Vanilla Market Overview – Food Ingredients First

- Vanilla MENA Market Overview 2024 – IndexBox

FAQs

1. Is vanilla really a viable crop for Bangladesh?

Yes! BARI’s six-year research shows that vanilla can grow well in Bangladesh’s climate, and the government may soon approve cultivation.

2. When will Bangladeshi vanilla be available for export?

If approved in 2025, vanilla plants could be distributed by April 2026, with initial exports likely in late 2026 or early 2027.

3. Why is natural vanilla in such high demand globally?

Consumers are moving away from artificial flavors for health and quality reasons. Natural vanilla is a key ingredient in clean-label food products.

4. How can I find trustworthy vanilla suppliers in Bangladesh?

Use platforms like Freshdi to verify suppliers, review certifications, and monitor real-time RFQs.

5. What are the risks of sourcing vanilla from a new market like Bangladesh?

Quality consistency and supply chain maturity are early challenges. Start with small orders, test for quality, and build partnerships gradually.