Introduction – China’s Plastic Auxiliary Equipment Market in Statistical Focus

When it comes to plastic auxiliary equipment, China is more than just a manufacturing powerhouse—it’s the global nerve center. In 2024 alone, China’s plastic processing auxiliary equipment market brought in a massive USD 1.0669 billion, and it’s only going up from here. By 2030, it’s forecasted to hit USD 1.431 billion, growing at a CAGR of 5.3%. Globally, the industry was worth USD 7.4 billion in 2024, and China held a commanding 39.8% share of the Asia-Pacific market. That’s serious dominance.

What’s fueling this growth? The sheer scale of China’s manufacturing sector, rising demand for plastic products across industries, and a strategic shift toward quality and innovation. From eco-conscious production methods to high-efficiency machinery, Chinese manufacturers are shaping the future of plastics.

But here’s the kicker—China isn’t just making equipment for itself. It’s exporting it all over the world. In 2024, the country exported 1.2 million tons of plastic tubes, pipes, and hoses, accounting for 25% of global exports in this category.

With this much at stake, picking the right supplier isn’t just smart—it’s essential. That’s where data-driven platforms like Freshdi come in, offering real-time insights, verified supplier credentials, and RFQ trends to help buyers make informed decisions.

Deep Dive – Key Production, Export Statistics & Demand Insights

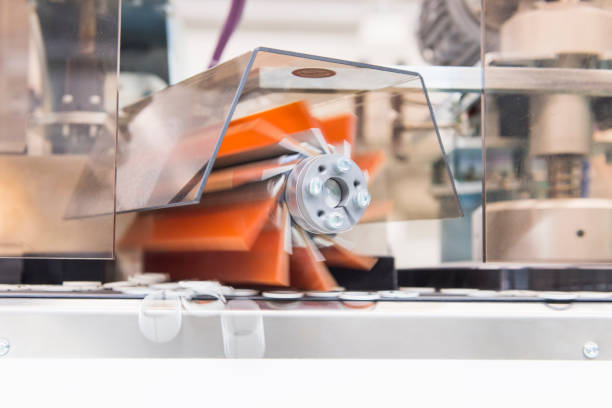

Let’s zoom in a bit. China’s footprint in plastic auxiliary equipment isn’t just big—it’s strategic. The most in-demand category? Material handling equipment, which made up 24.95% of the market in 2024. These are your loaders, conveyors, and feeders—the backbone of any plastic processing setup.

On the export front, China’s reach is growing fast. In 2024, polypropylene (PP) exports to Southeast Asia skyrocketed. Shipments to Indonesia more than doubled to 140,170 tons, a 132% increase year-over-year. Vietnam wasn’t far behind, with imports from China climbing 120% to 247,000 tons. That’s not just growth—it’s market capture.

And the demand is visible on platforms like Freshdi, where RFQ (request-for-quotation) volumes for plastic auxiliary equipment have surged, especially for vacuum loaders, plastic mixers, and granule auto-feeders. These RFQs reflect real-time trends, showing which products are hot and which suppliers are getting the most traction globally.

Top 8 Verified Plastic Auxiliary Equipment Suppliers in China – Leading Exporters by Volume

Choosing the right supplier can feel like finding a needle in a haystack. But we’ve done the legwork for you. Based on export volumes, certifications, international presence, and feedback from Freshdi users, here are October 2025’s top 8 suppliers you can trust:

-

Dongguan Sanzhong Machinery Co., Ltd.

Known for its precision-engineered photoelectric eye plastic auto loaders, Sanzhong leads in automation and efficiency. -

Jiangmen Jietuo Technology Co., Ltd.

Their stainless steel vacuum hopper loaders are a favorite for industrial clients demanding durability and hygiene. -

Ningbo Jianghang Machinery Co., Ltd.

A specialist in high-speed plastic powder mixers, ideal for PVC processing lines. -

Dongguan Mingkai Electromechanical Co., Ltd.

Their compact yet powerful 300g auto loaders are highly rated for small to mid-sized operations. -

Qingdao Create Trust Industry Co., Ltd.

Offering CE-certified internal mixers in various capacities, this supplier is trusted for compliance and quality. -

Zhangjiagang Beierman Machinery Co., Ltd.

Beierman’s granule vacuum suction machines are built for high-volume operations needing flexible capacity options. -

Yurefon Machinery (Zhangjiagang) Co., Ltd.

Yurefon shines with multifunctional mixers that handle heating, cooling, and drying in one unit. -

Wensui Intelligent Equipment Inc.

Wensui’s smart loaders are engineered for plastic extruders, combining automation with energy efficiency.

Dynamic Ranking Note: Keep in mind, platforms like Freshdi often feature Suppliers of the Month/Quarter, which recognize recent export performance, customer reviews, and supply chain excellence. Rankings can shift based on real-time activities.

Market Navigation – Statistical Trends, Pricing Analysis & Export Dynamics

So what’s trending in the world of plastic auxiliary equipment? Here’s what the data shows:

- Vacuum loaders and auto feeders are leading the charge, especially in Southeast Asia, the Middle East, and South America.

- Color mixers with heating/cooling functions are gaining popularity due to the growing demand for precision in color blending and thermal consistency.

- Internal mixers and granule suction machines are seeing rising RFQ activity among compounders and recyclers.

What about pricing? Like most commodities, plastic auxiliary equipment is subject to seasonal price shifts. For example, prices often dip slightly in Q1 due to reduced factory activity during Chinese New Year but rise again in Q2 and Q3 as global demand peaks.

By analyzing historical data—available on platforms like Freshdi—buyers can optimize their procurement strategies. Want to avoid peak prices? Look at trends from last year and time your orders accordingly.

Conclusion – Leveraging Data for Informed Procurement

The numbers don’t lie. China holds a dominant and growing position in the global plastic auxiliary equipment market. From production capability to export strength, its role is pivotal. Choosing the right supplier in a market this vast can be overwhelming—but it doesn’t have to be.

By using data-driven platforms like Freshdi, you can:

- Compare verified suppliers side-by-side

- Track real-time RFQ trends

- Access dynamic supplier rankings

- Make smarter, faster procurement decisions

Whether you’re sourcing vacuum loaders, internal mixers, or anything in between, leveraging Freshdi’s tools and insights gives you a serious edge.

Key Takeaways

- China commands nearly 40% of the plastic auxiliary equipment market in Asia-Pacific.

- Export volumes and demand for Chinese equipment are rising sharply, especially in Southeast Asia.

- Verified suppliers like Dongguan Sanzhong and Yurefon Machinery are setting industry benchmarks.

- Seasonal pricing trends can be predicted with historical data and market intelligence.

- Platforms like Freshdi empower buyers with real-time data, supplier verification, and strategic insights.

Buyer’s Checklist for Plastic Auxiliary Equipment Procurement

✅ Identify the specific auxiliary equipment you need (loader, mixer, feeder, etc.)

✅ Check supplier certifications and international export history

✅ Review RFQ trends on Freshdi to see current demand hotspots

✅ Time your purchase based on seasonal pricing trends

✅ Use Freshdi’s supplier verification tools to avoid unreliable vendors

Future Outlook – What’s Next for the Industry?

As the world shifts toward sustainability and automation, expect major innovations in:

- Energy-efficient equipment

- Smart automation with IoT integration

- Eco-friendly materials and recycling compatibility

- Export expansion into Africa and South America

China’s manufacturers are already gearing up for this next wave, and platforms like Freshdi will continue to be the go-to resource for staying ahead of the curve.

FAQs

1. What is plastic auxiliary equipment used for?

Plastic auxiliary equipment supports the main plastic processing machines. These include loaders, mixers, feeders, chillers, and dryers that enhance efficiency, accuracy, and automation.

2. Why is China a leader in plastic auxiliary equipment?

China combines large-scale production capacity, advanced technology, and competitive pricing, making it a global export leader in this sector.

3. How can I verify a Chinese supplier’s credibility?

Use platforms like Freshdi to check certifications, export history, and real user reviews. They also offer supplier verification services.

4. When is the best time to buy plastic auxiliary equipment from China?

Avoid Q1 if you want to dodge price hikes during Chinese New Year. Q2 and Q3 often offer better pricing and availability.

5. What’s the most in-demand auxiliary equipment in 2025?

Vacuum loaders, internal mixers, and multifunctional color mixers are leading the demand curve due to automation and customization needs.

References

- Grand View Research – Global Market Overview

- Grand View Research – China Market Focus

- Zhisheng AD – Export Statistics

- ChemOrbis – Southeast Asia Export Growth

- Statista – Plastic Production Trends

- Wikipedia – China’s Waste Import Ban