Introduction – Spain’s Packaging Machinery Market: A Quantitative Overview

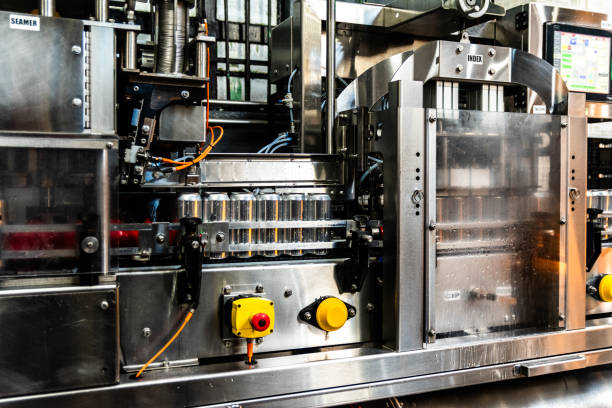

Spain isn’t just famous for flamenco, paella, and breathtaking coastlines—it’s also a powerhouse in the global packaging machinery industry. If you’re in the packaging game and looking at Europe for sourcing or partnerships, Spain should definitely be on your radar.

In 2024, Spain’s packaging machinery market raked in a whopping USD 1,830.4 million, and projections suggest it’ll hit USD 2,393.3 million by 2030, with a steady 4.7% CAGR (Grand View Research). That kind of steady growth speaks volumes about both the innovation and stability of this sector.

Globally, Spain commands around 3.1% of the packaging machinery market, making it one of the top 10 exporters worldwide (Fira Barcelona). With over 615 active companies and a total turnover of €4.63 billion, the sector is booming—and exports are fueling the fire.

From food and beverage to pharmaceuticals, Spanish packaging tech is finding its way into all corners of the globe. But here’s the kicker: the U.S. is currently Spain’s largest export market, followed by Europe, Latin America, and Asia. Clearly, Spanish packaging machinery is in serious demand.

Deep Dive – Key Production, Export Statistics & Market Signals

So, what’s driving this demand? Let’s break it down.

Core Production & Export Stats

- Export Value: In 2024 alone, Spain saw over USD 1.83 billion in packaging machinery sales.

- Export Growth: Exports to the U.S. jumped 72.7% in 2021. That’s massive.

- Top Export Destinations:

- United States – 12.1%

- France – 8.6%

- Italy – 6.8%

- Germany – 6.7%

- Portugal – 6.4%

These numbers clearly show Spain’s stronghold in both developed and emerging markets.

Demand Insights from Freshdi

Platforms like Freshdi provide real-time RFQ (Request for Quotation) trends that align perfectly with this data. Increased RFQs from the U.S. and Europe, especially in automated and sustainable packaging equipment, mirror the export surge. Buyers are actively seeking verified suppliers with strong export records—and Freshdi is where they’re looking.

Top 8 Verified Packaging Machinery Suppliers in Spain – August 2025

Based on verified export data, certifications, and buyer reviews, here are the Top 8 Packaging Machinery Suppliers in Spain this August.

1. PERNOD RICARD WINEMAKERS S.A.

- Location: Spain

- Specialty: Integrated packaging lines for beverage products

- Strengths:

- Strong foothold in U.S. and EU markets

- High customer satisfaction on Freshdi

- ISO-certified operations

- Why Choose Them: Trusted by global beverage brands and known for reliability and innovation.

Dynamic Ranking Note: Rankings like these are fluid. Platforms like Freshdi often update their “Suppliers of the Month/Quarter” based on live data, including export volumes, buyer feedback, and RFQs. So, always check for the latest updates before making big sourcing decisions.

Market Navigation – Statistical Trends, Price Insights & Export Dynamics

What’s Hot in 2025?

Demand is definitely shifting. Here’s what buyers and suppliers are focusing on:

- Food Packaging Equipment: Pulled in USD 676 million in 2025 and is expected to hit USD 873 million by 2030.

- Industrial Packaging: Growing from USD 956 million in 2025 to USD 1.39 billion by 2033.

- Packaging Automation: Jumping from USD 1.1 billion (2024) to USD 1.93 billion by 2033—that’s a 6.5% CAGR!

Seasonal Price Fluctuations

Buyers, take note: August and November are peak months. Why? Think holiday prep, back-to-school, and year-end stockpiling. Expect price hikes during these periods, especially for high-demand machines like form-fill-seal units.

Smart Purchasing with Historical Data

Using platforms like Freshdi, you can track price trends over time. Want to avoid the August surge? Place your orders in early Q2. Need a quick turnaround? Look for suppliers with solid inventory metrics and lead-time transparency.

Recent Developments – What’s Shaping the Market?

Mespack’s New HQ

In November 2025, Mespack began building their new 20,000 m² headquarters in Santa Perpètua de Mogoda. Scheduled for completion by mid-2027, this move is all about boosting collaboration and driving innovation in sustainable packaging. (Packaging Strategies)

Nefab Group’s Big Buy

In May 2025, Nefab Group acquired Embalajes Echeberria, giving Nefab a stronger hand in Spain’s high-growth sectors like e-mobility and lithium-ion batteries. (Pulpaper News)

DS Smith’s Expansion

DS Smith committed €11.35 million to expand its Cartogal plant in Galicia, adding 6,000 m² to boost production and storage. This move supports growing demand in northwest Iberia. (Pulpaper News)

Conclusion – Leveraging Data for Optimized Supply Chains

Spain’s packaging machinery sector isn’t just growing—it’s evolving. With strong export stats, a commitment to sustainability, and heavy investments in tech, the country is positioning itself as a go-to supplier hub for global buyers.

For businesses, the takeaway is clear: data-driven supplier selection is no longer optional. You need partners who understand market dynamics, can scale, and meet quality standards.

Platforms like Freshdi make this easier than ever. From analyzing RFQ trends and verifying suppliers to offering export insights and dynamic rankings, Freshdi empowers smarter sourcing.

Key Takeaways

- Spain commands 3.1% of the global packaging machinery market.

- Exports are booming, especially to the U.S. and Europe.

- August and November are peak demand months—plan purchases accordingly.

- Verified suppliers like PERNOD RICARD WINEMAKERS S.A. are leading the pack.

- Tools like Freshdi help buyers navigate the market with real-time data.

Buyer’s Checklist for Sourcing Packaging Machinery from Spain

- ✅ Verify supplier certifications (ISO, CE, etc.)

- ✅ Check export history and destination countries

- ✅ Use Freshdi to monitor RFQ trends and pricing signals

- ✅ Avoid peak order months if possible

- ✅ Review supplier performance metrics and feedback

Future Outlook

Spain’s packaging machinery industry is on a clear upward trajectory. As sustainability, automation, and digitalization become standard, expect more innovation and global integration. The next few years could see Spain rise further in global rankings—and your company can ride that wave with the right supplier partnerships.

How Freshdi Empowers Buyers

- 📊 Verified Supplier Profiles: Get complete insights on export volumes, certifications, and buyer ratings.

- 🔍 RFQ Analytics: Spot demand trends across industries and regions.

- 📦 Dynamic Rankings: Find top-performing suppliers updated monthly or quarterly.

- 💡 Market Intelligence: Access trade data, pricing trends, and procurement forecasts.

FAQs

Q1: Why is Spain a key exporter of packaging machinery?

Spain combines advanced manufacturing, strong R&D, and a focus on sustainability. Its strategic location in Europe and trade relationships with the U.S., Latin America, and Asia also make it an export hub.

Q2: How do I choose the right supplier?

Look for verified profiles on platforms like Freshdi, check certifications, export destinations, and buyer reviews. Always assess lead times and capacity.

Q3: What packaging machinery is in high demand in 2025?

Food packaging lines, form-fill-seal machines, and industrial packaging systems are hot right now—especially those supporting eco-friendly materials.

Q4: When’s the best time to place orders?

Avoid August and November when demand peaks. Spring and early summer are ideal for better pricing and quicker lead times.

Q5: What role does Freshdi play in procurement?

Freshdi helps buyers make informed decisions with access to real-time RFQ data, supplier performance metrics, and dynamic rankings, making it an essential tool for international sourcing.

References

- Grand View Research – Spain Packaging Machinery Market

- Fira Barcelona – Spanish Packaging Exports

- Packaging Strategies – Spanish Industry Turnover

- Pulpaper News – Nefab Acquisition

- Hispack – Export Performance

- ACCIO – Seasonal Price Trends

- Freshdi – Supplier Intelligence Platform